Summary:

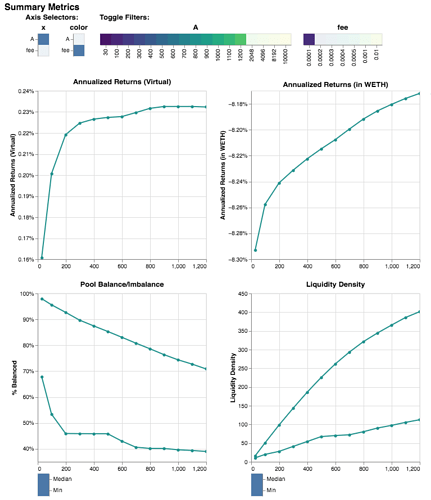

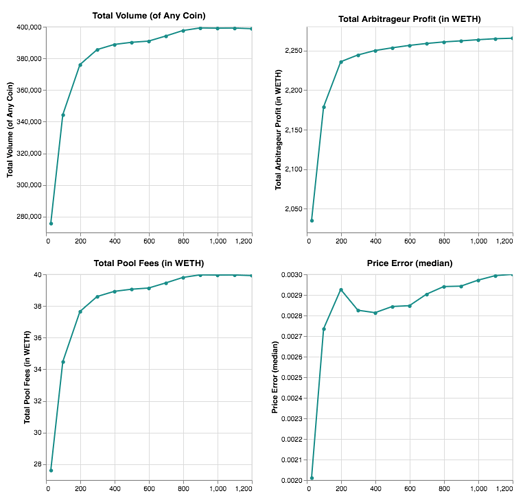

Increase the liquidity concentration of the stETH/ETH pool by ramping A factor from 200 → 900 over 1 week.

Abstract:

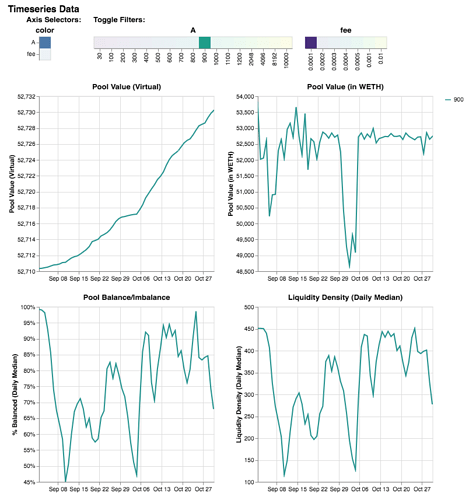

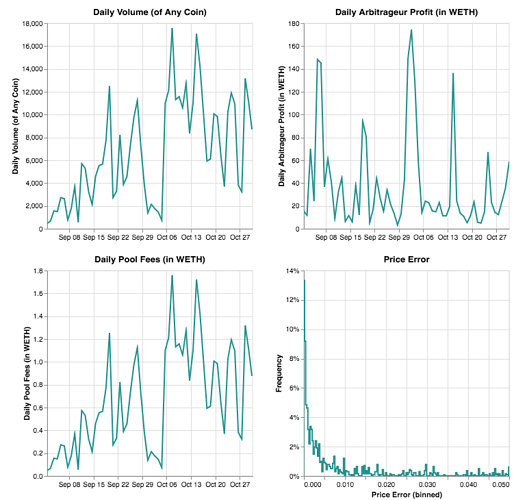

stETH is a rebasing LST with relatively low volatility. Therefore, we considered whether it would be safe to ramp A above 200 to better concentrate liquidity near the peg. Simulations suggested that an A factor up to 900 would maintain a reasonable pool balance while increasing returns and liquidity density.

Motivation:

There are three stETH Curve pools paired with ETH:

stETH: A=200, fee=0.01%, TVL=$140m

stETH-ng: A=1500, fee=0.04%, TVL=$50m

stETH- concentrated: A=1000, fee=0.04%, TVL=$1mDespite alternative stETH pools having higher fees and liquidity concentration, the OG stETH pool continues to retain the highest TVL. We can safely increase A factor to a point where the min pool balance does not become too extreme; a commonly used heuristic is to preserve at least 40% min pool balance. We also seek to maximize volume (and therefore pool returns) which has an optimal range around 800-1000. Our opinion is that A=900 is an optimal value for this pool.

Specification: