Summary

Add the sUSDS-long LlamaLend market gauge at address 0x1a915D963EE65943387dd35F54F0296BE4f925e5 to the GaugeController to receive CRV emissions.

Also given here is a market optimization analysis to justify the configuration of this market.

Abstract

- LlamaRisk has recognized yieldbearing stablecoin markets have attracted the most organic demand across LlamaLend markets and there is an opportunity to onboard additional markets within this category.

- Llamarisk has identified sUSDS as a candidate to be onboarded as collateral in Curve’s Lending Market

- In this post we will first present metrics showing the performance of this yield-bearing stablecoin asset since its deployment. We will also show how it compares with other, competing yield-bearing stablecoin assets to further portray the value proposition of onboarding this asset

- Finally, we show the results of our research conducted to make a recommendation for the sUSDS market at deployment and explain our methodology in making this recommendation

Motivation: sUSDS Performance

sUSDS was launched in 2024 as yield-bearing stablecoin asset to supplement their USDS stablecoin.

Sky (formerly Maker DAO) previously offered sDAI as a yield-bearing asset, where DAI was staked to obtain sDAI. USDS is meant to be an upgradeable stablecoin asset that would better suit Sky’s business needs.

sUSDS was released by Sky to give USDS holders an option to opt into a yield-bearing strategy. The smart contract which mints and burns this asset is an ERC4626 vault which accepts USDS as the deposit asset.

A depositor enjoys a yield which is determined by a preset Sky Savings Rate (SSR) which is set by Sky governance.

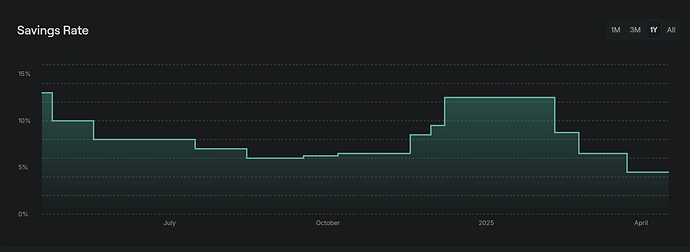

Historical SSR for sDAI and sUSDS, source: Spark

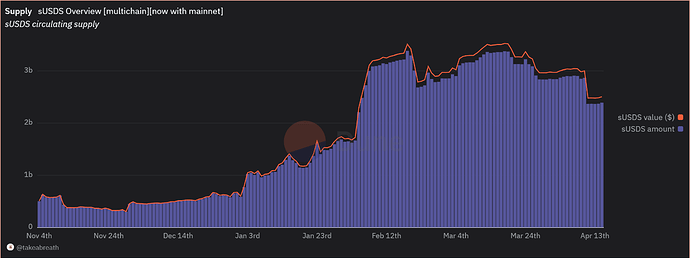

Since it was deployed on September 2024, the stablecoin has enjoyed rapid adoption. On Mainnet, which is where the sUSDS LlamaLend market will also be deployed, there is currently ~2.4B sUSDS in circulation at a market cap of ~$2.5B.

Source: Dune

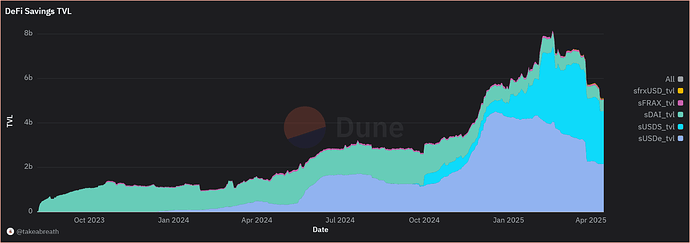

It is also currently the yield-bearing stablecoin asset with the most TVL on mainnet at ~$2.4B, recently edging out sUSDe, Ethena’s yield-bearing stablecoin asset, which has ~$2.2B TVL on mainnet.

Source: Dune

Market Optimization Analysis

Recommended Parameters

The following presents our recommended parameter set for a sUSDS market on LlamaLend:

| Parameter | Value |

|---|---|

| A | 300 |

| Fee | 0.2% |

| Loan Discount | 1.3% |

| Liquidation Discount | 1.0% |

| Min Rate | 0.1% |

| Max Rate | 25% |

Methodology

We used two simulation engines for deriving this recommendation: LlammaSimulator developed by Michael Egorov and Caffeine, Llamarisk’s general-purpose agent-based simulator.

LlammaSimulator Results

LlammaSimulator models the LLAMMA with a fixed set of parameters and one variable parameter to scan for to derive the optimal fee, A-factor and liquidation discount.

The tool uses price data for a given collateral (sUSDS in this case) to give a simulated arbitrageur opportunities to make trades which gets the LLAMMA price closer to market price. See appendix for more on price data we used.

The simulation is ran in steps, the first step is used to find an optimal fee:

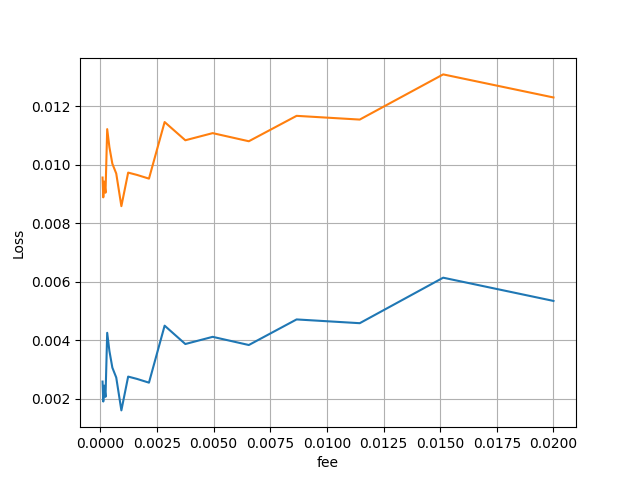

Source: LlammaSimulator

The optimal fee found was around 0.2%, consistent with precedent established by analogous markets (sDOLA-long, sfrxUSD-long). Using this fee, we fix it for the next step of the simulation, finding an optimal A-factor.

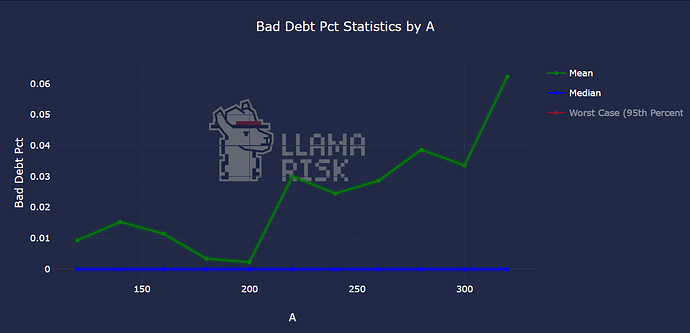

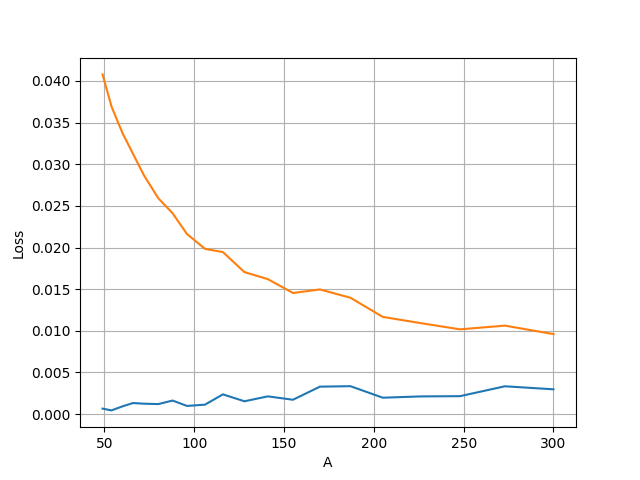

Source: LlammaSimulator

Stablecoin markets are inherently non-volatile and sUSDS has a history of strong peg performance. This is reflected in the output which shows very low loss and a preference for relatively high A values. The precedent set by analogous markets is an A value of 285. We find that probably this value could be pushed higher for sUSDS, but opt for A=300 to be fairly consistent with previously deployed markets. At A=300, LlammaSimulator suggests a very low liquidation discount of 0.4% (value of blue line at A=300), however we prefer to set this value slightly more conservatively at 1%.

Caffeine LlammaLend Simulator Results

We modeled LlammaLend using our general purpose, agent-based simulation engine, Caffeine. We run simulations under a controlled environment where the collateral is under market stress. See Appendix for more on how we do this.

The results of our simulations were aggregated to provide metrics used to determine an appropriate parameter set for this proposed market. See Appendix for more on how we set up our simulation environment, and more on metrics observed.

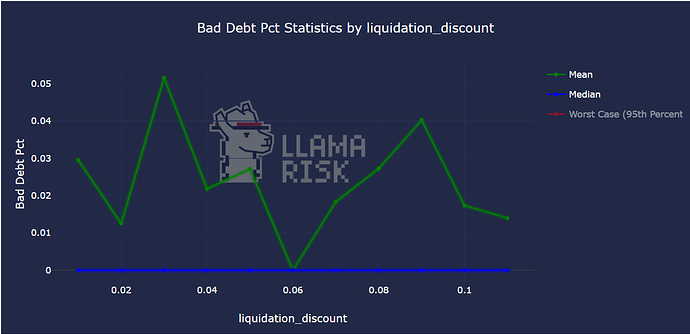

In our analysis, we tried to avoid using mean since outliers tend to skew results. However, median values tend to be very low due to the non-volatile characteristics of the collateral and Bad Debt was non-existent in our simulations. When it does occur it is typically very low: between 0% and 0.06%.

Borrower Loss was a bit more prevalent, and in our model where Arbitrageurs perform trades no matter the profit margin, borrowers actually made a small profit.

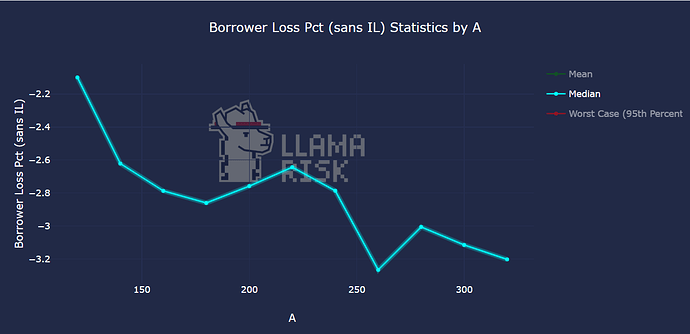

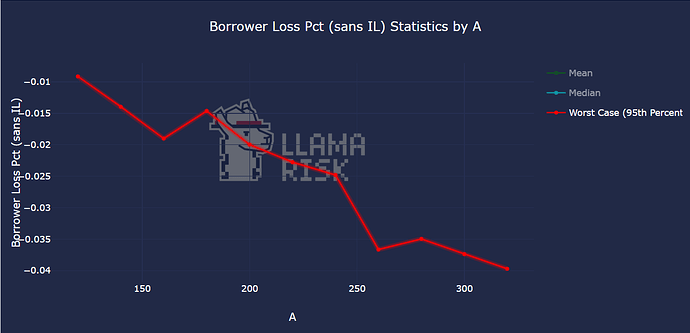

Here we show the median and worst case (95th percentile) Borrower Loss, and observe that higher A values were associated with lower losses.

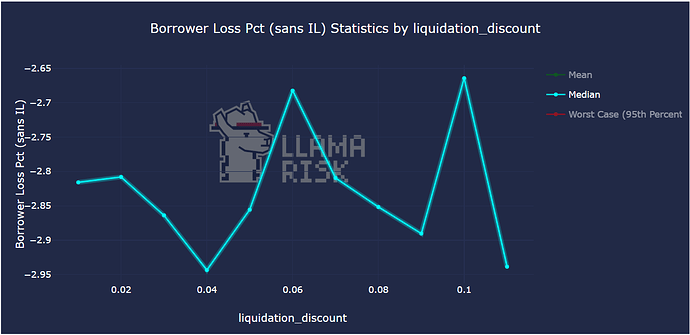

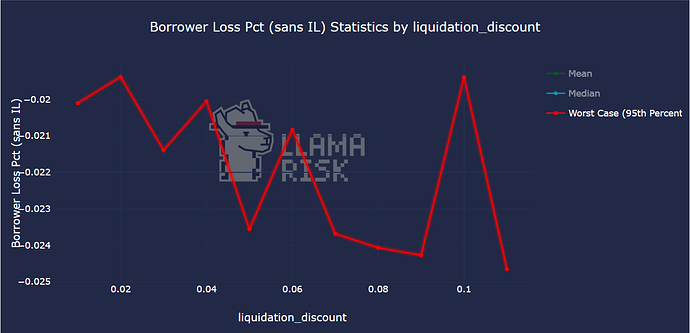

Less of a trend was observed between Liquidation Discount and Borrower Loss, particularly for the median case. For worst case, we do see a slight trend of higher Liquidation Discounts associated with lower losses, but the delta of Borrower Loss observed was ~0.005%; even in the worst case, Borrower Loss was very low.

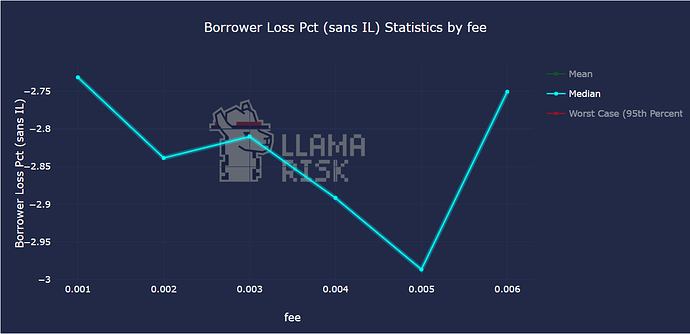

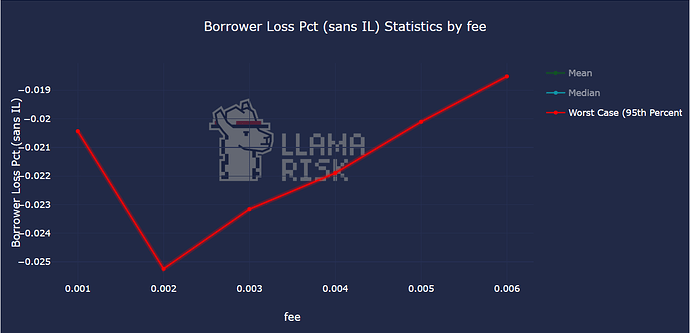

We pick the worst-case best fee of 0.2% for our recommendation, but the median-case best fee of 0.5% can also be considered for the future.

Monetary Policy Rate Assignments

The LlamaLend factory restricts min rate to 0.1% upon market deployment. We therefore established the market with precedent set by analogous markets, min/max rate being 0.1%/25%. Yieldbearing stablecoin market rates are inherently tied to the yield on the underlying, which would only exceed 25% in extraordinary circumstances.

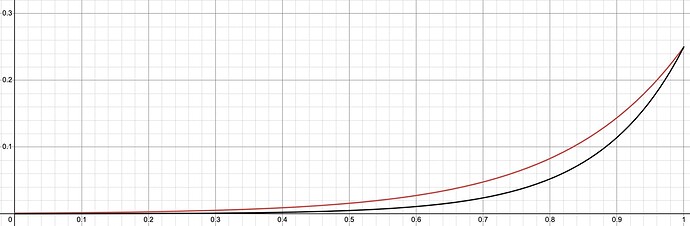

We generally find that, given the behavior of the Semilog MonPol model, min rates of 0.1% tend to be too high for optimal market performance. See below a comparison of a market set to 0.1%/25% (red) and 0.01%/25% (black). There is an opportunity to improve market utilization and returns to lenders by further reduction of min rate. We may consider further modification of the MonPol parameters after the market has been operating for some time.

Appendix

Simulation Assumptions

The LlammaSimulator abstracts away the Controller and Monetary Policy from its simulations. It also assumes that all trade activity in the LLAMMA is from arbitrageurs. These arbitrageurs make trades regardless of the theoretical profit margins from the trade (let’s call this “perfect arbitrage”).

For the LlamaLend implementation of Caffeine we defined a simulation environment which sets USDS as collateral, crvUSD as debt and observes Bad Debt % and Borrower Loss % as metrics. We used the GARCH model for simulating price paths for the collateral token. We found optimal params for this model based on historical price data on the collateral as well as a shock factor applied to price returns.

Bad Debt and Borrower Loss (the sum of Soft and Hard Liquidation loss) were taken as percentages, and reflects the percentage of debt issued which consists of Bad Debt and Borrower Loss, respectively.

The LlamaLend implementation of Caffeine used for these sims abstracts away the Monetary Policy and assumes all trade activity in the LLAMMA is from arbitrageurs.

We have an “external market” model which simulates price impact of a given trade size, this could be used to provide arbitrageurs with profit margins for a given trade. We however opted to not use this in our simulations for USDS as collateral because our external market model is better suited for volatile assets and arbitrage was scarcely done with it implemented. We therefore also assume “perfect arbitrage”.

Monetary Policy seems reasonable to abstract away, considering that we are simulating scenarios of short term market stress. The Monetary Policy however is designed to (dis)incentivize borrower behavior over a prolonged period.

Note: we conducted these simulations using USDS as collateral due to low availability of price data for sUSDS compared to USDS. So we are also assuming that arbitrageurs will be using the redemption mechanism of sUSDS smart contract, and that this asset’s price trajectory follows its underlying asset’s.

Price Data for LlammaSimulator

We used the sUSDS/DOLA pool on Curve to get price quotes from this pool and then converted these quotes to sUSDS/USDC using the DOLA/USDC pool on PancakeSwap using their API.

Specification

GAUGE_CONTROLLER = '0x2F50D538606Fa9EDD2B11E2446BEb18C9D5846bB'

ACTIONS = [

# Add sUSDS-long to gauge controller

(GAUGE_CONTROLLER, "add_gauge", '0x1a915D963EE65943387dd35F54F0296BE4f925e5', 0, 0)

]