Links:

- Website: https://www.llamarisk.com/

- Twitter: x.com

- Telegram: Telegram: Contact @LlamaRisk

Summary

LlamaRisk seeks to continue its partnership with Curve with an annual engagement spanning April 2025-2026. Our proposed scope emphasizes extensive collaboration with Swiss Stake and attention on supporting asset issuers and Curve protocol integrations. Our comprehensive suite of risk and growth services include:

- Advanced simulation tooling development and quantitative analysis applied to protocol optimization and support for third party integrators,

- Qualitative risk evaluation, including asset risk assessment especially for PegKeeper and crvUSD mint markets expansion,

- Risk Portal dashboards and risk monitoring to build confidence and understanding about protocol operations,

- Legal and operational management for grants Curve DAO receives from third party protocols and for developing integration solutions for regulated RWA assets.

These services have a B2B focus on integrations which LlamaRisk is uniquely capable of handling, especially given our long term alignment and knowledge about Curve and our established relationships with key organizations Swiss Stake, Convex, StakeDAO, and Yearn.

Our proposed maximum budget is $725k for the year, which allows us to dedicate a full time team of top tier qualitative and quantitative risk analysts to support Curve. We request a one year linear vest of 2M CRV from the Curve Community Fund to ensure adequate funding for the year (noting that $725k is the maximum allowable expenditure and that any remaining CRV would be returned or rolled over into a subsequent budget by year’s end). The vest recipient will be the LlamaRisk treasury multisig. We will provide quarterly progress reports to the DAO on our work and spending.

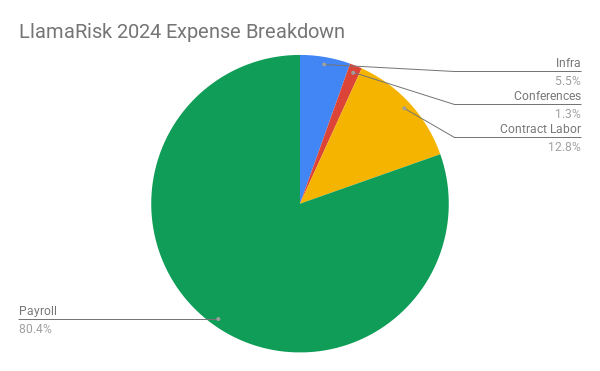

Section 1: 2024 Retrospective

The role LlamaRisk plays in Curve is constantly evolving as new products are launched and mature and as our own team expands with experts in a variety of fields relevant to our work. The breadth of our services to Curve has grown significantly over this past year, especially considering our humble beginnings in 2021 as a grass-roots movement within the Curve community. We have fostered our reputation for objective judgment, collaborative spirit, and diligent analysis, applying our recommendations strategically for the benefit of the DAO.

We now carry these qualities with us as we offer an expanded suite of risk services. This past year has been the most exciting yet as we have onboarded talented individuals and fostered skill sets that put us on par with the biggest names in DeFi risk services - and our dedication to Curve remains as strong as it has ever been.

You can read about our work over the past year in the reply to this post (forum character limits prevent inclusion here).

Section 2: 2025 Services Outline

Our three focuses for Curve in 2025 envelop the most comprehensive service offering of any risk provider in our industry:

- Quantitative Services

- Qualitative Risk Evaluation

- Growth Initiatives

The proposed service offering places a particular emphasis on deep collaboration with Swiss Stake. We will play an active role in protocol optimization, serving third-party protocol teams integrating with Curve, and creating revenue streams for the DAO. Our B2B focus will allow Swiss Stake to devote itself to its role as the core developer of Curve’s tech stack while LlamaRisk places emphasis on serving protocol teams building on Curve.

We have made tangible contributions to Curve from a growth perspective as evidenced by our vault strategy management and grants activities. Going forward we will continue a vision that combines risk management with growth initiatives. We have directly earned revenue to the DAO through our pursuit of grants on behalf of Curve, and we have been effective in our role thanks to the extensive professional network and reputation we have built over several years.

We are confident in our ability to deliver on the scope described below and to meaningfully contribute to Curve’s dominance across major DeFi verticals thanks to the faith Curve has placed in our team for several years now. Thanks to your support we now have the specialists, the tools, and the network to make 2025 the brightest year in Curve’s history.

