Summary:

Concentrator would like to propose the addition of the Harvest-for-All gauge with a max. emission of 25,000 CRV, so that a broader range of Curve community can sustainably benefit from more options and better services provided by Concentrator.

References/Useful links:

Website: AladdinDAO Project

Twitter: https://twitter.com/0xconcentrator

Audit report: https://aladdin.club/audits/AladdinDao_V3_Report_Secbit.pdf

Protocol Description:

Concentrator is an entirely new type of auto-compounding vault system, based on a philosophy of farm-and-hold. Rather than selling rewards constantly and buying more of the deposited token, Concentrator helps farmers concentrate yields from multiple Convex vaults into cvxCRV, then leverages auto-compounding to grow those returns even more. When it’s time to withdraw, users can choose from cvxCRV, CRV, CVX or ETH.

Motivation:

Concentrator provides a highly cost and time efficient way for Curve community to benefit from the enhanced yield. Although, it also comes with a bottleneck to further expanding our service for an even broader range of the community.

In order to achieve the auto-compounding, the system needs to periodically call the keeper function to harvest the reward from Convex vaults. The most logical timing to do so is when the admin fee that goes to the protocol (0.5% or 2.5% depending on the vault) is at least no less than the transaction fee for harvesting.

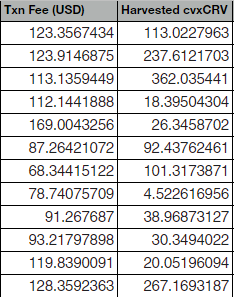

Over time, we have noticed that it is highly cost intense for the protocol in order to harvest for the users regularly, especially so when it comes to low yield Convex vaults, which would require

a huge amount of TVL and / or excessive waiting time for the vault to have accumulated enough reward before harvesting becomes economically worthwhile. Below is a list of the latest harvestings. As indicated from the table, the system already has to subsidize the cost even with high yield vaults sometimes, and it’s ever more evident after we added 3pool

Since the launch of Concentrator, we have received numerous requests from Curve community that ask us to add more low yield vaults. We truly believe that every community member deserves the benefits offered by Concentrator, regardless of their LP size or in which pool they have their LPs. However, as a very fresh protocol with limited resources, we can only subsidize the cost for our users to a certain extent. Therefore, we would like to receive funding via CRV emission that is going to be utilized as the transaction cost subsidy when Concentrator can no longer sustainably do so.

Goals and Expectations:

If approved,

- Concentrator will be able to add more low yield vaults that can be used by an even broader range of Curve community

- Concentrator at the meantime can better focus on operation optimization with its own resources to reduce the reliance on the fund

- Both Curve and Convex can see an increase in ecosystem participants that aim to make use of the broad range of options Concentrator offers