Summary:

This proposal seeks to add the ynETH-crvUSD lending/borrowing market to the Gauge Controller on the Curve Finance DAO. By doing so, we aim to incentivize lending and borrowing activities on Curve Lend, enhancing its utility and adoption.

References/Useful links:

- Website: YieldNest

- Documentation: YieldNest Docs

- Github: YieldNest GitHub

- Communities: YieldNest Discord, YieldNest Twitter

- Curve Lend pool: ynETH - crvUSD Lend/Borrow market

- ynETH Token Contract Address: 0x09db87A538BD693E9d08544577d5cCfAA6373A48

- ynETH - crvUSD lend gauge 0x8966A85b414620ef460DeEaCD821c30c442C433F

Protocol Description:

YieldNest is a liquid restaking protocol that provides streamlined access to high-yield, risk-adjusted DeFi strategies through permissionless, curated LRTs across multiple restaking and DeFi protocols.

Motivation:

Curve Lend will create more lend/borrow utility for crvUSD and ynETH. We are looking forward to incentivizing these markets and deploying more in the future.

Specifications:

-

Governance: Decentralization and community governance are important for YieldNest starting as an open finance protocol and plan to become a fully decentralized protocol. We are currently investigating Aragon OSx (Aragon V2) and plan to implement this once the protocol is in a more hardened and stable position. The YieldNest contracts are currently upgradeable using standard TransparentUpgradeableProxy and BeaconProxy contracts from the OpenZeppelin libraries. This is necessary given the project’s current stage and its dependency on Eigenlayer, which still makes breaking changes to the core protocol requiring logic upgrades. Admin and multisig addresses, along with their roles, are documented here and will be hardened over time.

-

Oracles: YieldNest will leverage a Curve Oracle a crvUSD/ynETH oracle will be built by multiplying the TricryptoLlama crvUSD/wstETH oracle with the ynETH/wstETH oracle. We are also hardening the price feeds by implementing a Redstone and Chainlink oracle to ensure accurate and reliable price feeds for its assets, mitigating risk and ensuring precise valuation.

-

Audits: Links to audits: Audits | YieldNest Docs .

Full initial system audit was conducted by ChainSecurity, with an additional audit from Zokyo. -

Centralization vectors: The centralization vectors for YieldNest include reliance on a centralized Oracle. Additionally, staking rewards management and validator operations (spinning up and exiting validators) are centralized in the early stages to ensure flexibility and mobility.

-

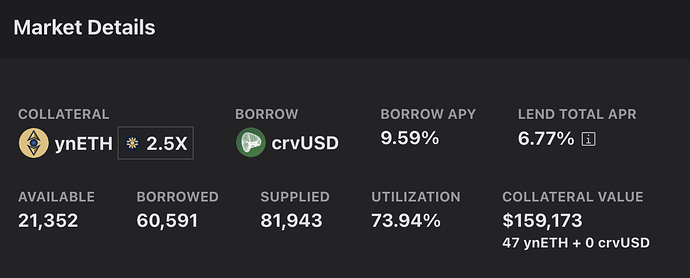

Market History: The market went live around 4-5 weeks ago and now has over 150K collateral and a 70%+ utilization rate.