Summary:

Increase USDC and USDT PegKeeper debt ceiling to 50m crvUSD from 25m.

Abstract:

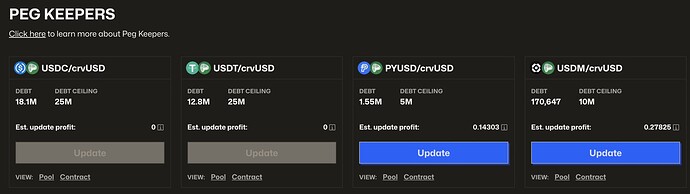

Both PegKeepers are set to a debt ceiling of 25m, targeting the USDC/crvUSD and USDT/crvUSD pool, respectively. This proposal will increase the ceiling to 50m each, allowing them additional liquidity to balance the target pools and protect against an upward depeg.

Motivation:

The USDT and USDC PegKeeper pools are the primary drivers of crvUSD stability, activating when excess demand for crvUSD leads to imbalance in the target pools. With the recent launch of Resupply, it allows users to leverage supply crvUSD to LlamaLend markets. High reward potential with leverage on crvUSD has initiated a period of heightened crvUSD demand. The supply of crvUSD has increased substantial, mainly from PegKeeper debt.

During periods when PegKeeper debt makes up a larger share of overall debt, rates to mint crvUSD drop substantially, in this case to near zero- incentivizing borrowers to mint crvUSD.

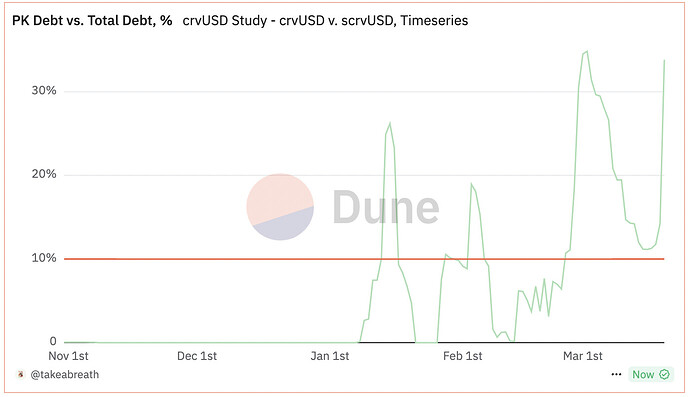

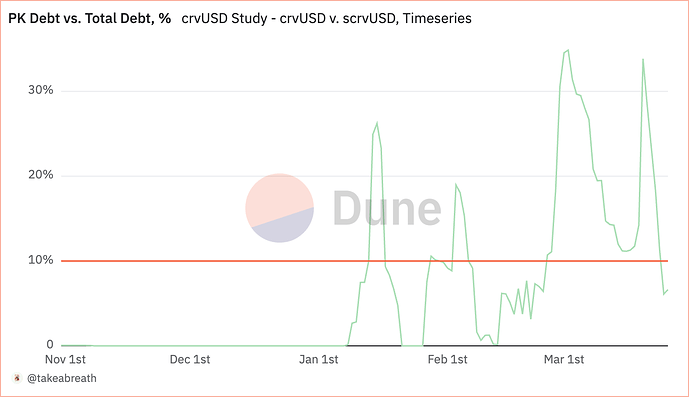

This is especially true when PK debt is over 10% of the overall crvUSD debt. See below that the debt from PegKeepers has been consistently above this threshold since February 25.

While this dynamic between PegKeeper debt and mint market rates should equilibrate the proportion of crvUSD minted by borrowers and by PegKeepers (i.e. lessen the reliance on PegKeepers), there may be a delayed reaction by market participants, as has been the case over the past month. Therefore there may be need for additional PegKeeper debt to support crvUSD stability during prolonged periods characterized by high reliance on PegKeeper debt.

Note that, at time of writing, the PegKeeper Debt is 32.62m of 65m, or 50% of the total PegKeeper debt ceiling.

Specification:

CONTROLLER = '0xC9332fdCB1C491Dcc683bAe86Fe3cb70360738BC'

ACTIONS = [

# USDC debt ceiling 50m crvUSD

(CONTROLLER, "set_debt_ceiling", "0x9201da0D97CaAAff53f01B2fB56767C7072dE340", 50000000000000000000000000),

# USDT debt ceiling 50m crvUSD

(CONTROLLER, "set_debt_ceiling", "0xFb726F57d251aB5C731E5C64eD4F5F94351eF9F3", 50000000000000000000000000),

]

This vote appears that it may not reach quorum and will not be enacted. LlamaLend market borrowers should be aware of the oracle used in each LlamaLend market, as the oracle type can influence the market’s sensitivity to changes in crvUSD price. This is particularly important to understand in current conditions where demand for crvUSD has increased from the introduction of scrvUSD several months back and now Resupply protocol launch. While PegKeepers have never reached their debt ceiling, the outcome of such condition would likely result in crvUSD rising above its peg. Depending on the speed and severity of an upward depeg, LlamaLend market positions may enter soft liquidation and may become at risk of hard liquidation.

