Summary:

Reduce TUSD pegkeeper debt ceiling from 5m to 0 crvUSD.

Abstract:

A previous proposal in August 2023 was approved to reduce the TUSD pegkeer max debt from 25m to 5m after transparency concerns were raised that reduced confidence in TUSD’s ability to maintain a strong peg. TUSD has struggled to maintain its peg recently, having depegged consistently to around $0.98-0.99 over the past month. Due to continued stability concerns, this proposal is to reduce the pegkeeper debt ceiling to 0. Pegkeeper v2 has undergone an audit, it improves resiliency to stablecoin depegs, and TUSD can be considered for that updated pegkeeper. Note that reducing debt ceiling will not immediately remove crvUSD debt- the existing pegkeeper can only burn crvUSD from the pool when the crvUSD/TUSD pool has rebalanced and the crvUSD price is <=$1.

Motivation:

Llama Risk’s assessment of TUSD back in August 2023 concluded that:

“We believe that until an upgrade to crvUSD Pegkeepers is implemented with precautions in place that mitigate the negative effects of Pegkeeper asset depegs, TUSD should not be included as a crvUSD Pegkeeper.”A compromise was made to reduce exposure to 5m max debt, which has proven to be a wise decision, as TUSD has experienced difficulty maintaining a peg in the past month. Possible reasons contributing to the depeg have been covered by DLnews and other news outlets. This has resulted in the pegkeeper depositing to the crvUSD/TUSD pool up to its debt cap between January 18-21.

crvUSD depends on its pegkeeper assets to have a strong assurance of peg stability. A prolonged or permanent depeg of any of these assets could result in unbacked crvUSD in circulation which affects its ability to hold its dollar peg. There are three other pegkeeper assets (USDT/USDC/USDP) and others being considered for onboarding (pyUSD). The advantage of removing exposure to TUSD’s stability issues outweighs the downside of reduced pegkeeper diversity at this time.

Specification:

Data from the crvUSD Risk Dashboard by intotheblock

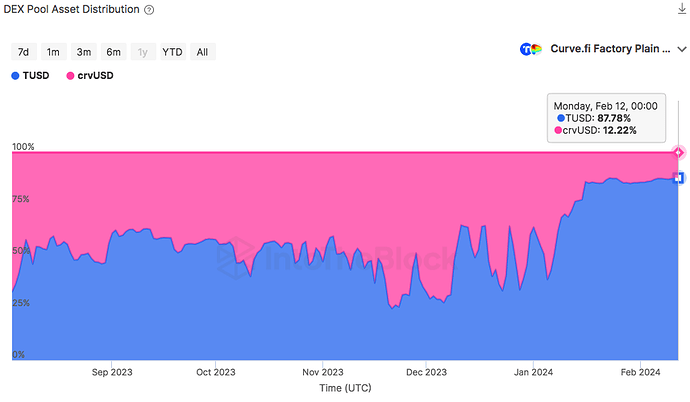

crvUSD/TUSD pool balance:

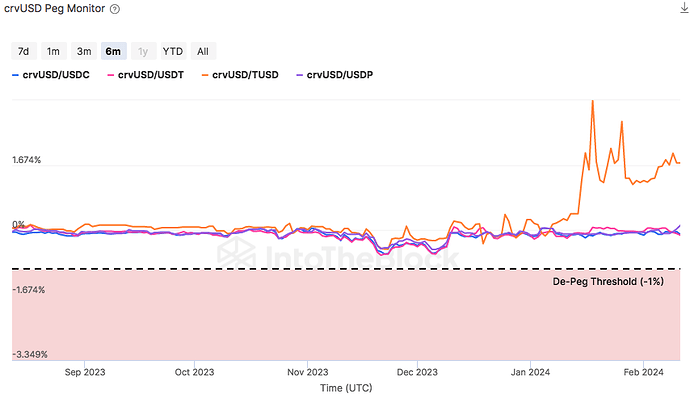

crvUSD pool oracle price:

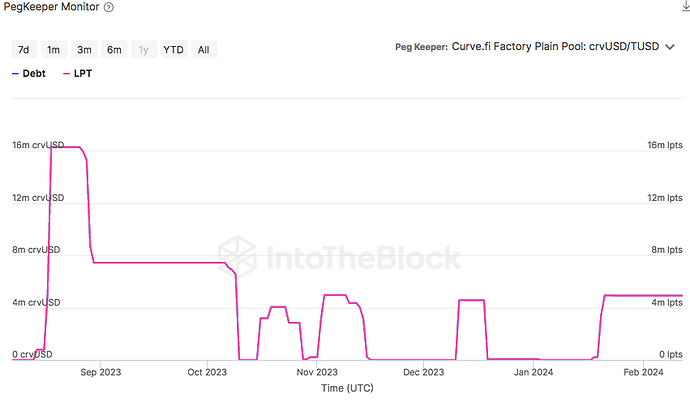

TUSD pegkeeper debt:

To reduce debt ceiling to 0, DAO must call set_debt_ceiling() to the crvUSD Controller Factory, giving the TUSD Pegkeeper as an argument.

├─ To: 0xC9332fdCB1C491Dcc683bAe86Fe3cb70360738BC

├─ Function: set_debt_ceiling

└─ Inputs: [(‘address’, ‘_to’, ‘0x1ef89Ed0eDd93D1EC09E4c07373f69C49f4dcCae ’), (‘uint256’, ‘debt_ceiling’, 0)]