Introduction:

This proposal aims to address the financial setbacks experienced by JPEG’d DAO and its community due to the Vyper exploit on July 30th, 2023 while having more locked veCRV owned by ecosystem participants. JPEG’d is a leading NFT lending protocol, which has had an active presence on Curve since its inception in early 2021 and has a good track record of safe and professional operation. They swiftly mitigated the impact to their users using their treasury and recovered funds. Passing this proposal would demonstrate Curve DAO’s commitment to supporting DAOs who work at growing the Curve ecosystem.

Background:

On July 30th, 2023, Curve DAO faced an exploit that impacted various pools, including the pETH/ETH and JPEG/pETH pools. This exploit resulted in a loss of approximately worth 1,375 ETH both in JPEG tokens in ETH equivalent, significantly affecting JPEG’d DAO and its users. We acknowledge that this loss was not a result of any action taken by JPEG’d DAO, and we appreciate the timely actions taken by the JPEG’d team to recover and redistribute the majority of the losses to their community members. In fact, JPEG’d worked days and nights to compensate their users faster than anyone else affected.

Since inception in March 2021, JPEG’d DAO has a proven track record of consistent Curve governance participation, with holdings of over 1.5 million CVX tokens, and of Curve liquidity provision with over $20 million in the pUSD/3CRV pool and holding over $20 million in the pETH/ETH pool at the time of exploit… During the aftermath of the exploit, JPEG’d commendably focused on resolving the financial losses of their users and not blame attribution. The team managed to recover 90% of the exploited funds and disbursed them to their affected users, and non-users.

JPEG’d users were made 100% whole at JPEG’d DAO’s expense, while non-users were reimbursed ~80% of their value. The recent Curve DAO proposal managed to make the other pETH/ETH LP whole, but didn’t address the cost incurred by JPEG’d DAO as a Curve user.

Proposal:

In recognition of the loyalty and resilience demonstrated by JPEG’d DAO during this challenging period, this proposal is to compensate JPEG’d DAO for the losses incurred due to the exploit on July 30th, 2023.

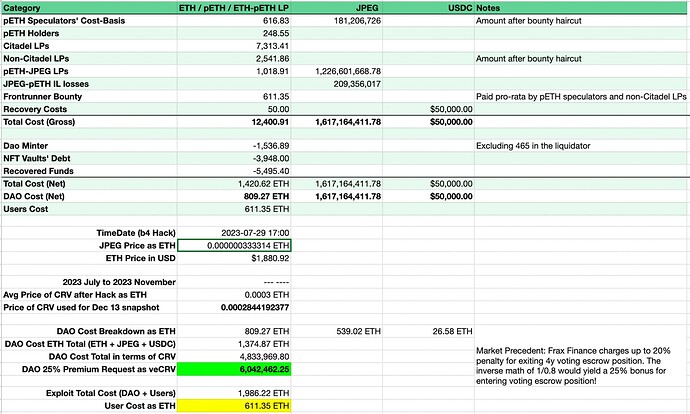

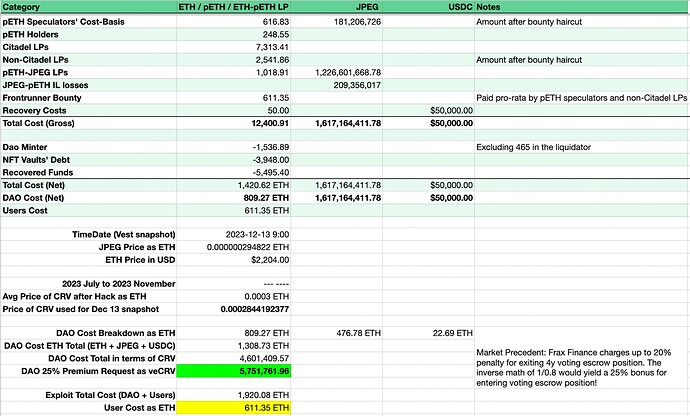

The losses incurred by JPEG’d are split as follows:

| Token | Amount |

|---|---|

| ETH | 809.27 |

| JPEG | 1,617,164,411.78 |

| USDC | 50,000.00 |

| TOTAL ETH VALUE | 1,374.87 ETH |

Based on the price of CRV in ETH at the time of the hack, and accounting for a 25% premium request for the risk undertaken by JPEG’d DAO. We propose offering 6,042,462.25 veCRV tokens as compensation, a form that aligns with the risk undertaken by JPEG’d DAO. The premium aligns with a market precedent: Frax Finance charges up to 20% penalty for exiting 4y voting escrow position. The inverse math of 1/0.8 would yield a 25% bonus for entering voting escrow position. Alternatively, buying CRV OTC with a lock would result in a similar discount. We believe this compensation is fair, considering the circumstances, and will contribute to driving liquidity back to Curve.

JPEG’d DAO was already whitelisted to be eligible to lock CRV, and they will lock and use the resulting veCRV for participation at Curve governance.

State of DAO finances

Curve DAO has spent 71’768’597.75 CRV out of 123’915’151 CRV available in the DAO for the hack compensation already. However, there is also Curve Community multisig [0xc420C9d507D0E038BD76383AaADCAd576ed0073c] which currently holds 13M worth of already vested CRV. I propose to use CRV from that reserve. The Community Grants Council who controls it, however, doesn’t want to singlehandedly make such an important decision, so it is proposed that the multisig will transfer 6.042M CRV tokens to Curve DAO, and the DAO will hold a fully decentralized vote about this compensation.

Conclusion:

This proposal presents an opportunity for Curve DAO to reaffirm its commitment to fairness and support for loyal members within its ecosystem and is a fair gesture seeing we already compensated all users affected by the July exploit, except JPEG’d DAO. Providing compensation in veCRV will not only close this gap but encourage further participation in Curve governance.