Summary:

Kill CRV emissions for ApeUSD/FraxBP gauge by calling

set_killed().

References/Useful Links:

- Crypto Risk Assessment on ApeFi: Asset Risk Assessment: ApeUSD - Crypto Risk Assessments

- ApeUSD gauge contract: https://etherscan.io/token/0xd6e48cc0597a1ee12a8beeb88e22bfdb81777164

- ApeUSD/FraxBP pool: https://curve.fi/#/ethereum/pools/factory-v2-138/deposit

- Curve DAO vote for gauge: https://dao.curve.fi/vote/ownership/200

- Convex Snapshot vote for gauge: Snapshot

Motivation:

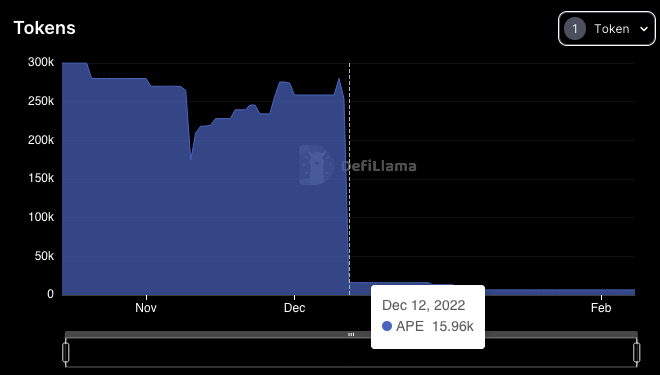

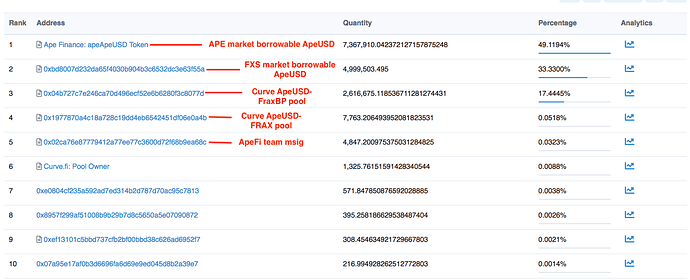

The Crypto Risk team has been looking into ApeUSD and recently released the report linked above. The report raises concerns about the ApeFi protocol and asserts that it does not meet, nor has it ever met, the criteria necessary to have a Curve gauge. A recap of the questions Crypto Risk investigates:

- Is it possible for a single entity to rug its users?

- If the team vanishes, can the project continue?

- Do audits reveal any concerning signs?

The findings in the report conclude that ApeFi places a significant amount of trust in an anonymous team that may only be composed of one or two individuals. Crypto Risk has reached out to the team in an attempt to bring ApeFi’s security practices up to an acceptable level. Response on the part of the ApeFi team has been unproductive, prompting this proposal to kill the gauge.

The gauge vote was bundled along with gauges for sUSD, LUSD, GUSD, BUSD, alUSD, USDD, and TUSD /FraxBP pairs. We strongly urge DAO voters to vote against bundled gauge votes in the future. Bundled gauge votes make it difficult for voters to properly vet each protocol receiving a gauge and increase the likelihood that a low-quality or malicious protocol will receive a gauge. It is likely that, had ApeUSD been up for vote singly, the DAO would not have allowed it to receive CRV emissions.

For:

Halt CRV emissions for ApeUSD/FraxBP gauge

Against:

Do not halt CRV emissions for ApeUSD/FraxBP gauge