![]() Useful Links

Useful Links

- Llamarisk Debt Ceiling Methodology

- WBTC vs cbBTC Dune Dash

- LlamaRisk Qualitative Evaluation of cbBTC

Summary

This proposal analyzes cbBTC suitability and parameter optimization for crvUSD mint markets to support the onboarding of a cbBTC market. Relevant considerations include asset adoption metrics, market parameters, debt ceiling, and pool oracle.

Tl;dr recommended parameters:

| Asset | Liquidation Discount | Loan Discount | A Factor | Fee | Debt Ceiling ($crvUSD) | Oracle EMA | Reference Pool |

|---|---|---|---|---|---|---|---|

| cbBTC | 5% | 8 % | 100 | 1.3% | 22 M | 700 | 0x839d6bdedff886404a6d7a788ef241e4e28f4802 |

Motivation

Coinbase Wrapped BTC is a token backed 1:1 by native Bitcoin held by Coinbase. It is a transferable token redeemable for the underlying BTC. cbBTC is analogous to previously deployed crvUSD mint markets. It has seen strong adoption since inception and, as collateral in crvUSD mint markets, could enhance the growth of crvUSD.

Specification

Adoption and Usage

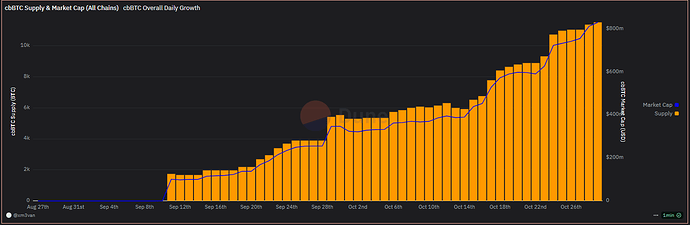

cbBTC is gaining significant onchain traction, steadily increasing its market share and adoption. Its supply has grown to 13.27k BTC (as of early November 2024).

Source: WBTC vs cbBTC Dashboard

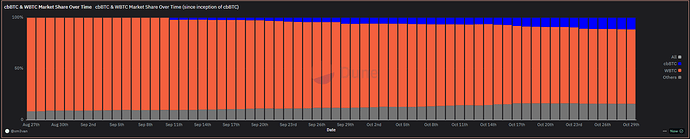

cbBTC is aggressively capturing tokenized BTC market share, having continuously increased since inception and currently standing at 12.9% market share. Compared to WBTC’s 71.1%, it is still relatively minor, but the trend indicates a growing preference among users for cbBTC.

Source: WBTC vs cbBTC Dashboard

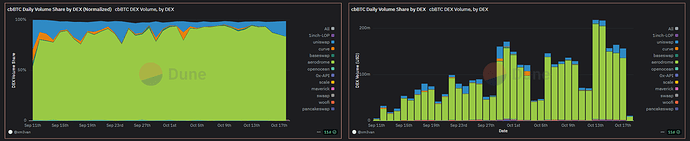

Similarly, the onchain trading volume of cbBTC is substantial, reaching 200 million in volume daily. Note, however, that a significant portion of DEX volume happens on Aerodrome. Removing Aerodrome reveals overall daily volumes currently in the 30m range, although there remains a clear upward trend since inception.

WBTC, by comparison, achieves daily volumes of 30 million and generally has daily volume in the 10-20m range.

Source: WBTC vs cbBTC Dashboard

The relatively large volumes of cbBTC may be indicative of excitement or incentives around a product launch that Coinbase heavily promotes. However, adoption and usage metrics for now are portraying a strong contender in the tokenized BTC space that Curve may benefit from integrating more deeply on its own platform.

Market Parameters Optimization

We have two simulation tools available for determining optimal market parameters for crvUSD.

- LLAMMA-simulator: A tool by michwill for optimizing LlamaLend markets

- crvUSDrisk sim: Our proprietary crvUSD tool based on previous work by Xenophon Labs, 0xReviews, and Curve Research.

We run both tools to cross-reference the results and increase confidence in suitable parameter selection for the market.

Sim 1: LLAMMA-simulator

Key Inputs are:

- BTC-USDT pair on Binance as price input from 2021-10-01 to have approximately 4 years of trading history and capture a variety of market conditions.

Experiment: Fee

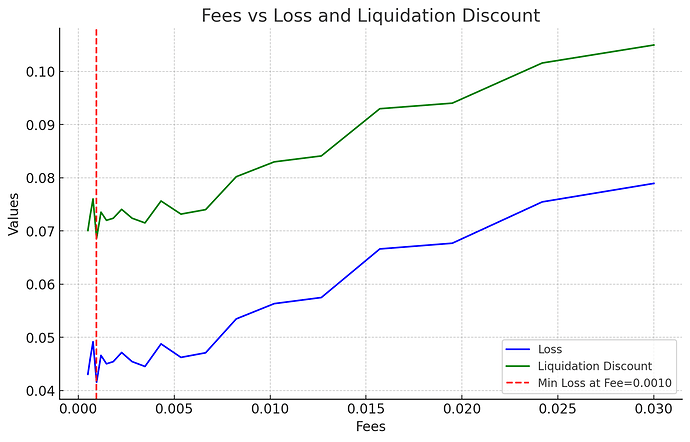

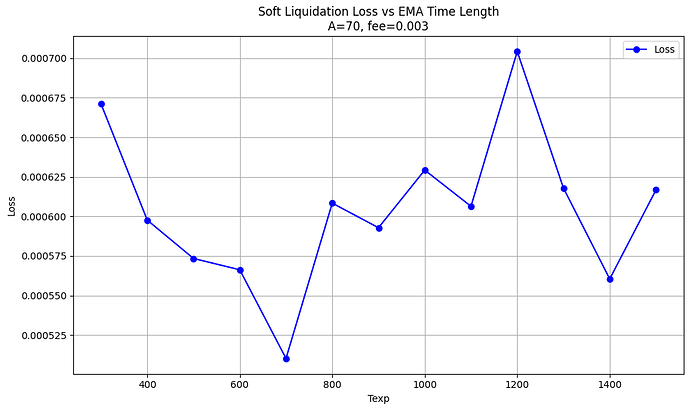

We set up an experiment for A=70, Band=4, and fee range from 0.0005 to 0.03, with an EMA time of 700.

Loss is minimized for Borrowers at a fee between 0.001 and 0.003, as indicated in the chart above. This suggests an optimal fee of 0.001. (Note that the simulator does not account for gas fees, which may merit a higher optimal fee in practice.)

Experiment: A Factor

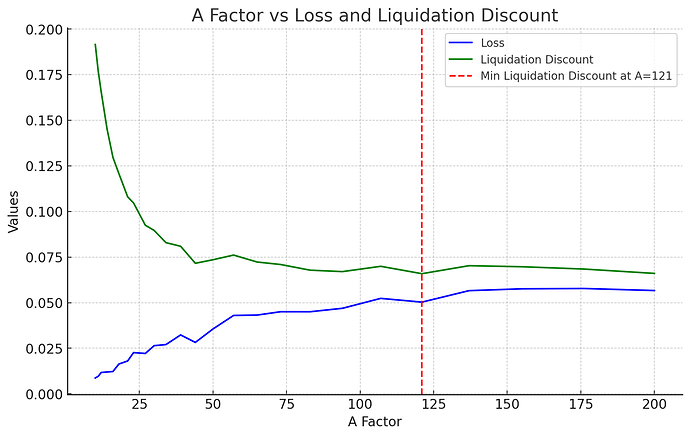

Similarly, for the A Factor experiment, we test a range from 10 to 200 with fee set to the recommended 0.001 and an EMA time of 700.

The results suggest that Liquidation Discount is minimized at A = 121 with a Loss of 5%. Consequently, our recommendation is A_factor = 121, liquidation_discount = 0.05 and loan_discount = 0.08.

Sim 2: crvUSDrisk sim

We assume:

- Inputs for synthetic pricing are based on the volatility of WBTC over the last ~4 years, where available.

- Borrower behavior is assumed to follow that of the WBTC<>crvUSD Mint Markets.

- Debt across collateral markets and crvUSD liquidity in the PegKeeper pools has been studied over the past 3 months. We have excluded the USDM Pool due to the relatively recent deployment.

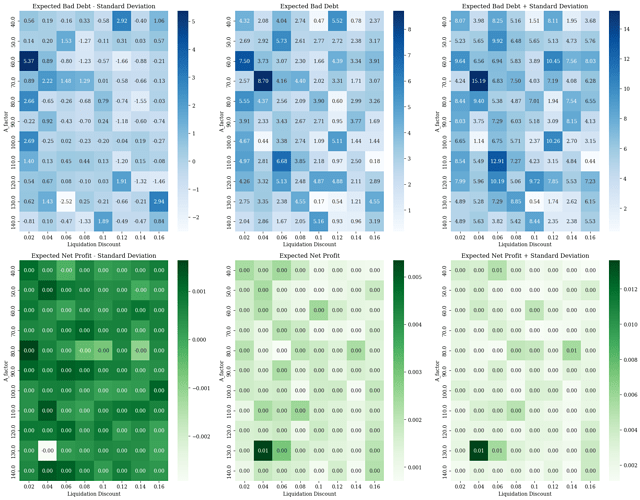

The results suggest multiple promising parameter sets. The most promising (and consistent with LLAMMA-simulator results) is A_factor= 100 and liquidation_discount= 0.04, therefore a loan_discount of 0.07 with a fee of 0.003. This configuration generates low expected bad debt under severely adverse conditions and still allows the generation of a relatively decent net profit. This selection constitutes the most aggressive safe parameter selection, which allows for the highest max LTV without incurring bad debt.

Our simulation tool suggests slightly more aggressive parameters relative to the Llamma-simulator. We can also cross-reference the crvUSD markets already deployed for WBTC and tBTC to compare precedents set by those.

tBTC and WBTC Markets Parameters

tBTC and WBTC mint markets are the closest reference assets already deployed on crvUSD. They have the following market parameters:

- A= 100

- fee= 1.9%

- liquidation discount =0.06

- loan discount =0.09

The recommended cbBTC market parameters, based on simulations above, are slightly more aggressive allowing borrowers to take out ~92% compared to a Max LTV of ~89%.

Notice in particular that the fee is much higher than suggested in our simulation. These markets were actually instantiated with a 0.6% fee and increased in March 2024. michwill gives his explanation here, which addresses gas fees and the increase in soft liquidation losses when gas fees increase. He has opted to set fees slightly below the oracle price as constant band range to ensure the current band is not more than 1 band where it should be. This increases borrower losses somewhat but helps borrowers recoup losses associated with reduced arbitrage efficiency when gas prices increase.

We can adopt this methodology for the fee recommendation by using the formula 1 - ((A - 1) / A)^2 to get a 1.99% oracle price as constant band range. Referencing the loss from the fees chart above, we can see a sizable bump in losses above 1.3%. We therefore can settle at 1.3% as a middle ground that reduces losses while also accounting for gas price volatility.

As for loan/liquidation discount, both llama-simulator and crvUSDrisk sim have suggested these markets can safely be made more aggressive. We may suggest the values liquidation discount = 0.05 and loan discount = 0.08 as a reasonable compromise between results from the two simulations and the previously deployed markets.

Debt Ceiling

We use an approach for recommending a debt ceiling in crvUSD markets that we have recently developed. Our methodology is published here.

To arrive at the recommended debt ceiling we focus on ensuring liquidations are profitable by modeling different liquidation paths. We estimate soft liquidation efficiency based on asset volatility and use historical borrower positions to factor in the risk preferences of borrowers. We arrive at a recommendation by quantifying a price drop scenario based on historical volatility.

