Summary:

The SmartWalletWhitelist contract requires any contract wishing to interact with Curve DAO to first pass a vote of approval by the DAO. This proposal is to retire the whitelist contract and make access to Curve DAO universally permissionless.

Background:

The whitelist requirement was created as part of the initial implementation of Curve DAO. It imposes a requirement that any contract wishing to interact with the DAO must first pass a vote of approval by the DAO (51% approval, 30% quorum). This includes the right to lock CRV and to participate in DAO governance. As per the Curve Github Docs, the original rationale states “The account which locks the tokens cannot be a smart contract (because can be tradable and/or tokenized)”. The concern was that certain contracts may undermine the locking feature of veCRV and whitelisting was a precautionary measure to prevent governance attacks. As it happens, EVERY platform whitelisted to date has relied on tokenization of veCRV as a central design feature.

The whitelist requirement has failed in its intended purpose. On the contrary, it creates a walled garden that has the detrimental consequence of stifling innovation, deterring developers from building applications that integrate with Curve DAO.

Some Whitelist History:

Only 3 contracts have been successfully whitelisted to date:

Yearn - August 2020

There was a lot of support for this. Curve was stretching its legs, DeFi summer was raging. The rationale for approval assumed that Yearn had no intention of tokenizing veCRV, and Curve was only helping them boost their yield farming products and enabling voting rights. Genie came out of the bottle in November, when Yearn released their “Backscratcher” Vault, creating the first instance of tokenized veCRV.

StakeDAO - January 2021

Having a close relationship with Curve core team, this proposal faced no controversy and easily passed its whitelist approval vote. They implemented their own wrapped veCRV to compete with Yearn.

Convex - April 2021

This proposal had a lot going for it. Convex found a product-market fit not captured by the previous protocols, it was headed by people deeply involved with the community who understood Curve, and it wished to share ownership stake with members of Curve DAO. Its novel use cases and aggressive execution has made Convex the most powerful entity in the Curve ecosystem. Its wrapped veCRV is so popular that Convex is nearing a majority stake in Curve’s governance.

A number of proposals to whitelist have failed. Reasons include (1) Failed DAO vote, (2) Developers chose to build on already whitelisted platforms, (3) Project abandoned. Failed whitelistings include:

Whitelist Consequences:

Whitelisted platforms have enjoyed a significant advantage in building influence over Curve DAO. Each platform seeks to attract CRV deposits by offering all of the financial benefits of owning veCRV while bypassing the lock period. Voting rights of the deposited CRV are captured by the platform, which is either retained or redistributed to a second layer governance body. The history of wrapped veCRV has proven that the most lucrative wrapper attracts the majority of newly locked CRV.

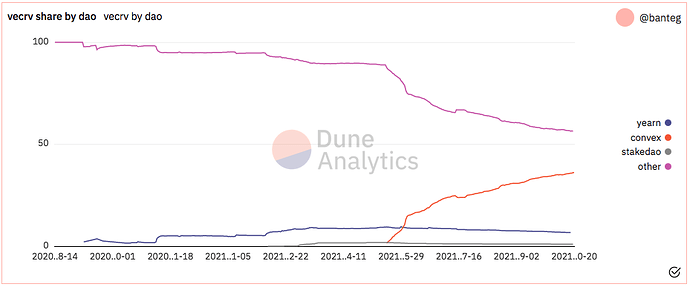

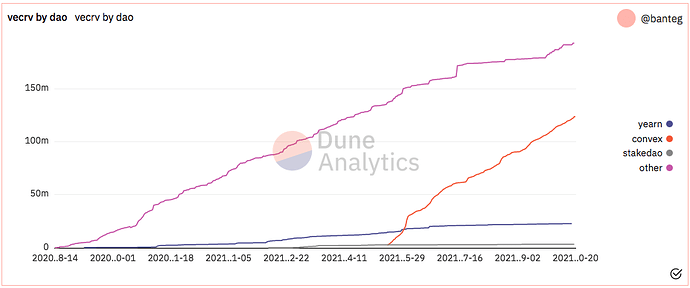

Chart below shows the decline in individual CRV locking over time (other), as whitelisted contracts gain dominance. As organizations grow to become the dominant governance participants in Curve DAO (orgs now own ~44% of all veCRV), we must ensure that the competitive landscape is open to all. The whitelist creates an unfair advantage to a select few organizations, inhibiting new entrants and creating monopolistic power centers that could become a single point of failure.

Appeal to Convex:

I’ll preface by disclosing that I regularly participate in Convex, a significant portion of my net worth is tied to it, and I only vlCVX.

Anyone paying attention can see plainly that Convex is dominating the Curve DAO war. And their success has been well deserved. So on the topic of repealing the whitelist, Convex is in an uncomfortable position. The easy way to keep expanding power is to not give an opponent the opportunity to take market share. Repealing the whitelist could be easily interpreted as opening the floodgates to potential rivals.

But the way to ensure long term prosperity for Curve, and thus Convex itself, is to relentlessly maintain a policy of supporting permissionless innovation. The whitelist is a form of permissioned access, and it turns away developers who might otherwise produce something of value to Curve. Convex depends not only on Curve for its success, but also on its wider ecosystem. Yearn products are integrated into Convex, yet Convex’s piece of the pie isn’t made smaller by the existence of Yearn. Together they compound the size of the pie.

We can choose to support a free market with a rich ecosystem of developers coming up with novel applications, who challenge us to keep improving our product, and whose products we integrate, together compounding value creation for the entire Curve ecosystem. This is the value of open source development and its why we are all here expending our energy to build a new financial system. We believe that open will always win.

That’s why I can say that as a stakeholder, my interests are aligned with Convex when I support removing the whitelist. Always take the long view, and see that what is good for Curve is good for Convex. Take some time and consider the long term consequences of choosing to enforce or repeal the whitelist. I think you will agree that repealing the whitelist is good for Curve and that what is good for Curve is good for Convex. If in doubt, vote with charlieoliver.eth.

For:

Remove whitelisting requirement for contracts wishing to interact with Curve DAO

Against:

Preserve whitelisting requirement for contracts wishing to interact with Curve DAO