Summary:

Reduce sfrxUSD-long LlamaLend market min rate from 0.5% to 0.1% (min/max will be 0.1%/25%).

Abstract:

The min/max parameters of the Semilog monetary policy control the interest rate curve for the LlamaLend market based on its utilization. Reducing min rate to 0.1% is the minimum allowable by the contract and is the same configuration as the sDOLA market (the 0.1/25 configuration was implemented on March 24).

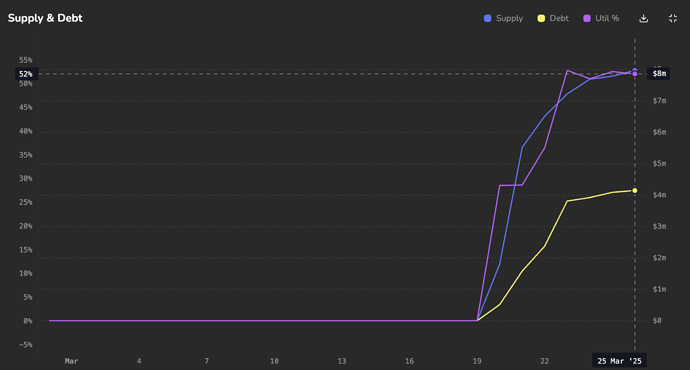

CurveMonitor: sfrxUSD market

Motivation:

The sfrxUSD-long stable lending market allows leveraged exposure to sfrxUSD yields, meaning that organic utilization of the market is bounded by APY of the underlying. Over the past 6 months, sFRAX/sfrxUSD has ranged from around 5-11%, currently at 5% APY.

The recently deployed sfrxUSD LlamaLend market currently sits at 52% utilization with a borrow APY of 3.9% with the current monetary policy configuration.

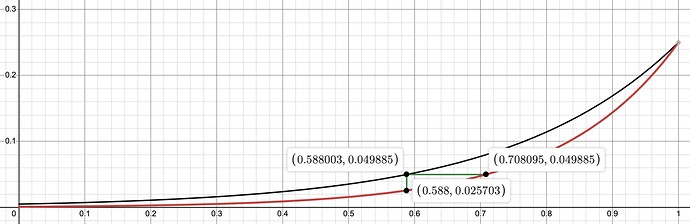

Given the assumption that the lend market borrow rate matches the yield of the underlying (5%), reducing the min rate to 0.1% will immediately reduce the borrow rate 48.5% to 2.57%. Rate equilibrium would be achieved at 70.8% utilization, an increase of 20.4%. See below the current IRM curve in black vs the proposed IRM curve in red.

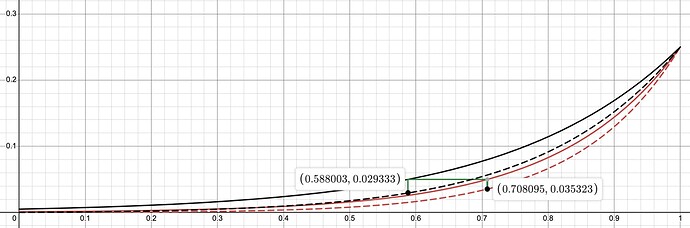

At borrow rate equilibrium, the proposed change would increase lend rates from 2.9% to 3.5%, increasing the market efficiency by 20.4%. See below the market lend rates for each IRM curve shown as dashed lines.

Further rate modification will be assessed after making this adjustment and allowing more time for the market to develop such that a thorough optimization analysis can be conducted.

Specification:

ACTIONS = [

# sfrxUSD min/max rate 0.1%/25%

("0x312b6844E118E01b6684b4B2eAD9FE5cD14Eb6DC", "set_rates", 31709791, 7927447995),

]