Summary:

This proposal modifies the monetary policies for crvUSD mint markets and the crvUSD PegKeepers. It will:

- Switch weETH monetary policy from non-yielding markets contract to yielding markets

- Reduce rate shift on yielding crvUSD markets from 2% to 1.5%

- Increase Target Fraction of all monetary policies from 10% to 20%

- Increase PegKeeper total debt ceiling from 65m to 115m crvUSD total

This proposal will be divided into two votes- the first will be action 1-3 (monetary policy specific) and the second with be action 4 (PegKeeper specific).

Abstract:

This proposal is a modification of two previous proposals relevant to crvUSD stability and rate management:

There are four actions that make up this proposal:

- Switch weETH monetary policy from non-yielding markets contract to yielding markets: This is the MonPol contract used by wstETH and sfrxETH, contract here.

- Reduce rate shift on yielding crvUSD markets from 2% to 1.5%: This will affect wstETH, sfrxETH v2, and weETH markets by reducing the borrow rate spread against other markets by 0.5%.

- Increase Target Fraction of all monetary policies from 10% to 20%: This will reduce borrow rate sensitivity to the presence of PegKeeper debt.

- Increase PegKeeper total debt ceiling: Increase USDT and USDC PegKeeper debt ceiling by 20m each and increase PYUSD PegKeeper debt ceiling by 10m.

Motivation:

The general motivation for this proposal has been explained in the previous proposals linked above. Basically, the current crvUSD regime is characterized by very low borrow rates and high PegKeeper debt utilization. This can be explained by a combination of factors- scrvUSD and Resupply present substantial supply sinks that drive up crvUSD demand, reducing borrow rates. Meanwhile, demand for leverage is relatively low and is not efficiently normalizing rates. Existing borrowers are likely to be fairly rate insensitive, and therefore the near-0 rates recently may be overly drastic and not producing immediate desired outcomes.

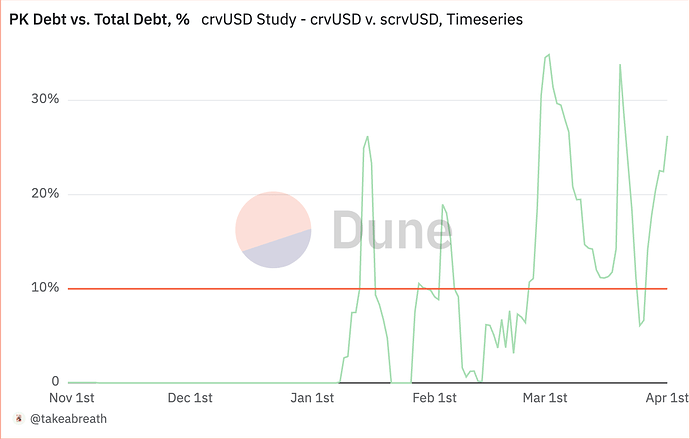

Central to this proposal is the relationship between PegKeeper debt and crvUSD borrow rates. PegKeeper debt as a portion of overall debt (DebtFraction) has been rising significantly, on average, and when exceeding the TargetDebt (specified in the monetary policy contract) rates will become quite low. This is set to 10% now, as shown below against the DebtFraction.

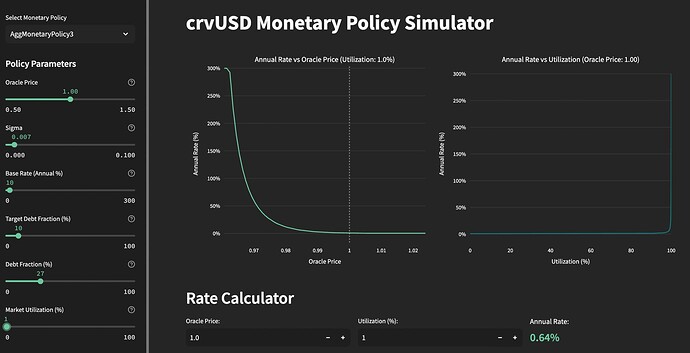

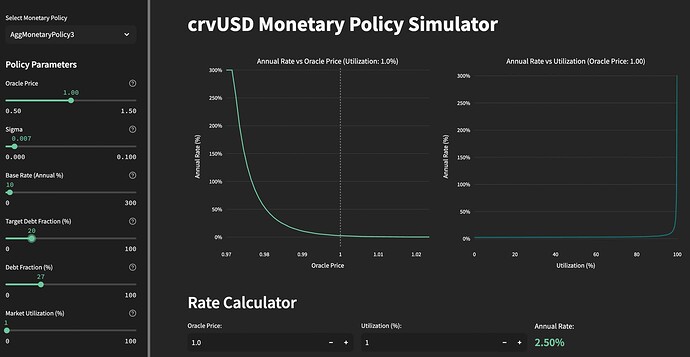

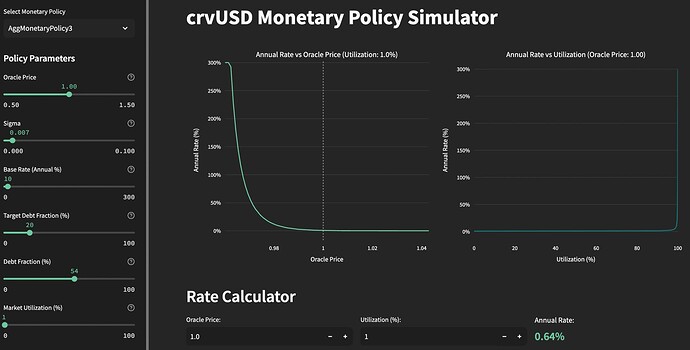

Below is a model of the crvUSD Monetary Policy behavior to demonstrate how increasing the TargetFraction will influence rates. This model is not yet public, but is something we are working to publicize for those interested. We show the current conditions as of April 2 and how adjustment to the TargetFraction will modify crvUSD borrow rates.

Current condition: TargetFraction 10% | DebtFraction 27% | Rate 0.64%

Future condition: TargetFraction 20% | DebtFraction 27% | Rate 2.5%

Future condition, rate equilibrium: TargetFraction 20% | DebtFraction 54% | Rate 0.64%

If we assume PegKeeper utilization increases further as a result of this change, we could expect a 54% DebtFraction, which currently equates to 124m crvUSD in circulation * 54% = 67m crvUSD total PegKeeper debt. This exceeds the current total PegKeeper debt ceiling, and therefore requires additional buffer on the ceiling to ensure it is not reached.

The previous proposal to increase PegKeeper debt ceilings did not pass quorum, either because of lack of awareness or controversy in the proposal. Please review our followup post, outlining the sensitivity of LlamaLend markets to an upward crvUSD depeg. It has happened previously that a transient upward depeg resulted in losses to LlamaLend borrowers, and we consider it important the DAO take measures to avoid another upward depeg scenario.

Increasing the debt from PegKeepers may also be considered desirable for prospective leveragers. An ample reserve of PegKeeper debt guarantees a specific quantity of crvUSD liquidity that will defend crvUSD against a downside depeg, enabling borrowers to open substantial position sizes. It is much preferable to have substantial PegKeeper debt as an incentive to borrow rather than allow crvUSD to have an upward depeg, which will put LlamaLend borrowers at greater risk of liquidation.

Specification:

Vote 1: Monetary Policy Modification

WEETH_CONT = '0x652aEa6B22310C89DCc506710CaD24d2Dba56B11'

YIELDING_MONPOL = '0x8D76F31E7C3b8f637131dF15D9b4a3F8ba93bd75'

NON_YIELDING_MONPOL = '0x8c5a7f011f733fbb0a6c969c058716d5ce9bc933'

SFRXETH_MONPOL = '0xc684432FD6322c6D58b6bC5d28B18569aA0AD0A1'

ACTIONS = [

# WEETH to yielding AggMonPol

(WEETH_CONT, "set_monetary_policy", YIELDING_MONPOL),

# Reduce extra_const on yielding AggMonPol from 2% to 1.5%

(YIELDING_MONPOL, "set_extra_const", 475646879),

# Yielding markets TargetFraction 20%

(YIELDING_MONPOL, "set_target_debt_fraction", 200000000000000000),

# Non-yielding markets TargetFraction 20%

(NON_YIELDING_MONPOL, "set_target_debt_fraction", 200000000000000000),

# Old sfrxETH market TargetFraction 20%

(SFRXETH_MONPOL, "set_target_debt_fraction", 200000000000000000)

]

Vote 2: PegKeeper Modification

CONTROLLER = '0xC9332fdCB1C491Dcc683bAe86Fe3cb70360738BC'

ACTIONS = [

# USDC debt ceiling 45m crvUSD

(CONTROLLER, "set_debt_ceiling", "0x9201da0D97CaAAff53f01B2fB56767C7072dE340", 45000000000000000000000000),

# USDT debt ceiling 45m crvUSD

(CONTROLLER, "set_debt_ceiling", "0xFb726F57d251aB5C731E5C64eD4F5F94351eF9F3", 45000000000000000000000000),

# PYUSD debt ceiling 15m crvUSD

(CONTROLLER, "set_debt_ceiling", "0x3fA20eAa107DE08B38a8734063D605d5842fe09C", 15000000000000000000000000),

]