2.1 Quantitative Research and Development

LlamaRisk is placing emphasis on development of methodologies implemented by our simulations tooling as a foundation for our role in risk monitoring and protocol optimization, ultimately informing our recommendations through governance participation. Specific deliverables include:

2.1.1 Caffeine Simulations Framework

Caffeine is our own simulation framework that is highly adaptable, designed for rapid experimentation and operational performance. It simulates 100’s of instances of the Ethereum blockchain efficiently and concurrently and can simulate any EVM smart contract with any sort of agent. This can be used to precisely optimize crvUSD, LlamaLend, Curve AMM, and any future Curve product or implementation upgrade. Caffeine addresses limitations of existing sim tools have been developed for single purposes and lack modularity in their design.

We have already developed the agents and application requirements for LlamaLend markets, allowing us to stress test these markets with historical or synthetic adverse market scenarios. This application may be particularly useful for integrating protocols like Resupply to validate how robust a particular market is before approving its onboarding.

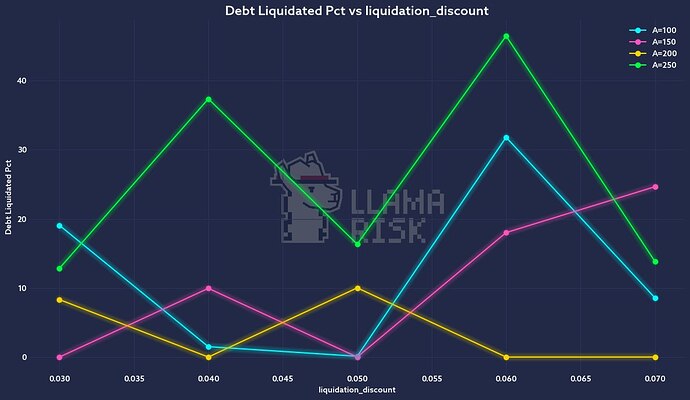

As an example of simulation results analysis, we can visualize relevant metrics such as debt liquidated, bad debt, and borrower losses across multiple dimensions of parameter sets to identify optimal parameterization.

Swiss Stake developers have indicated an interest in using Caffeine for research purposes, including to test hypothetical market configurations and upcoming implementations. We will grant Swiss Stake a license to access and use the Caffeine codebase, have access to all code upgrades, and LlamaRisk will offer technical support and collaborate on experiments. This license will be free to Swiss Stake, pending our active engagement with Curve DAO.

2.1.2 Protocol Optimization R&D

Given below are topics of interest and our plans for continued R&D:

