Summary:

Reduce TUSD PegKeeper debt ceiling to 0.

Reduce pyUSD PegKeeper debt ceiling to 5m

Abstract:

PegKeeper debt ceiling is the max amount of crvUSD that a PegKeeper can mint to a target crvUSD pool. Historically, the USDC/USDT pools have been the primary liquidity centers and most useful PegKeeper pools for keeping crvUSD on peg. This proposal balances the proportional debt ceiling to PegKeeper pool TVL so reliance on each PegKeeper is suitable for the significance of the respective pool. It also proposed to fully remove exposure to TUSD due to regulatory risk and solvency concerns.

Motivation:

The current PegKeeper debt ceilings vs pool TVLs along with proposed ratio are as follows:

| Pegkeeper | Debt Ceiling | Pool TVL | Debt Ceiling/TVL | Proposed Ratio |

|---|---|---|---|---|

| USDC | 25m | 12.62m | 1.98 | 1.98 |

| USDT | 25m | 9.69m | 2.58 | 2.58 |

| pyUSD | 15m | 963k | 15.58 | 5.19 |

| TUSD | 10m | 556k | 17.99 | 0 |

Notice the PegKeeper ceiling to TVL ratio is much higher for pyUSD and TUSD. These pools also have not shown a strong trajectory in their TVL:

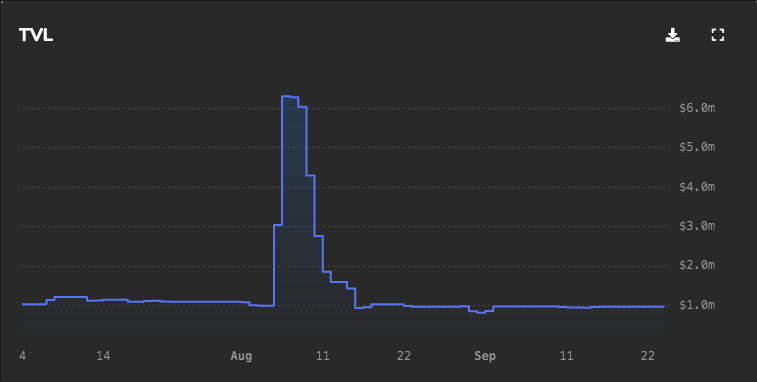

pyUSD

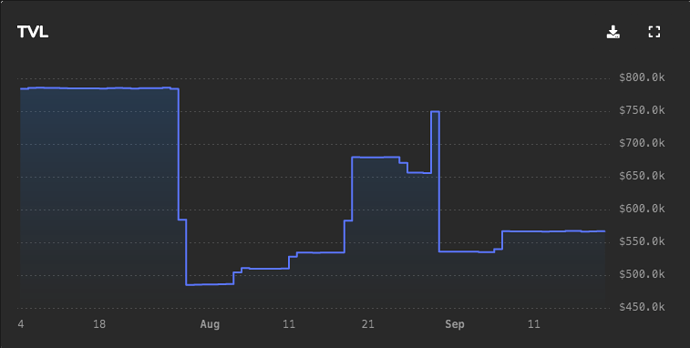

TUSD

This can cause potential issues with the PegKeepers because of ratio limits. A recent proposal voted to increase the caller_share of these PegKeepers to incentivize updating these less efficient PegKeepers. Ratio limits require multiple PegKeepers to deploy debt before increasing the total share of debt that can be deployed. One can play with this Desmos graph to experiment with how changes in debt ceiling affect the ratio limit of the PegKeepers. Essentially, the high debt ceiling relative to pool size may limit the deployment of debt in the USDT/USDC PegKeepers (the important crvUSD PegKeepers) and artificially require more debt to deploy through the pyUSD/TUSD PegKeepers (the “supplementary” PegKeepers).

Ultimately Curve requires a strong diversity of PegKeepers, but that is another discussion. crvUSD is overexposed to minor stablecoins, especially TUSD which has a dubious track record and has recently been charged by the SEC with defrauding investors. LlamaRisk has always taken a skeptical stance toward TUSD, and stakeholders are advised to read the public attestations provided for TUSD. Attestations disclose that nearly 100% of reserves are with the Hong Kong depository institution:

The Hong Kong depository institution also invests in other instruments to generate yield, which are made up of investments that may not be readily convertible to cash, subject to market conditions or fund performance.

Furthermore, attestations disclose that accounting is done at cost. It is impossible to have any insight, based on publicly available information, whether the reserves backing TUSD are liquid or even if the stablecoin is solvent. What we do know is that TUSD experienced prolonged depeg following its offboarding from Binance in February and supply drawdown from 3.3B in Nov '23 to 500M in April '24. The supply has since remained conspicuously static, indicating that there is little public interest in the stablecoin and it may be largely held by insiders. In fact, 78% of the supply on Ethereum (~50% of total supply) is held by an EOA associated with Justin Sun.

PegKeeper V2 was designed to mitigate exposure to stablecoin depegs. However, it may be prudent to consider completely removing crvUSD exposure to TUSD, which has a notably poor track record on peg stability and transparency standards compared to all other PegKeeper stablecoins. Other PegKeeper contenders may include USDM. A followup proposal will address onboarding USDM PegKeeper.

Specification:

call crvUSD ControllerFactory: 0xC9332fdCB1C491Dcc683bAe86Fe3cb70360738BC

TUSD_PK: "0x0a05FF644878B908eF8EB29542aa88C07D9797D3"

PYUSD_PK: "0x3fA20eAa107DE08B38a8734063D605d5842fe09C"

set_debt_ceiling(TUSD_PK, 0)

set_debt_ceiling(PYUSD_PK, 5000000000000000000000000)