Summary:

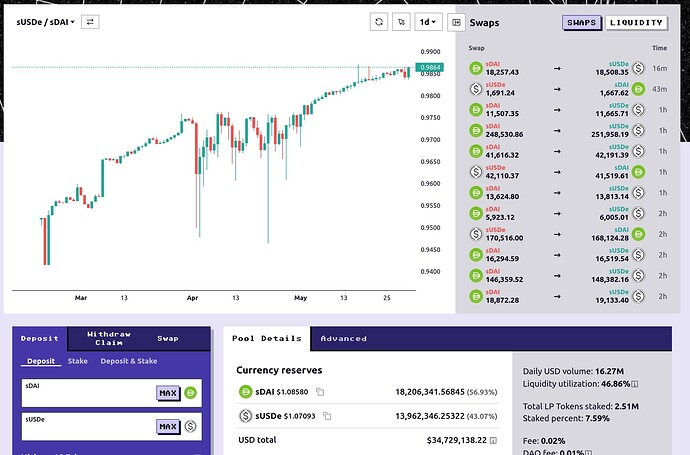

Ethena’s sUSDe vault provides a very interesting currency for farming and speculation. Currently giving around 25% APR, it is also fairly volatile, with fluctuations up to 0.5%-1% (or even more). Liquidity for sUSDe is also very good.

It would be very advantageous for traders to leverage in the dips (say, at -1% deviation). With x35 leverage, one could win 35% of the initial deposit while earning a few hundred % APR.

Below I present a description of how this can be achieved.

Market parameters:

Simulator required few modifications to support two different Thalf times: one is for sUSDe/sDAI pool (Thalf = 30 min), and another for sDAI/FRAX (Thalf = 10 min). Data used /frax pool because it historically had a better liquidity and existed for longer, however in reality we would use sUSDe/sDAI + sDAI/crvUSD or even (better) need to create sUSDe/crvUSD.

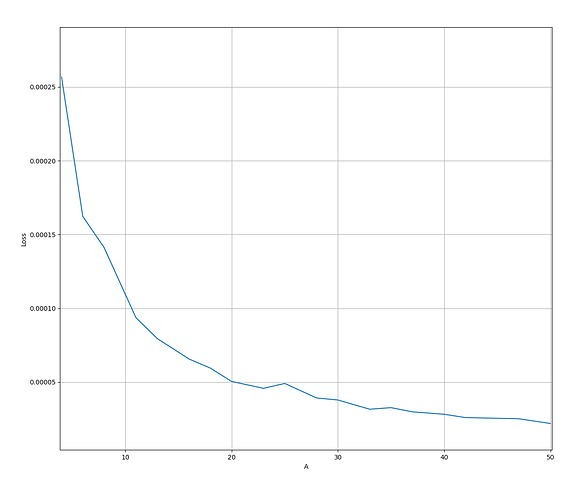

Results show that maximum leverage is achievable at the following parameters:

fee = 0.2%

A = 200

liq_discount = 1.4% (conservative)

loan_discount = 1.9%

Max leverage = 1 / (1.9% + 0.96%) ~= x35

The graph for maximum losses in an hour:

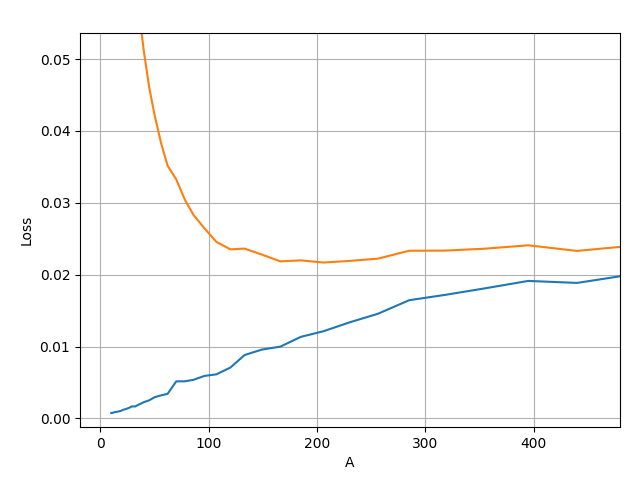

Average losses are much much smaller, on the order of 0.025% per day at max leverage:

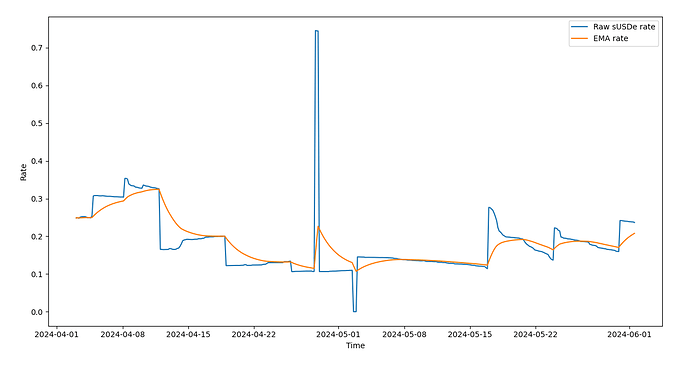

Dynamic monetary policy:

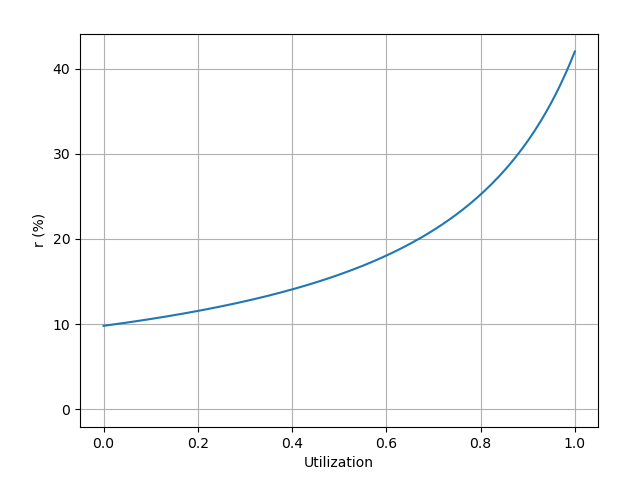

Monetary policy is pegged to EMA of sUSDe rate: it reaches its value at utilization = 85%, getting lower to 35% that rate at utilization = 0:

Simulation for this rate curve is presented here, smart contract can be found here.

Comparison of EMA and raw sUSDe rates is on the picture below (we peg rate to EMA):

Addrresses: