Summary:

Reduce min rate for WETH2, WBTC, wstETH2 LlamaLend Markets from 3%, 2%, and 3% respectively to 0.5%.

Abstract:

A recent proposal replaced the Secondary MP with Semilog on a number of markets, including the three included in this proposal. These proposal would adjust the min rate of three of these markets with the following adjustments:

| Market | Controller Address | Monetary Policy | Current Params | Adjusted Params |

|---|---|---|---|---|

| wETH2-long | 0x23f5a668a9590130940ef55964ead9787976f2cc | Semilog MP | 3%/70% | 0.5%/70% |

| wstETH2-long | 0x5756a035f276a8095a922931f224f4ed06149608 | Semilog MP | 3%/70% | 0.5%/70% |

| wBTC-long | 0xcad85b7fe52b1939dceebee9bcf0b2a5aa0ce617 | Semilog MP | 2%/70% | 0.5%/70% |

Motivation:

The current parameterization of these markets is not optimal. The markets equilibriate around 45-50% utilization which reduces yield to suppliers, making these markets less competitive. Reducing the min rate will reduce rates further, but should shift the market equilibrium to a more favorable state for lenders.

Specification:

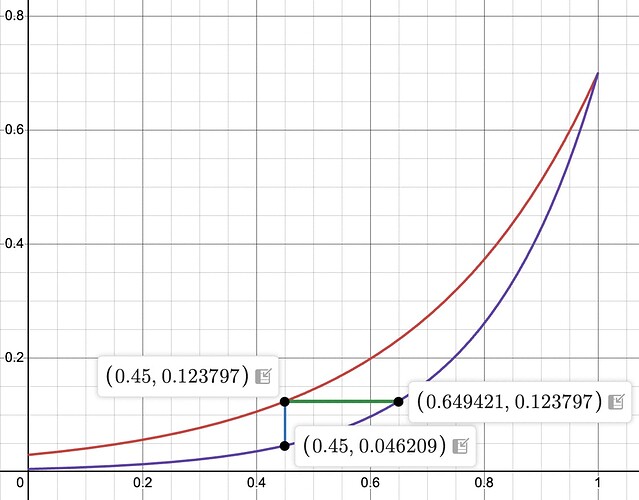

The red curve shows the current Semilog params (min/max is 3%/70%), producing a borrow rate 12.38% at around the equilibrium of 45% utilization. The min rate reduction (reflected in the purple curve) will immediately reduce the rate to 4.6%, but will shift the market equilibrium to 65% utilization.

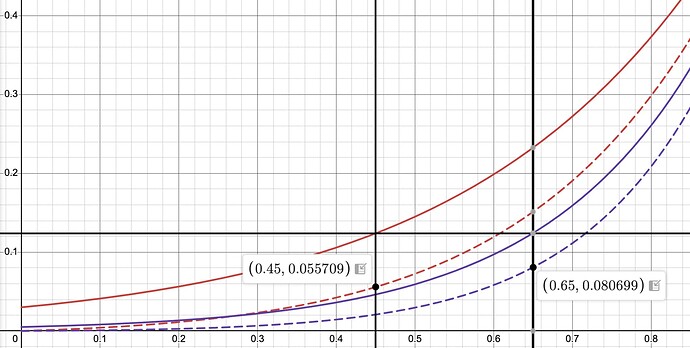

The dashed lines show the lend rate for the current IRM (red) and the adjusted IRM (purple). Assuming markets equilibriate at 12.38%, the lend rate will increase from 5.57% to 8.07%, a ~45% increase in market efficiency.

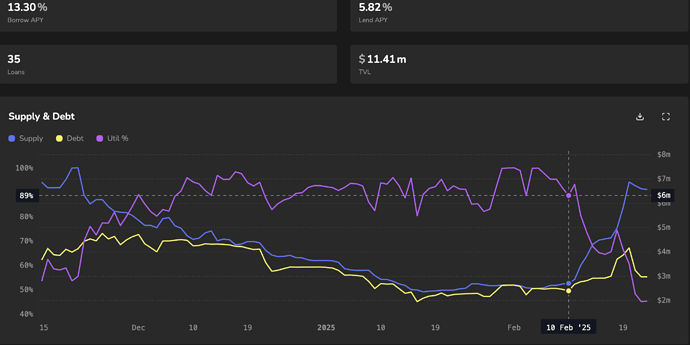

The above uses the current conditions of the WETH2 market as an example to demonstrate the impact reducing min rate is expected to have on borrow/lend/utilization rates. See below the dynamics of the market after implementing the Semilog IRM on 2/11/25- rates immediately increased substantially, prompting lenders to enter the market, reducing utilization and increasing the rate spread.

For:

Improve market efficiency with the aim to improve returns for lenders

Against:

Increasing the min/max spread will increase rate sensitivity of the IRM.