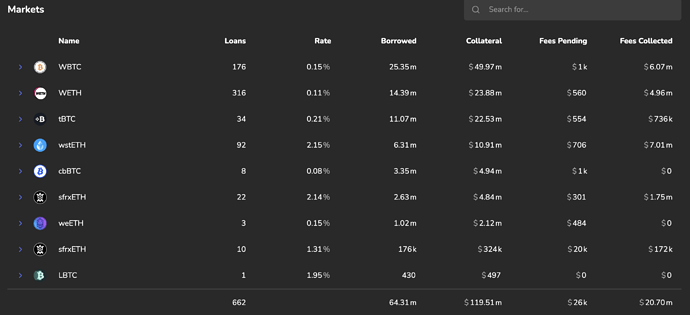

See below a chart of the predominant LlamaLend markets on mainnet and their respective oracle configuration. Markets that use the oracle CryptoFromPool and CryptoFromPoolsRate rely on a single Curve pool or chain of Curve pools to denominate pricing in collateral/crvUSD. This configuration exposes borrowers to crvUSD pricing risk specific to the constituent pools, and are more sensitive generally to fluctuation in stablecoin pricing. Newer pools have been instantiated with the CryptoFromPoolsRateWAgg, CryptoFromPoolVaultWAgg, and CryptoFromPoolWAgg implementations that combine the underlying pool price oracle with the aggregate price of crvUSD across multiple PegKeepers. This pricing method is more resilient to transient price spikes, although a sustained upward crvUSD depeg will reflect in the LlamaLend market oracle. This means, while newer LlamaLend markets are less likely to be affected by transient crvUSD depegs, borrowers may enter soft liquidation or become at risk of hard liquidation if crvUSD experiences a sustained upward depeg and their position is high LTV.

| Market |

Oracle |

Pool |

vault |

agg |

| WETH2 |

CryptoFromPool |

0x4eBdF703948ddCEA3B11f675B4D1Fba9d2414A14 |

|

|

| CRV |

CryptoFromPool |

0x4eBdF703948ddCEA3B11f675B4D1Fba9d2414A14 |

|

|

| tBTC |

CryptoFromPool |

0x2889302a794dA87fBF1D6Db415C1492194663D13 |

|

|

| WETH |

CryptoFromPool |

0x4eBdF703948ddCEA3B11f675B4D1Fba9d2414A14 |

|

|

| wstETH2 |

CryptoFromPool |

0x2889302a794dA87fBF1D6Db415C1492194663D13 |

|

|

| sUSDe-v2 |

CryptoFromPoolsRate |

0x57064F49Ad7123C92560882a45518374ad982e85 |

|

|

| WBTC |

CryptoFromPoolsRate |

0x7F86Bf177Dd4F3494b841a37e810A34dD56c829B, 0x4DEcE678ceceb27446b35C672dC7d61F30bAD69E |

|

|

| pufETH |

CryptoFromPoolsRate |

0xEEda34A377dD0ca676b9511EE1324974fA8d980D, 0x2889302a794dA87fBF1D6Db415C1492194663D13 |

|

|

| ynETH |

CryptoFromPoolsRateWAgg |

0x19B8524665aBAC613D82eCE5D8347BA44C714bDd, 0x2889302a794dA87fBF1D6Db415C1492194663D13 |

|

0x18672b1b0c623a30089A280Ed9256379fb0E4E62 |

| sDOLA |

CryptoFromPoolVaultWAgg |

0x8272E1A3dBef607C04AA6e5BD3a1A134c8ac063B |

0xb45ad160634c528Cc3D2926d9807104FA3157305 |

0x18672b1b0c623a30089A280Ed9256379fb0E4E62 |

| sFRAX |

CryptoFromPoolVaultWAgg |

0x0CD6f267b2086bea681E922E19D40512511BE538 |

0xA663B02CF0a4b149d2aD41910CB81e23e1c41c32 |

0x18672b1b0c623a30089A280Ed9256379fb0E4E62 |

| sfrxUSD |

CryptoFromPoolVaultWAgg |

0x15e4ff94B70a8F146b4e4aFD069014d126035752 |

0xcf62F905562626CfcDD2261162a51fd02Fc9c5b6 |

0x18672b1b0c623a30089A280Ed9256379fb0E4E62 |

| USDe |

CryptoFromPoolWAgg |

0xF55B0f6F2Da5ffDDb104b58a60F2862745960442 |

|

0x18672b1b0c623a30089A280Ed9256379fb0E4E62 |

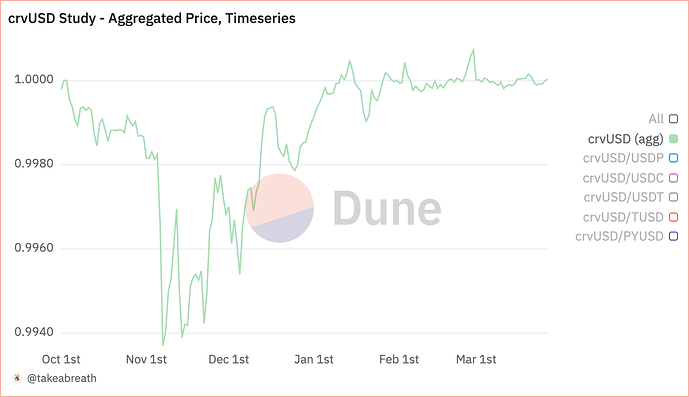

See below the trajectory of crvUSD aggregated price, noting that scrvUSD was introduced in November 2024. Since then, the peg has improved substantially.

PegKeeper debt as a percent of total debt is an important metric that informs crvUSD borrow rates and indicates the relative reliance on PegKeepers. Since crvUSD achieved a strong peg in January, PegKeepers have become very active. Note that PegKeepers tend to rise sharply when activated, indicating significant market events that require the rapid deployment of crvUSD liquidity to maintain stablecoin stability. With the combined supply sinks from scrvUSD and Resupply, PegKeeper reliance is likely to remain high and may make more volatile moves going forward.

For more information about crvUSD upward depeg events, there was an event that happened in June 2024. LlamaLend market borrowers are encouraged to review the Incident Report we published following the event:

2 Likes