We need to consider the effect of the price shock on the respective Aave market while making a recommendation for the cbBTC market on Curve. This is because Aave represents a substantial market that will have a material impact on cbBTC onchain activity in an adverse scenario.

For validating borrower distributions, it was assumed that WBTC serves as a reasonable proxy for cbBTC. We therefore take the borrower distribution of the WBTC market for crvUSD to assess prospective cbBTC borrower riskiness.

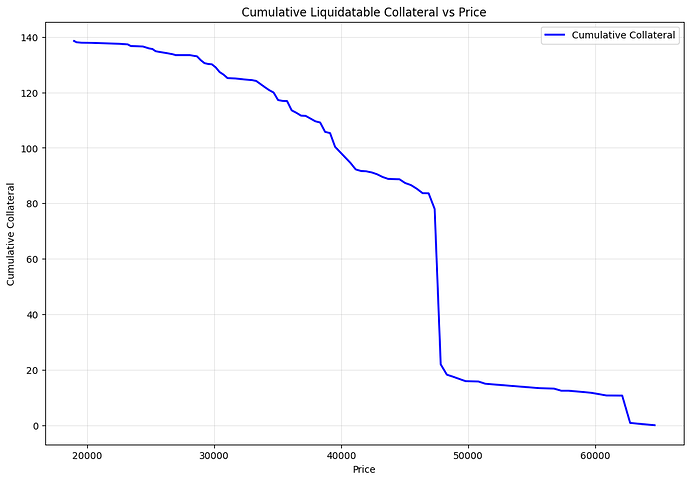

Below is the WBTC liquidatable collateral on Curve at different price points. Because of the unique property of soft liquidations, the exact amount of liquidatable collateral cannot be determined, so we use a probabilistic methodology for this (linked above).

Since we are considering the Aave market to inform global onchain market impact, we need to check the borrower distribution for the Aave cbBTC market as well. The chart below shows the liquidatable collateral vs price for cbBTC on Aave. We are using the cbBTC market from Aave and not WBTC because the cbBTC market is already established and would directly impact the new cbBTC market on Curve.

If we assume a 10% price shock ($60,000 to be precise which is realistic and practical), ~200 cbBTC becomes liquidatable as a combined total of the WBTC market on Curve and the cbBTC market on Aave.

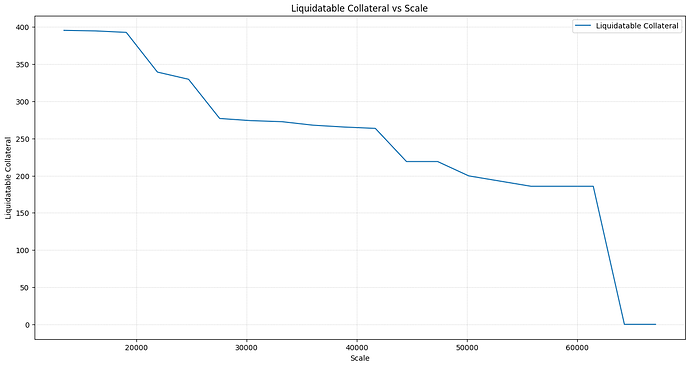

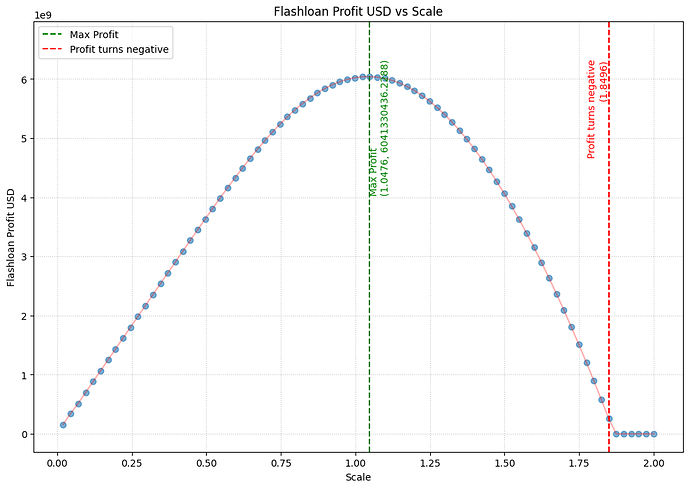

We scale this data with respect to current price impact data to determine at what scale are the liquidator profits going negative (i.e. liquidations won’t happen and the protocol takes bad debt). Note that the scale here is referencing the current WBTC crvUSD market and its current outstanding debt (~22m crvUSD). Our scale value is in reference to that market’s debt.

Upon scaling, we get the following chart:

The scale shows maximal liquidator profits ~1, which gives us a safe debt ceiling of 22m crvUSD. This is the maximum multiple we can scale exposure to cbBTC without incurring significant price impact. We can alternatively scale the total liquidatable (200 cbBTC) up to 1.8x (before liquidator profits turn negative) and determine an aggressive debt ceiling for crvUSD as follows:

- 200 * 1.8 = 360 (

total_liquidatablecbBTC in our hypothetical scenario) - Liquidatable on Aave = 200 (since we assume nothing is being changed on Aave)

- 360 - 200 = 160 (

new_liquidatableon curve) - 160 / 20 = 8 (

new_scalefor curve) - 8 * 22m = 176m (aggressive crvUSD debt ceiling for cbBTC at 1.8x scale)

Since we are not 100% sure of the alignment of borrower behaviors for cbBTC compared to WBTC, and because this is a recommendation for a newly deployed market, we recommend a value that is more on the conservative side. Once the market is populated, we can use actual borrower behaviors to make accurate quotes for the debt ceiling.

Oracle EMA Length

We recommend an in-house oracle deployment using Curve pool oracles similar to wstETH, meaning a TVL-weighted EMA based on Tricrypto pools, Stableswap pools, and a reference pool as outlined here in the crvUSD Documentation.

EMA Time Optimized for Soft Liquidations

We simulate soft liquidation losses for different EMA times for a fixed Parameter Set of A=70 and fee=0.003 with a single position using the maximum number of bands (i.e. 50). Using the Llamma-simulator we compare the performance of different EMA times.

The results suggest that an EMA length of 700s is most suitable for the cbBTC market, and hence, should be amended in the respective pool.

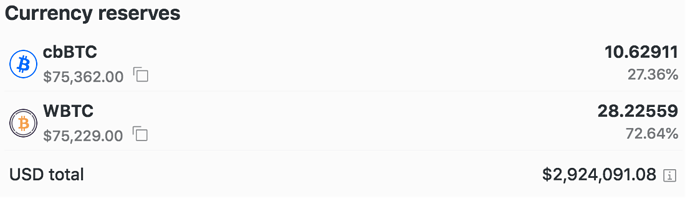

Reference Pool

We identified as reference pool for the Oracle as the cbBTC/WBTC pool:

Source: cbBTC/WBTC

As cbBTC is a new asset and has not proliferated across DEXs to the degree that more mature assets like WBTC, special attention should be placed on the liquidity in this pool to ensure it does not become susceptible to oracle manipulation. The pool has been receiving gauge weighting and TVL has been growing recently, but these trends may quickly reverse.

However, manipulation is likely prohibitively expensive for an attacker who would need to maintain the manipulation over multiple blocks. Given a 13-second block time and a 700s EMA time, the price oracle could potentially change by approximately 13 / (700 / ln(2)) = 1.29% per block.

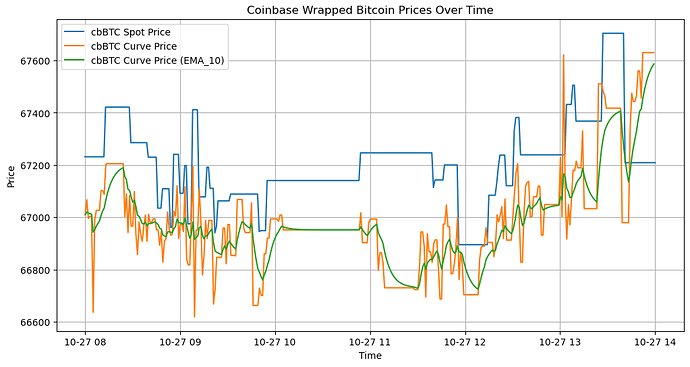

Empirical Validation

We empirically validate the promising EMA time by retrieving a high volatility scenario for cbBTC on the 27th of August 2024. The inputs for this analysis are the spot prices from dex.guru and Curve. The StableSwap pool’s last_price function was queried each minute for the specified time range.

| EMA Length | Mean Difference EMA | Variance Difference EMA | Volatility EMA | Correlation EMA | RMSE EMA | MAE EMA |

|---|---|---|---|---|---|---|

| 8 | -221.066971 | 21,556.367165 | 169.696580 | 0.6044000 | 16.290513 | 241.810765 |

| 10 | -222.501109 | 20,696.304845 | 164.257277 | 0.6061990 | 16.277548 | 241.643034 |

| 12 | -223.831562 | 20,125.247035 | 159.555699 | 0.6054080 | 16.278868 | 241.783546 |

| 13 | -224.462954 | 19,910.093587 | 157.421351 | 0.6044470 | 16.282801 | 241.893637 |

| 15 | -225.667202 | 19,572.925911 | 153.493210 | 0.6018960 | 16.294654 | 242.192940 |

| 17 | -226.803041 | 19,320.211213 | 149.926720 | 0.5989070 | 16.309727 | 242.551387 |

| 30 | -232.949190 | 18,513.460315 | 131.583420 | 0.5788080 | 16.424842 | 244.560974 |

Key Observations:

- Mean Difference EMA: Becomes more negative as the EMA length increases, indicating a growing average discrepancy between the EMA and the reference price.

- Variance Difference EMA: Decreases with longer EMA lengths, suggesting that longer EMAs have variances closer to the reference variance but may lag in responsiveness.

- Volatility EMA: Decreases with longer EMA lengths, showing that longer EMAs produce smoother price lines with less fluctuation.

- Correlation EMA: Peaks at EMA 10 with a value of 0.6062, indicating the strongest linear relationship with the reference data at this length. EMA 12 similarly performs well with 0.6054.

- RMSE EMA: Lowest at EMA 10 (16.2775) and EMA 12 (16.279) , meaning this length has the smallest average squared differences between the EMA and the actual prices.

- MAE EMA: Also lowest at EMA 10 (241.643) and EMA 12 (241.783), indicating the smallest average absolute differences.

Based on the data, EMA Length 10 (i.e. 600 EMA) and EMA Length 12 (i.e. 700 EMA) offers the best balance of accuracy, responsiveness, and reliability. It has the highest correlation with the reference data and the lowest RMSE and MAE values, making it the most effective choice for your Oracle setup.

We would recommend setting the pool oracle EMA time to the higher end at 700s to improve manipulation resiliency.

Conclusion

Although the cbBTC market is new and there are certain attributes that give some users pause (e.g. no PoR yet, ability to freeze addresses), we believe there is an outsized opportunity for Curve to onboard this asset. Furthermore, it aligns with the category of assets already onboarded to crvUSD mint markets, which are tokenized BTC and ETH/ETH LSTs. This category of assets can be considered some of the most reliable collateral types available on Ethereum presently, and cbBTC fits with the precedent Curve has set with previously deployed markets.

This data-driven proposal suggests the deployment of a cbBTC market for crvUSD with the following parameters.

| Asset | Liquidation Discount | Loan Discount | A Factor | Fee | Debt Ceiling ($crvUSD) | Oracle EMA | Reference Pool |

|---|---|---|---|---|---|---|---|

| cbBTC | 5% | 8 % | 100 | 1.3% | 22 M | 700 | 0x839d6bdedff886404a6d7a788ef241e4e28f4802 |