LlamaLend Monetary Policy Optimization

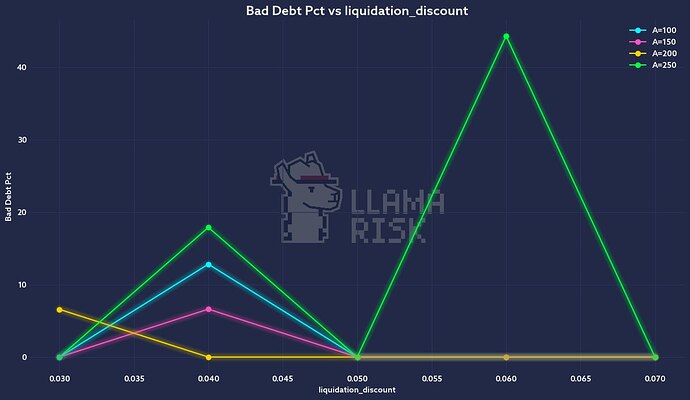

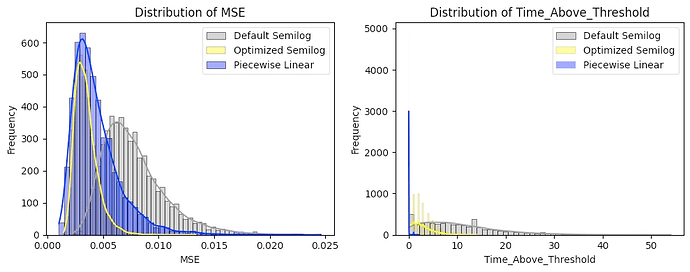

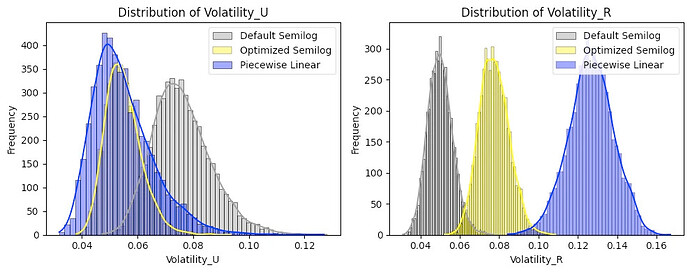

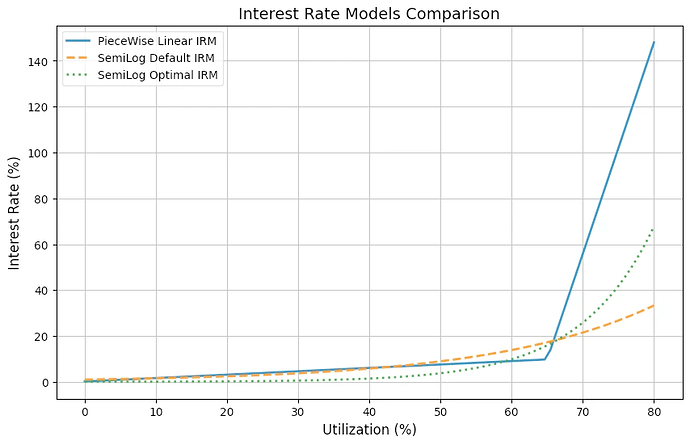

We have developed a methodology for optimizing the Monetary Policy employed by LlamaLend markets. There are deficiencies inherent to the Semilog model, namely that its simplicity makes it less adaptable for optimal performance. Especially since we aim to actively manage market parameters for performance optimization and supplier protection, we will continue R&D efforts to introduce superior models.

Our methodology for optimizing Semilog is adaptable to experimenting on hypothetical IRMs. In fact, our publicized research includes a comparative performance of a hypothetical linear piecewise model commonly used in DeFi lending products. We aim to continue this research with the goal of implementing a superior model that will provide better liquidity assurances and better equilibriate the needs of both borrowers and lenders.

See metrics of IRM performance in our simulations for the current Semilog vs. a hypothetical Linear Piecewise model:

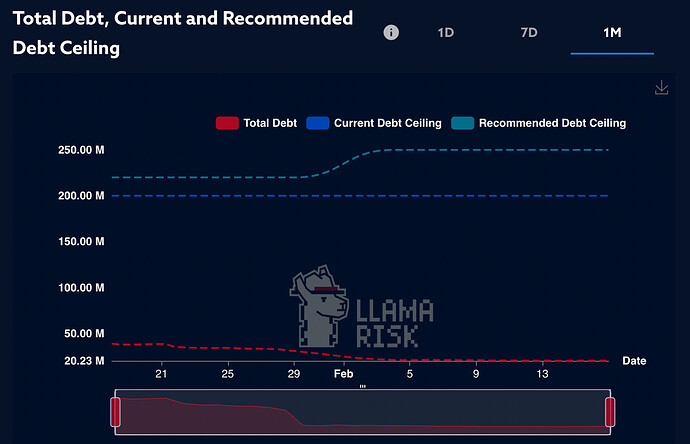

Debt Ceiling Methodology

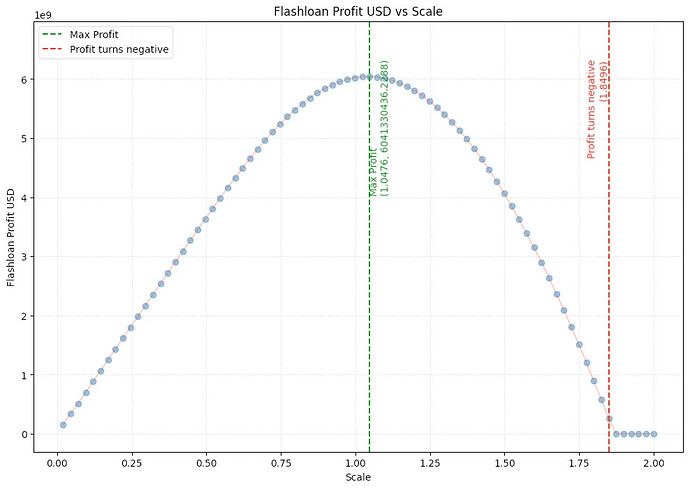

We have developed a methodology to determine suitable debt ceilings for crvUSD markets, given the global liquidity depth of the collateral, the borrower behaviors, the leverage across major DeFi platforms, and accounting for the liquidation mitigation properties of the LLAMMA mechanism. This offers insight into how much growth potential a given collateral can support and if exposures have reached unsafe levels. See below the scale against liquidator profits, which expresses a multiplier on the debt ceiling against simulated liquidator profits (the ideal debt ceiling is at max liquidator profit, and the highest safe level is just before profits turn negative).

