Proposal to Whitelist Abracadabra mCRV Voter Contract

Summary and Abstract

Proposal to whitelist Abracadabra’s magicCRV contract in Curve’s SmartWalletWhitelist contract, allowing Abracadabra to participate in Curve governance, lock CRV to provide boosts on MIM related pairs, create a tradable locked version of CRV through liquidity incentives for a magicCRV <> CRV pool and build unique lending tools with preferential rates for magicCRV tokens.

-

Whitelist Abracadabra magicCRV contract in Curve’s SmartWalletList, in order to take part in the governance process and Locking CRV.

-

magicCRV will align Abracadabra’s growth strategy with Curve and ignite deployment of new cauldrons which attract additional volume to Curve.

-

magicCRV specific cauldrons will act as a token sink by locking CRV for the maximum amount of time and relocking it continuously.

Introduction to Abracadabra

With $2.6B TVL in our isolated lending markets, Abracadabra and MIM are pillars of the defi ecosystem.

Abracadabra uses variations of Kashi and Bentobox smart contracts, which have been audited multiple times and proved safe and battle-tested.

The Current Situation

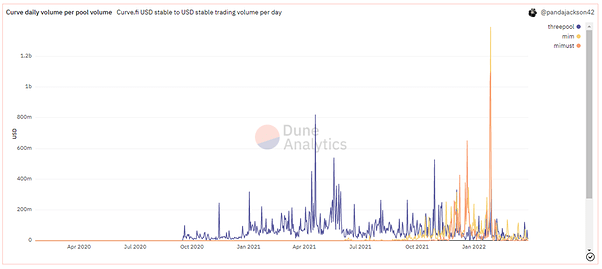

Since its inception, Abracadabra has been steadily supporting the Curve finance ecosystem, because of the shared values between our protocols. The synergies between Curve and Abracadabra have brought a large amount of volume to the Curve MIM pools across different networks, as well as values for the holders of both CRV and SPELL.

We believe it is time to make a step forward, and bring this partnership to the next level.

Motivation:

Abracadabra and Curve have had a symbiotic relationship, since the inception of MIM attracted significant value in form of TVL and daily trading volume to Curve.

Through heavily promoting the bribing system, it brought new utility to veCRV holders and demonstrated the true value of veCRV’s voting power.

Not only did Curve’s daily volume increase significantly since the launch of the MIM-3pool, but by identifying new trends and implementing specific cauldrons, Abracadabra was able to create and promote multiple pools across multiple chains, including the UST-MIM pool. This resulted in Abracadabra related Curve pools consistently bringing the highest daily volume to Curve, compared to any other protocol. magicCRV will align Abracadabra’s growth strategy with Curve and ignite deployment of new cauldrons which attract additional volume to Curve.

Abracadabra is constantly incentivising liquidity providers to bring balance to the MIM-3pool, and in doing so spending capital in exchange for non sticky liquidity. In the past months, we have been working towards acquiring a CRV position in order to be able to vote for our own gauge allocation and actively participate in Curve governance.

magicCRV

We have developed a system called magicCRV (mCRV). This cauldron is based on a lending market where users provide CRV as collateral for 0% interest fee, and in doing so they lock their CRV and delegate their voting power to Abracadabra.

New magicCRV cauldrons will focus on attracting CRV through preferential cauldron rates, which will act as a token sink for any CRV used in them.

Every time a user deposits CRV in our market, the token is locked for 4 years, and wrapped into mCRV. When a position needs to be closed users get back mCRV.

A mCRV <> CRV pool on Curve, will then allow the user to swap mCRV for their CRV tokens if they wish to do so.

At the same time, we are now able to use the voting power of those locked CRV to improve MIM peg on the main MIM-3Pool as well as the mCRV <> CRV pool, resulting in more volume and hence fees for CRV token holders.

Proposal

This proposal is intended to whitelist the mCRV voter smart contracts and allow Abracadabra to take part in the gauge voting.

Specification

Curve DAO whitelisting of the following smart contract, in order to allow locking of CRV, voting and boosted rewards:

- Abracadabra magicCRV Voter Contract: 0x129149DC63F5778a41f619Bb36212566ac54eA45

Voting:

This part will be updated with the poll link once the vote is live.