Grant Period: September to November 2024

1. Executive Summary

This report provides an overview of accomplishments, status updates and expenditures for the first quarter since receiving the grant for software research and development work as well as related tasks for the benefit of Curve ecosystem. All the funds received have been allocated toward the deliverables outlined in the grant proposal, with a strong focus on development, ecosystem growth, and responsible financial management.

Swiss Stake AG has made significant progress in developing new features, enhancing user experience, and strengthening the Curve ecosystem. The following sections detail the achievements and updates for this reporting period - the first three months since the grant has been received, as well as the next steps planned for the coming months and periods to follow.

We also would like to use the opportunity to thank the community for the tremendous support and trust which was necessary for securing the grant. The team is very grateful and appreciative for the sustainable environment as a result of the grant received and is dedicated to work diligently and fully committed to deliver first class features and developments for Curve.

2. Accomplishments and Progress

Over the first three months since receiving the grant, Swiss Stake AG has achieved significant milestones in developing innovative features, improving user experience, and reinforcing the Curve ecosystem. This section provides a comprehensive overview of the progress made during this reporting period, highlighting key achievements and updates, along with a forward-looking outline of the next steps planned for the coming months and beyond.

Please find below the respective updates for this period:

CrvUSD scaling

Improved crvUSD dynamics and peg with the introduction of Savings crvUSD (scrvUSD)

The introduction of scrvUSD as an interest-bearing stablecoin addresses this by providing low-risk yields derived from a portion of the interest paid by crvUSD minters. This yield is managed on-chain by CurveDAO, which effectively acts as a decentralized, on-chain central bank offering “low-risk” returns. User funds in the scrvUSD module are not re-hypothecated, and all collateral remains fully on-chain, making it a secure choice compared to other popular stablecoins. Both crvUSD and scrvUSD smart contracts are audited by leading industry firms such as Chainsecurity, Statemind, and Peckshield, with an immutable design ensuring composability and reliability.

To date, scrvUSD attracted $25M crvUSD and 357’000 crvUSD have been sent as reward for scrvUSD curve holders.

Additional work has been done to have a price feed of scrvUSD current value from Ethereum Mainnet on other EVM/L2. This allows scrvUSD/crvUSD liquidity pools on every EVM chain we deploy.

This feature supports the scaling of crvUSD as a leading true decentralised stablecoin, ultimately increasing revenue for veCRV holders.

There are continuous efforts to build further supply sinks to support crvUSD scaling.

https://dune.com/takeabreath/scrvusd-growth

Support for LP tokens of Curve pools as collateral for crvUSD minting

Research and prototyping have been done for integrating Curve LP tokens as collateral for crvUSD, enhancing capital efficiency and opening new avenues for synergies between Curve’s DEX, its stablecoin and its lending markets.

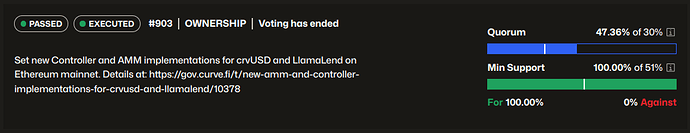

The work on smart-contract level has been done and audited. The update has been deployed and activated by vote by curve DAO. Curve benefits from this enhanced capital efficiency, allowing liquidity to be utilized more effectively. Research and improvements on this features are ongoing.

https://dao.curve.fi/#/ethereum/proposals/903-OWNERSHIP

Code for two-way lending markets

Two-way lending markets allow users to borrow against collateral which can be borrowed itself.

Work on the two-way lending markets has been postponed as curve-lite took most of our attention. As isolated lending markets proved to be a good supply sink for crvUSD, further development direction is refining the one-side lending market and making it more versatile.

DEX Improvements

Improved cryptoswap algorithm for better crvUSD integration to allow for much more efficient forex pools

This has been researched and implemented, the current stage is experimental, it will be production ready some time in 2025. Test data shows this allows higher liquidity density and thus more capital efficiency than cryptoswap now.