Additional research can be done on the limits of LLAMMA’s protective capability, as this involves arbitrage actions that are inherently probabilistic and introduce uncertainty for users. Empirical observation of arbitrage efficiency for specific collateral types under various scenarios can help us to more accurately model liquidator profits and to more directly communicate LLAMMA’s protective capability to users.

2.1.3 Risk Portal Development

Our vision for the Curve Risk Portal is two fold:

- A resource for ourselves, Curve developers, and third party asset issuers to optimize markets and assess areas to improve the protocol.

- A resource for end users and integrating protocols to have insights about the health of Curve markets.

This will be a continually expanding product that shares insights about many aspects of Curve AMM, LlamaLend, and crvUSD mint markets.

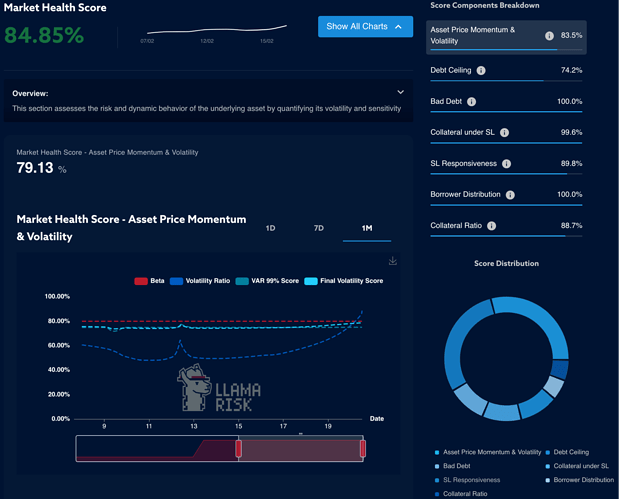

We have already developed a methodology for identifying crvUSD markets health, which includes both the dynamics of the market and its underlying collateral. Market Health Scores is valuable for Curve to build confidence in its markets, for users to understand the risks involved with markets, and for integrating protocols to assess the suitability for onboarding a market.

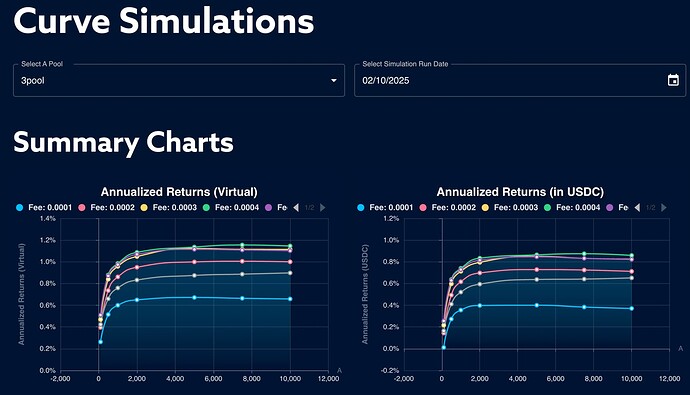

As we take a leadership role in Curve AMM optimizations, we have publicized historical CurveSim simulation results on the Risk Portal. We will use this work to improve proactive optimization of Curve pools for the benefit of asset issuers and for our own consultation to Curve DAO. An upgrade to this section will involve a methodology for assigning optimizations to a market and monitoring for changes in optimization recommendations.

The Curve Risk Portal is custom tailored to Curve’s needs, and therefore we will prioritize and add features as they are requested by Curve developers and ecosystem partners. Our goal is to improve transparency standards around risk management so governance decisions can be referenced from public resources rather than from within a black box with minimal oversight or peer review.

2.2 Risk and Growth Consultancy

Effective consultancy with our mutual service providers, DAO organizations, and the Curve community are paramount to our role as risk providers to Curve. Our recommendations and process for enacting them have a direct impact on how successfully Curve competes in the market and mitigates potential risks.

2.2.1 Swiss Stake Collaboration

Close collaboration with Swiss Stake is central to our 2025 service offering. We propose that LlamaRisk maintain a focus on supporting protocols in need of integration support, optimization, and risk management of their AMM pools and LlamaLend markets. This will allow Swiss Stake to focus on technology development while LlamaRisk’s focus will be on serving the needs of third party developer teams building on Curve.

We have already established organizational practices with Swiss Stake to keep our teams mutually informed about priorities and project status. Our partnership with Swiss Stake provides balance since LlamaRisk is an independent organization and collaborations will improve oversight as well as demand clear strategies for both our teams.

As a more specific example, Swiss Stake is actively pursuing the expansion of chain deployments through Curve-lite. LlamaRisk will collaborate closely with Swiss Stake on chain deployments, offering a suite of bootstrapping services that involves qualitative risk evaluation, markets deployment and optimization, and incentives management. These activities will directly impact the success of Curve on new chains with the goal of achieving sustainable adoption.

2.2.2 LlamaLend Consultancy

While we intend to support all Curve products, we have an immediate priority in promoting the sustainable growth of LlamaLend.

As we have developed tooling and an expertise in analyzing the performance of crvUSD products, we are equipped to play a central role in assisting prospective LlamaLend market creators and protocols integrating these markets. Although these markets are permissionless, there are hurdles to adoption due to complexity in parameter optimization, establishing a suitable oracle, and setting an appropriate monetary policy. LlamaRisk plans to offer guidance to asset issuers and further promote the adoption of these products.

We have already built a foundation to offer service to market creators and to benefit protocols looking to integrate select LlamaLend markets:

- Our LlamaLend implementation on Caffeine can optimize market parameters suitable for a given collateral type and predict the reliability of the market in adverse scenarios.

- Our Monetary Policy Optimization methodology ensures the IRM is configured in a way that will protect lenders and optimize market performance by referencing historical market behaviors.

- Our Market Health Risk Portal observes market dynamics relevant to its risk profile and proactively alerts of conditions that may require action.

As with all our work, we are committed to maximizing transparency, and we will publicize our methodologies and analyses as an educational resource for other prospective integrators.

2.2.3 Protocol Optimization & Risk Steward

While we are fully committed to providing informed consultancy on matters involving protocol optimization and risk management, LlamaRisk believe we are well-suited to also actively manage a variety of Curve markets. This concept is similar to the Aave Risk Stewards, which allows one or more whitelisted service providers to set market parameters within a predefined bound, with the DAO retaining ultimate authority. A Risk Steward implementation would allow Curve to optimize more efficiently and reduce reliance on DAO voting without sacrificing DAO oversight.

This is a concept that has been discussed with Swiss Stake and would involve their collaboration to implement a proxy owner with a Risk Steward role. The contract would include a time delay after every action and set limits on the magnitude of parameter changes.

Some examples where a Risk Steward may be valuable:

- CryptoSwap to repeg pools that have become stuck in a depegged state

- LlamaLend to modify the min/max rates of LlamaLend markets to enhance market efficiency.

- StableSwap pools to optimize liquidity concentration.

- crvUSD mint markets to set debt ceilings according to our methodology to define safe exposure levels.

For reference, we are already implementing methodologies that allow us to make informed recommendations to the DAO. Our LlamaLend Monetary Policy Optimization Methodology is being used to optimize markets through governance proposals. In general, we observe that max rate should be increased and the IRM curve adjusted to create a stronger target utilization zone (see CRV optimization below):

We have begun implementing our Debt Ceiling Methodology toward monitoring safe recommended debt ceilings in crvUSD mint markets. By monitoring liquidity depth and borrower behaviors, we can proactively mitigate against excessive exposure to a particular collateral type (WETH market in the Curve Risk Portal shown below):

Finally, we are actively monitoring for StableSwap AMM optimization opportunities through historical CurveSim runs on select pools in the Curve Risk Portal. These allow us to adapt to properties of the underlying tokens and ensure competitive returns for LPs and the DAO (3pool shown below):

Active protocol optimization ties in with our overall mission to offer superior quantitative services to Curve, which we plan to implement in a proactive way. We are currently developing tooling to monitor, automate, and scale protocol optimization across all Curve products.

2.3 Curve Booster Foundation

LlamaRisk has been instrumental in securing grants on behalf of Curve DAO, amounting to ~$1.5m in value over the past year. We are collaborating with Swiss Stake to establish a foundation which will improve the operational efficiency of this endeavor.

This involves setting up an appropriate legal entity for these activities and managing the process from grant acquisition to execution. The DAO could delegate responsibility to this entity, which handles KYC/AML, and could then task a chain manager to do BD. Execution is an especially needed component, as it is imperative grant funds are deployed in the most effective way to achieve desired outcomes. The chain manager would authorize using the grants to attract stablecoin issuers present on these chains, striving to maximize impact through co-incentives deals.

LlamaRisk’s role will be to oversee the development of a Curve Booster Foundation and ensure the grants are carried out to the satisfaction of the granting protocol for the mutual benefit to Curve. We will assist in putting capable chain managers in place and supervising their performance. We will set expectations of performance monitoring so the strategies can be properly reviewed and so both Curve and the granting partner have assurance about the effective use of grant funds.

2.4 Qualitative Evaluation

Qualitative risk assessment is the foundation of LlamaRisk’s service offering and for which we have built our reputation. As we are always improving our process for objectively assessing risk, we will continue providing analysis for purposes relevant to Curve. This includes stablecoin risk evaluation for PegKeeper onboarding, an area that we consider to be a critical dependency for crvUSD’s continued stability. We also continuously monitor trends and pay particular attention to assessing categories of assets that gain momentum (e.g. synthetic stablecoins like USDe, LRTs, RWAs). Growth categories often involve substantial speculation and reliance on short term incentives which may mean high exposure on Curve and the potential for destabilizing consequences. Our priority is to preserve Curve’s reputation by offering transparency about these risks and doing everything possible to properly inform Curve’s users.

We possess a unique skill set among DeFi risk providers in terms of our regulatory risk evaluation and consultancy. We will continue research on regulatory issues relevant to Curve and design protections, including comprehensive risk disclaimers that can be displayed on the Curve UI. Our work in this field will improve confidence with users interacting with Curve and encourage the adoption of institutional users, especially as TradFi and DeFi begin to converge.

LlamaRisk will expand on our concept for assessing market health from a qualitative perspective by developing a generalized framework for scoring asset risk. This will encompass such diverse assets as native tokens, LST/LRTs, stablecoins, and RWAs and will account for fundamental differences in trust assumptions for custodial and decentralized protocols. This will allow Curve to showcase LlamaRisk Asset Risk scores on the UI with the goal to build confidence in markets and reduce the risk premium in attracting capital.

Section 3: 2025 Budget Breakdown

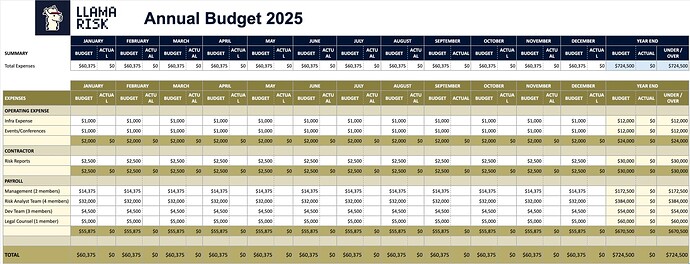

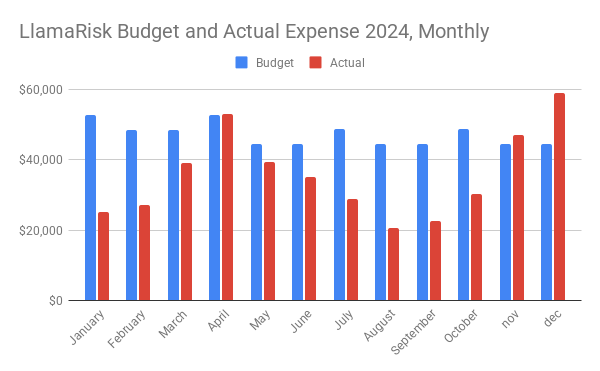

The budget breakdown given below reflects the proposed scope for this year.

You can read the breakdown of our proposed budget requirements in the reply to this post.

Budget Summary

LlamaRisk requests a one year linear vest of 2M CRV from the Curve Community Fund to finance our annual budget of $725k, spanning April 2025 to April 2026.

$725K will be our maximum allowable expenditure, and depending on actual expenditure and CRV volatility we may not use the full amount. Distributions will be made monthly in CRV at the USD equivalent value at time of distribution. Any funds remaining at the end of the year will be returned to the DAO or rolled into a subsequent year’s budget.

The vest recipient address is the LlamaRisk treasury multisig: 0xE8555F05b3f5a1F4566CD7da98c4e5F195258B65.