Summary:

Halt CRV emissions for USDN/3CRV gauge by calling

kill_me().

References/Useful links:

- Crypto Risk Assessment on USDN: A risk assessment on Neutrino’s USDN ecosystem for veCRV holders and LPs

- USDN gauge contract: https://etherscan.io/address/0xf98450b5602fa59cc66e1379dffb6fddc724cfc4

- Proposal on USDN interest distribution: sCIP#8 - USDN Interests Distribution

- USDN current backing ratio: https://beta.neutrino.at/api/explorer/get_br

- Neutrino blog post on peg defense strategy: Support Neutrino and Earn More Rewards by Bringing your USDN Home to Waves Protocol. | by Neutrino Protocol | Neutrinoteam | Medium

- Twitter announcement to dramatically reduce USDN staking yield: https://twitter.com/neutrino_proto/status/1530191763209601026

Motivation:

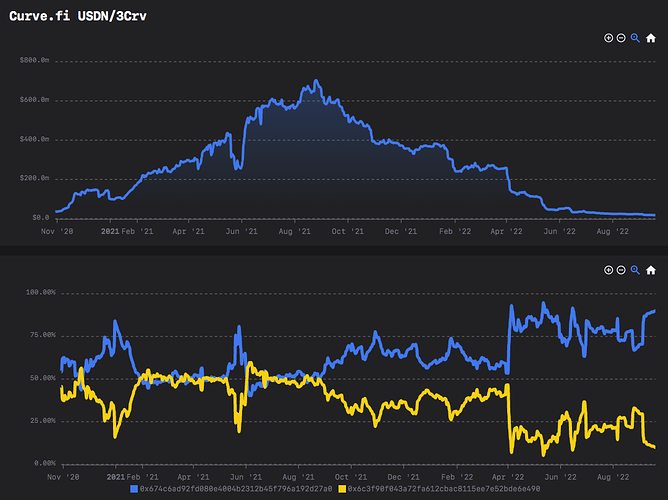

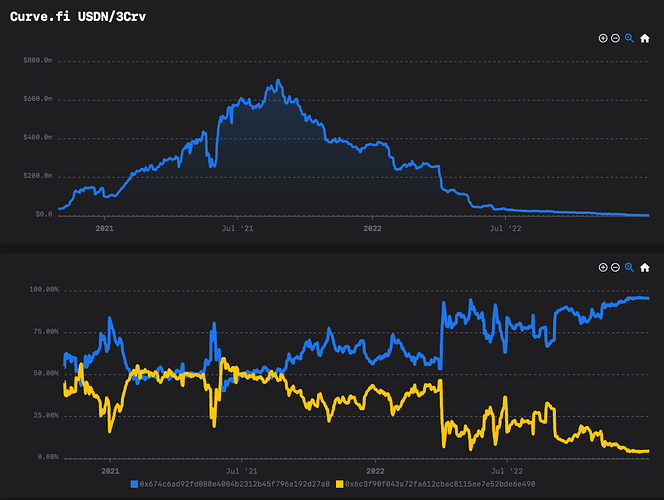

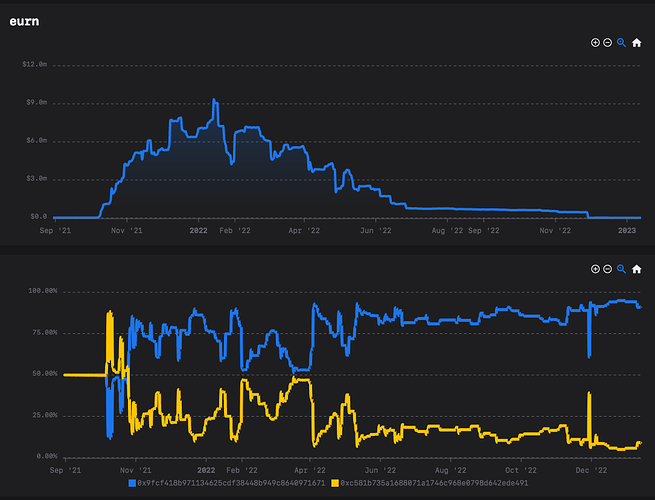

The Crypto Risk team has been looking into USDN and recently released the report linked above. USDN has been struggling to keep peg since April this year, following a liquidity crunch on the Vires lending platform that resulted in $500m in bad debt. Peg defense measures taken by Neutrino have greatly reduced the TVL of the Curve pool as well as its pool utilization.

This pool has a unique revenue model that is unlike any other Curve pool. Instead of having a 50% admin fee on swaps, veCRV is granted 50% of USDN staking income. This was a substantial source of revenue for veCRV until May '22, when Neutrino announced it would be reducing USDN staking yield as part of its peg defense strategy. Currently staking APY is .11%, meaning the pool is producing negligible income for the DAO until USDN recovers sufficiently to continue staking rewards (at the discretion of Neutrino). Despite the distressed state of USDN, and attempts by the Neutrino team to consolidate the USDN supply back to Waves, the USDN Curve pool is still weighted to receive 1% of CRV emissions.

The Crypto Risk team is advising Neutrino to migrate liquidity to a V2 pool that will be better equipped to handle volatility. A migration also means USDN pool can finally follow the same standards for pool revenue used by every other Curve pool.

For:

Halt CRV emissions for USDN/3CRV gauge

Against:

Do not halt CRV emissions for USDN/3CRV gauge