Enabling DAO cross-chain functionality (starting with boosts for pools deployed on non-Ethereum chains)

Cross-chain governance is done and standardized. Cross-chain governance is part of curve-lite and can be deployed on every EVM chain where Curve is deployed. Cross chain Boosts currently works on fraxtal but soon will be working on any chain.

UI/UX Improvements

Roll out of several UI/UX improvements and Curve dApp code refactoring

Work is ongoing to improve the UI/UX of the Curve interface and experience. To support this, a product designer has been added to the team to focus on this project. With the goals of simplifying new user onboarding and improving Curve’s frontend and backend code.

Improvements will be rolled-out progressively as they are built. The first ones to be live are the support for Curve-Lite, an improved navigation and a fully revamped DAO page. Community feedback on these changes has been great.

During Q1 and Q2, the focus will be on Curve Lend and CrvUSD improvements. All frontend code will be open sourced.

Curve DAO app v2

The new governance site for Curve DAO is live since the second week of December and a forecast of the future design overhaul which will be applied for the other part of the curve site.

The new DAO pages represent a shift toward more intuitive, native interactions. Instead of struggling through multiple platforms to lock CRV tokens, gauge liquidity distribution, or simply monitor voting power, participants can now handle these tasks within a single, unified environment. The updated interface also offers a clearer path for newcomers, who may have previously found the original layout discouraging.

Further improvements and updates will be applied as per the ongoing UI/UX improvements efforts.

Communications Improvements

Ongoing efforts to improve communications about Curve and its ecosystem

Curve’s blog has been relaunched and ongoing efforts are being done to make sure information regarding Curve and its ecosystem is dispersed far and wide and to reinforce the perception of Curve as the leading and most trusted DEX for stablecoins and DeFi tooling.

As a result, news regarding Curve have surfaced in major Crypto related publications, and co-marketing efforts with partners (protocols, asset issuers, chains, etc) have increased and are bearing fruits.

This effort will be maintained throughout 2025.

unStable Summit partnership & DevCon participation

Curve was present as a main supporter for unStablecoin Summit in Bangkok. The event, organised by Party Action People was a success. It saw technical conversations about stablecoins, with a gathering of actors from DeFi, CeFi and TradFi – protocols, banks and governments. Each eager to learn about each other’s challenges and leverage blockchain’s potential to change how humans transact.

During DevCon, we were present at several key events, and some team members took the stage to spread Curve’s gospel, as well as demonstrate the team’s skill and know-how.

There will be ongoing efforts to make sure Curve’s presence in key events is felt.

3. Financial Overview

3.1 Summary of Fund Usage

The below overview outlines the allocation of grant funds for the first 3 months:

| Category | Amount spent | Percentage of Total Funds Allocated |

|---|---|---|

| Security Audits | 413 | 32% |

| Software Development | 292 | 22% |

| Community & Tech Support | 263 | 20% |

| Front End Development | 170 | 13% |

| Research & Analytics | 94 | 7% |

| Infrastructure | 71 | 5% |

| Total | 1,303 | 100% |

All numbers expressed in CHF in ‘000

Security of contracts and operations is our utmost priority. Code contracts are routinely audited as well as all financial risks assessed.

The distribution of costs across categories is dynamic and can vary from quarter to quarter. These fluctuations are primarily driven by shifting priorities and evolving areas of focus as we advance the project. Depending on the stage of development, certain categories may require increased investment in specific quarters—for example, development efforts, security audits, or community initiatives—while others may experience a temporary decrease. This flexible allocation ensures that resources are directed efficiently to where they are most needed, aligning with project goals and delivering maximum impact.

3.2 Focus and alignment

We remain fully committed to using and managing the grant funds in a responsible and sustainable manner, consistent with the objectives outlined in our original proposal. Over the past quarter, we have implemented our strategy to optimize the use of grant funds by staking CRV tokens that are not immediately needed.

To achieve this, we have partnered with major liquid locker projects, including platforms such as Convex, StakeDAO, and Yearn, ensuring that the staked funds generate yield while remaining secure and accessible. This approach allows us to maximize the utility of the grant, reinvesting the yield into key development and ecosystem initiatives as planned.

This strategy not only underscores our commitment to financial prudence but also aligns with our broader goal of sustaining long-term contributions to the Curve ecosystem. With this position, Swiss Stake is fully aligned with other veCRV holders and any improvements to Curve’s revenue directly benefits both. We will continue to monitor and adjust our staking activities as necessary to ensure the most effective use of resources and provide detailed updates in future reports.

3.3 Yield Generation

Staked CRV tokens in liquid wrappers (e.g., Convex, StakeDAO and YearnFinance), current yield rate being around 25k CHF per week (based on the last 2 weeks). Those funds will be used in line with the grant request and if not used, rolled over into subsequent periods.

4. Sustainability

We recognize the critical importance of establishing a sustainable business model that reduces or eliminates reliance on future grant funding. Over the past quarter, we have diligently initiated efforts to develop this model, aligning with the commitment outlined in our original grant proposal.

While we are still in the early stages of this process, we are pleased to report that progress is on track. We have begun laying the groundwork for a long-term strategy and are actively exploring viable pathways to achieve self-sufficiency. Our goal remains to ensure the continued growth and resilience of the Curve ecosystem while maintaining transparency with the community.

We will continue to dedicate resources to this initiative and look forward to providing further updates on our progress in future reports.

5. Next Steps

Looking ahead, Swiss Stake AG has identified several key deliverables and focus areas that will shape our work over the coming quarters. These initiatives are designed to build on the progress achieved so far, address current challenges, and ensure the long-term sustainability and growth of the Curve ecosystem. This section outlines our planned activities, providing a roadmap of priorities and actionable steps to achieve our strategic objectives in the months ahead.

The strategy for 2025 focuses on solidifying its position as the leading decentralized platform for equivalent asset swaps, stablecoins, and lending. The goal is to drive adoption, increase revenue for veCRV holders, and expand Curve’s ecosystem across multiple chains, while ensuring operational efficiency and product excellence.

Vision

“All routes lead to Curve”

Primary Objectives

Drive Adoption:

- Scale crvUSD as the premier decentralized stablecoin with a $5B market cap target.

- Position Curve as the go-to destination for asset issuers, liquidity providers, and advanced traders.

- Solidify Curve’s brand and messaging as a vehicle behind which the community can rally.

Increase Revenue for veCRV Holders:

- Boost trading volume, liquidity depth, and crvUSD activity to maximize revenue.

Streamline Operations:

- Clean up and refactor the app’s codebase alongside the UX/UI revamp to create a unified, user-friendly experience.

Expand Ecosystem:

- Deploy Curve Lite on strategic chains and integrate Llamalend to enable cross-chain adoption.

Key Action Items

Product and Ecosystem Enhancements:

- Integrate crvUSD into Llamalend, streamline borrowing markets and integrate crvUSD and scrvUSD across other protocols

- Adding support for liquidity pool tokens as collateral for crvUSD. Smart contracts are ready for this, but this needs integration into the front-end and risk valuation of potential assets.

- Improve Curve’s cross-chain functionalities

- Deploy Curve Lite on EVM-compatible chains with standardized templates and pricing.

- Refactor app code and revamp UX/UI to reduce user friction and improve scalability.

- Bring the experimental stage of the new, improved Cryptoswap to production readiness.

- Improve AMM algorithms to remain competitive.

Community and Business Development:

- Enhance communication, branding, and partnerships to increase Curve’s mind share.

- Host or be guest on virtual events on various platforms to educate users about Curve’s stablecoin, stableswap and lending features.

- Launch targeted campaigns to showcase Curve’s trust factor and unique features, like LLAMMA.

Organizational Efficiency:

- Adopt tools like Slack and Notion to improve communication and project management.

- Introduce clear roles, team leads, and weekly standups for better accountability.

6. Conclusion

Swiss Stake AG is proud of the progress made during the first 3 months since the grant has been received and remains committed to delivering innovative solutions for the Curve ecosystem.

The next quarter will focus on advancing technical deliverables, continue improving user experience, and fostering community growth. We appreciate the community’s continued trust and support and look forward to sharing further progress in the next report.