Hi all,

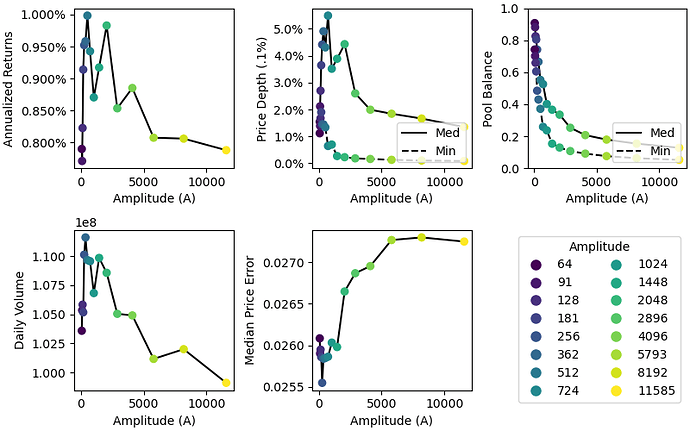

I ran simulations on this using the last 2 months data. TL;DR: Results are a bit noisy, but A should probably be <=100 to ensure that the pool remains reasonably balanced.

As you can see from the two figures below (upper right panels), raising A much higher than ~100 could result in pretty bad imbalance given the current volatility in FEI price. This volatility appears to be decreasing with time (and higher A may help with that…), but given current conditions, my sense is that A ~= 100 is probably the highest you can go.

For the balance metric used here, I usually think you want to maintain .7 minimum (equivalent to 65%/35% balance in a 2-coin pool), and ideally around .8 (equivalent to 60%/40%).

Summary:

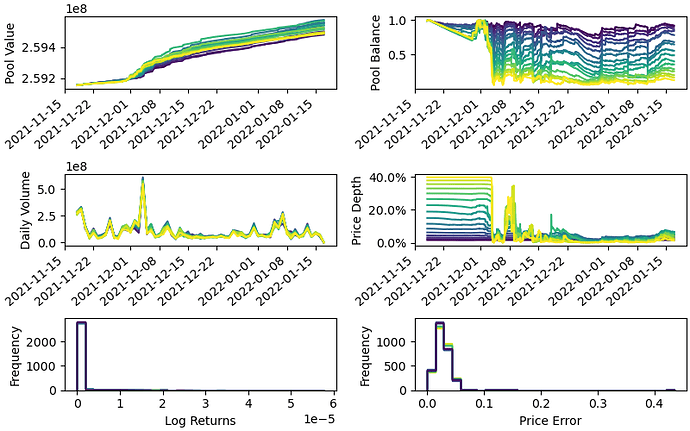

Time series:

2 Likes

FEI just got a gauge about a week ago, which I imagine contributed a lot to the noise (in addition to short lifespan of the pool). Theyve previously incentivized liquidity on UNIv3, I see pairs with DAI and USDC. Possible to run a simulation with their UNI pool, which I’m guessing is where majority of liquidity was before curve gauge?

Can you clarify what you mean by this? Sorry, I’m just not sure I’m understanding.

For this simulation, “traders” arbed the market VWAPs, which ya, were dominated by Uni V2 and V3.

I think the noisiness comes from the high kurtosis of the FEI price. It tends to move <1 cent, but will occasionally jump 3 cents between candles. It’s possible this can be steadied with higher A, but its hard to know how much the Curve pool will dominate vs. follow the general market price.

gotcha, I was mistaken, they dont have any gauge weighting yet, and doesnt look like there’s been dramatic changes in the pool size recently

Thank you @nagaking for the analysis. Upon review of the results and further discussion internally, we have decided to amend the proposal to raise the A factor to 250 instead - and will monitor whether to further raise A to 500 in a later vote. The revised post will be up shortly in the thread as I am unable to change the original post.

1 Like