Summary:

Increase the amplification coefficient (A factor) on the OUSD Metapool (factory-v2-9) from 100 to 500.

Abstract:

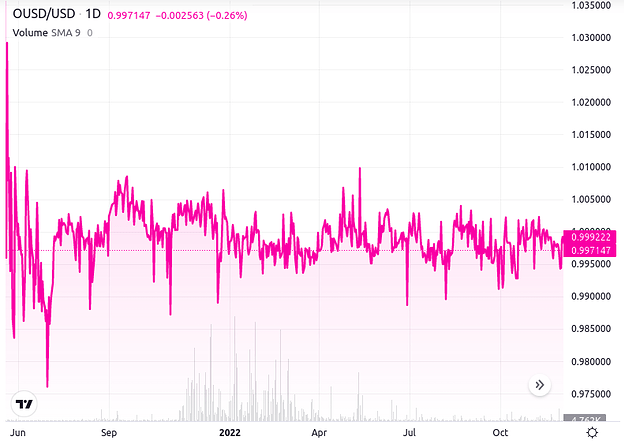

Origin Dollar (OUSD) is the self-custodial, yield-generating stablecoin. It is fully collateralized at all times and automatically distributes DeFi yields in the form of increased token supply. The price of OUSD remains pegged at ~$1.00 but the balance of each account holding the token increases at least once per day. OUSD can be redeemed by anyone at any time for a mixture of DAI, USDC, and USDT. The protocol has successfully scaled up to $300 million and back down to the current circulating supply of $51 million without any issues. OUSD is traded on KuCoin, Gate and Uniswap in addition to most of the volume occurring on Curve.

Motivation:

According to the Curve documentation:

The amplification co-efficient (“A”) determines a pool’s tolerance for imbalance between the assets within it. A higher value means that trades will incur slippage sooner as the assets within the pool become imbalanced.

Note: Within the pools, A is in fact implemented as 1 / A and therefore a higher value implies that the pool will be more tolerant to slippage when imbalanced.

The docs go on to suggest that the pools with the highest A factors should consist of “redeemable assets” as opposed to pools requiring lower A factors consisting of “uncollateralized algorithmic stablecoins” and “non-redeemable, collateralized assets”.

OUSD not only supports permissionless redemptions, it is collateralized by the same stablecoins as 3Crv, which is the other side of the pool in question.

The OUSD Metapool’s current A factor is considerably lower than all of the other top 10 USD-based metapools by TVL:

| Pool | A | |

|---|---|---|

| OUSD/3Crv | 100 | |

| 3pool | 2000 | |

| Frax/3crv | 1500 | |

| Frax/USDC | 1500 | |

| MIM/3Crv | 2000 | |

| alUSD/3Crv | 200 | |

| LUSD/3Crv | 500 | |

| sUSD/3Crv | 256 | |

| Compound | 4500 | |

| TUSD/3Crv | 600 | |

| USDD/3Crv | 200 |

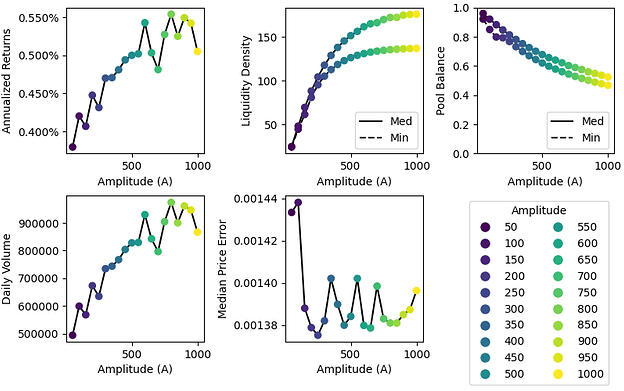

The A factor for the OUSD Metapool was last updated in September of 2021 with an increase from 10 to 100. At the time, OUSD’s circulating supply was around $20 million and daily trading volume rarely exceeded $50k. Since then, the daily trading volume has exceeded $10 million on multiple occasions. An increase to the A factor would facilitate larger trades with less slippage and continue to generate greater fees for Curve LPs and CRV stakers.

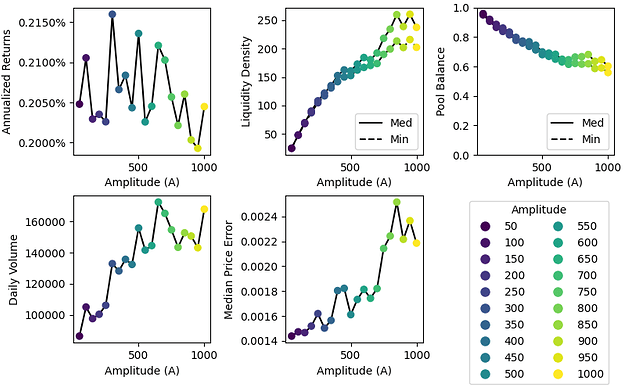

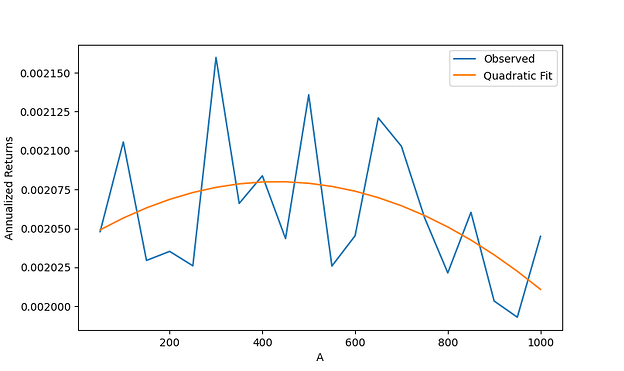

We are proposing to increase the A factor on the OUSD Metapool over a one-week period with a recommendation to go from 100 to 500 at this time.

For:

- Better peg stability for an asset fully collateralized by the same tokens as 3pool

- Reduced slippage to support large trades

- Increased trading volume and additional fees

Against:

- Low existing trading volume compared to some other pools