Summary:

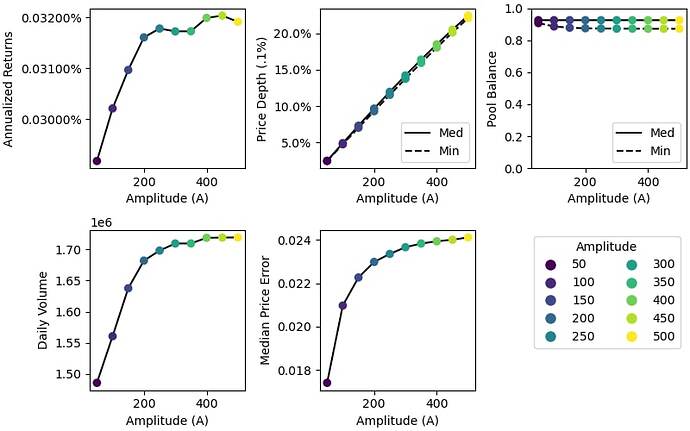

Proposal to raise A parameter on USDN pool to 250

Abstract:

Motivation:

Raising the A factor will reduce volatility for larger trades and position the pool.

Specification:

Raise the A parameter from 100 to 250 on the USDN (https://curve.fi/usdn ).

For:

Raising A will decrease “spurious” arbitrage in USDN pool, since USDN is always redeemable through Neutrino protocol smart contract at 1:1 ratio. Low A values lead to imbalance in the pool and increased volatility, which has no economic substance because of the specific USDN architecture. This, it turn, should lead to the increased utility of USDN stable coin and increased volume in the USDN, because trading 1:1 peg is essential for USDN utility as a stable coin.

Against:

Do not raise the A parameter of the USDN pool (do nothing)

Poll: