Summary:

Proposal to update ETH+/ETH cryptoswap pool parameters to increase liquidity density at peg, stabilize price scale, and reduce fees.

Curve Monitor: Parameter Proposal 84

Abstract:

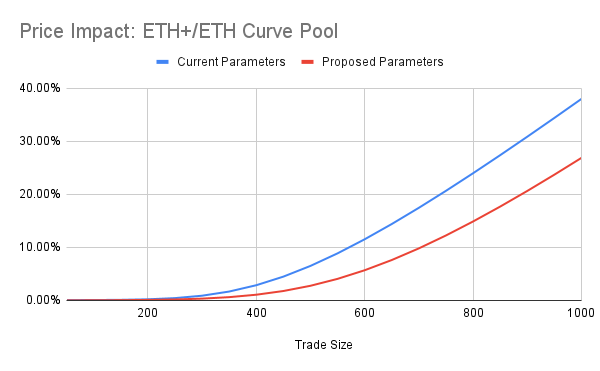

The ETH+/ETH cryptoswap pool currently has relatively conservative parameters for like-kind assets. This proposal is to update them with parameters found to be robust across multiple LST and LRT pools in simulations. These parameters are expected to strengthen the peg by increasing liquidity density near peg, stabilizing price scale, and reducing trading fees (encouraging arbitrage volume).

Since ETH+ has exhibited price stability against ETH, and can be redeemed for highly liquid LSTs, these parameter changes should be relatively low risk.

Motivation:

The parameter updates are designed to accomplish 3 goals.

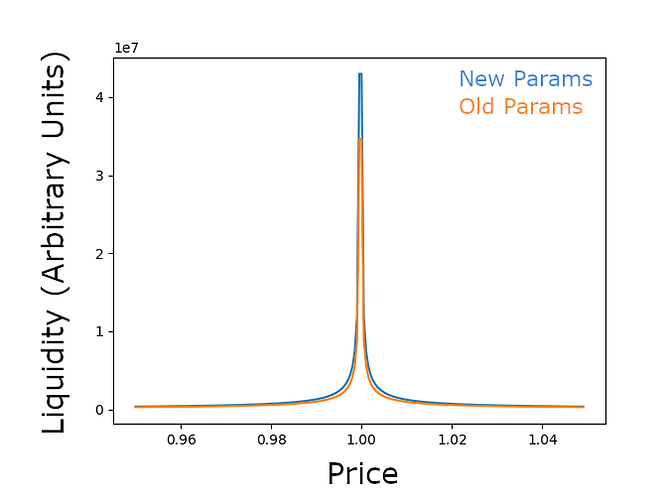

- Increase liquidity density near the peg. Increasing gamma moves liquidity from the far tails of the bonding curve to the center of the bonding curve near the peg. This should reduce slippage, tightening the peg.

-

Reduce the frequency of price scale updates. ETH+ diversifies across LSTs to reduce volatility, and typically accrues yield at a rate of 1-5%. So, its price scale is expected to only update relatively slowly. The proposed parameters make price scale changes less frequent by slowing the internal oracle EMA, raising the adjustment step, and increasing the allowed extra profit.

-

Reduce fees. mid_fee is reduced to 0.005% and out_fee to 0.08%, with commensurate changes in fee gamma. These changes may increase volume and encourage arbitrage closer to the peg.

Specification:

A = 20000000 (unchanged)

gamma = 0.02 (from .01)

mid_fee = 0.005% (from 0.03%)

out_fee = 0.08% (from 0.45%)

fee_gamma = 0.03 (from 0.3%)

ma_half_time = 1200 (from 600)

allowed_extra_profit = 0.000001 (from 0.00000001)

adjustment_step = 0.000025 (from .0000055)

For:

Increase liquidity density at peg, stabilize price scale, and reduce fees.

Against:

May modestly increase pool imbalance; lower fees may reduce pool profits