scrvUSD Market Dynamics Analysis

LlamaRisk has conducted an analysis of the market dynamics of crvUSD and scrvUSD since its deployment and increase in fee share from 10% to 20%. The analysis should inform DAO voters about the significance of scrvUSD to crvUSD, including its impact on circulating supply, crvUSD peg, and borrow rates and assist the DAO in making more informed decisions about future fee share increases.

A timeline of events is as follows:

-

Nov. 1: The first deposit to scrvUSD was made.

-

Nov. 9: A vote to distribute 10% fee share to scrvUSD and give DAO control of the vault was executed.

-

Nov. 22: A vote to increase fee share to 20% and reduce TWA window from 7 days to 2 days was executed.

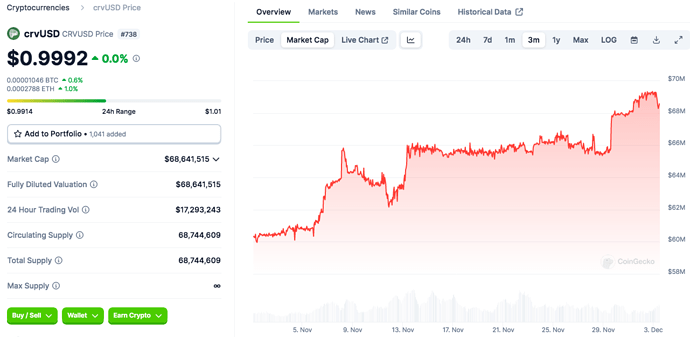

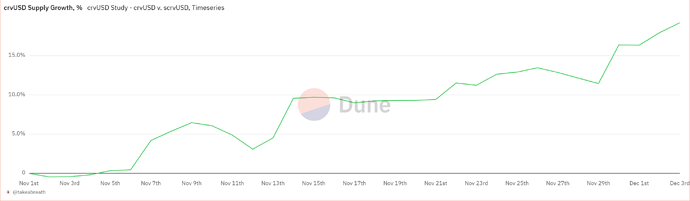

crvUSD Supply Growth

We observe notable growth in crvUSD supply since scrvUSD was deployed. There has been a 20% increase in crvUSD circulating supply since scrvUSD deployment. There do not appear to be immediate reactions to the introduction of fee sharing and increases, although there is reasonable evidence to suggest there may be a slight delay ~1 week between the introduction of rewards and an influence on the supply.

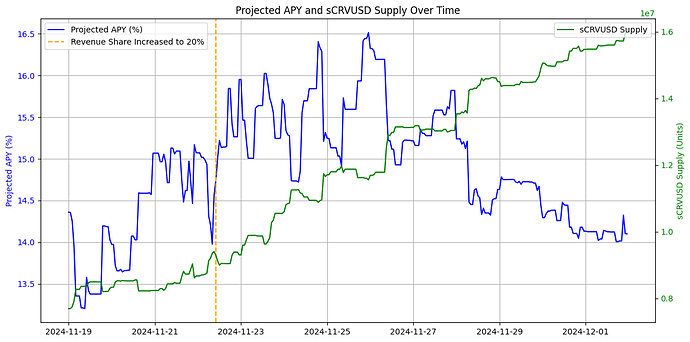

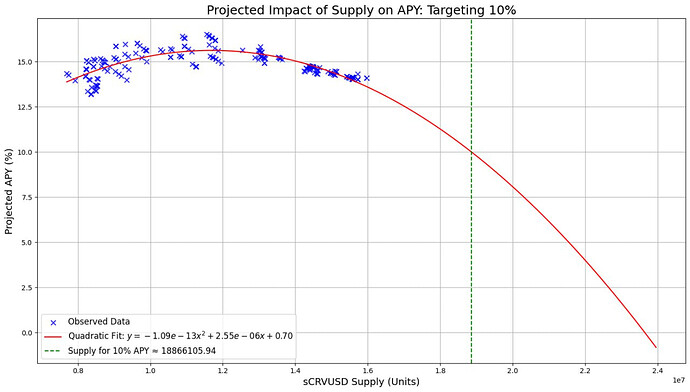

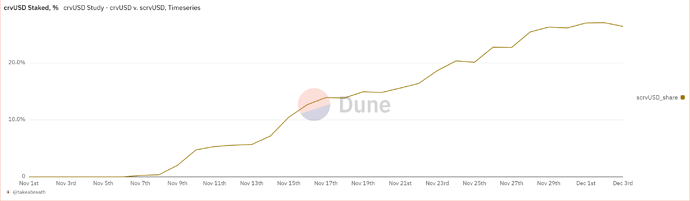

scrvUSD Supply vs APY

There has been a consistent growth trend in scrvUSD supply since the fee share was increased on Nov. 22. This trend has continued as yields have declined from 16.5% to 14%.

An inverse relationship between scrvUSD supply and APY is confirmed with a moderate fit. We can project that targeting a 10% rate at the current fee share would result in around 19m crvUSD staked or around 27.5% of the current circulating supply. This may be a reasonable APY target, given current market conditions and the fact that scrvUSD is newly deployed and may require a higher yield than comparable stablecoins. For reference, the DSR is at 8.5% and GHO borrow rates are at 12.5%/8.75% for the standard/discounted borrow rate.

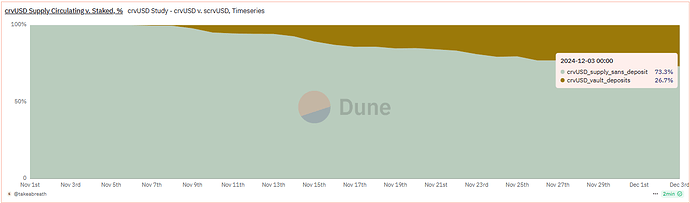

scrvUSD Share of crvUSD

We observe that ~26.4% of crvUSD supply is staked and that the proportion of crvUSD staked has been increasing steadily. The growth has remained stable over the past few days as crvUSD supply has expanded in tandem with scrvUSD supply growth.

Monetary Policy

The borrow rates for crvUSD are determined by a combination of the price of crvUSD and the proportion of pegkeeper debt to overall crvUSD debt. We are interested if conditions have taken place such that scrvUSD is serving as a reliable supply sink and pushes market dynamics toward borrow rate reduction and conditions that will support continued supply growth.

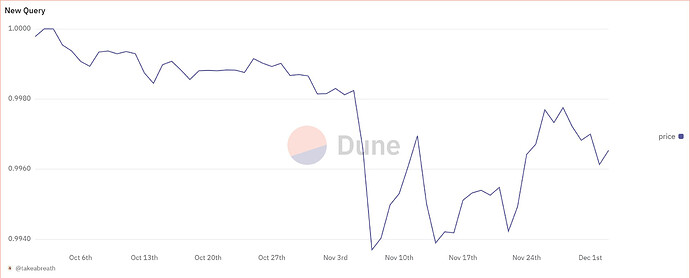

crvUSD Peg

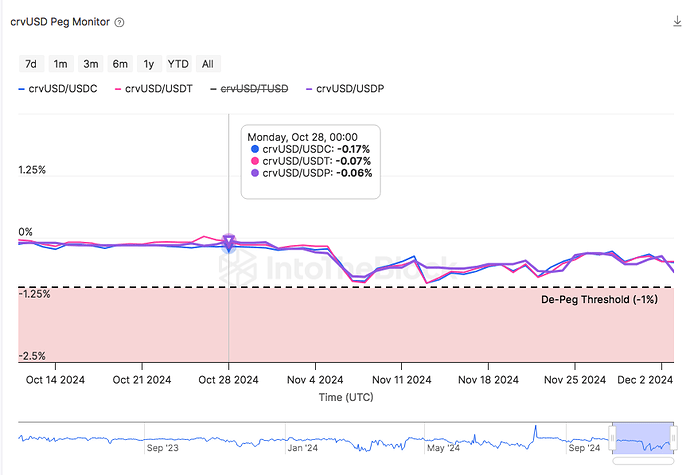

We observe that the peg has been under pressure since early November, which coincides with bullish market sentiment that may be a contributing factor. The peg seems to be recovering somewhat since the fee share increase on Nov. 22, but we do not observe sufficient upward peg pressure that would activate pegkeepers and reduce borrow rates substantially.

The peg against individual pegkeeper pairs further demonstrates the relative difficulty crvUSD has experienced recently in maintaining its peg.

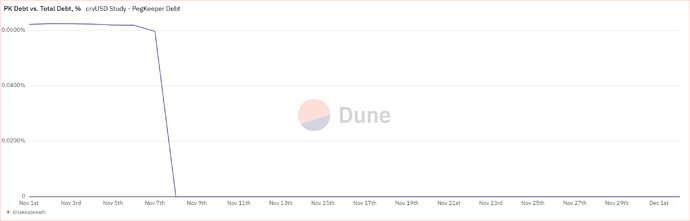

PegKeeper Debt

Indeed, we confirm that no pegkeepers have been activated since scrvUSD deployment. Again, this time period aligns with a substantial shift in broader market sentiment, so it is difficult to determine the influence of scrvUSD amid very volatile market conditions.

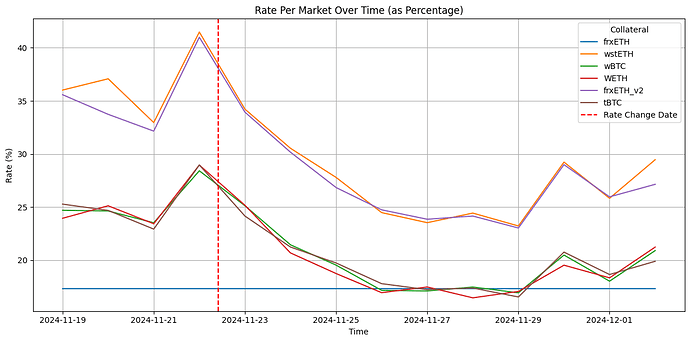

crvUSD Borrow Rates

Borrow rates have reduced since the fee share was increased on Nov. 22, being inversely correlated to the crvUSD peg performance. The trend is positive overall, but does not meet critical thresholds for incentivizing substantial supply expansion. There is reasonable evidence that crvUSD continues to flow into scrvUSD and will likely contribute to peg strength in the near term.

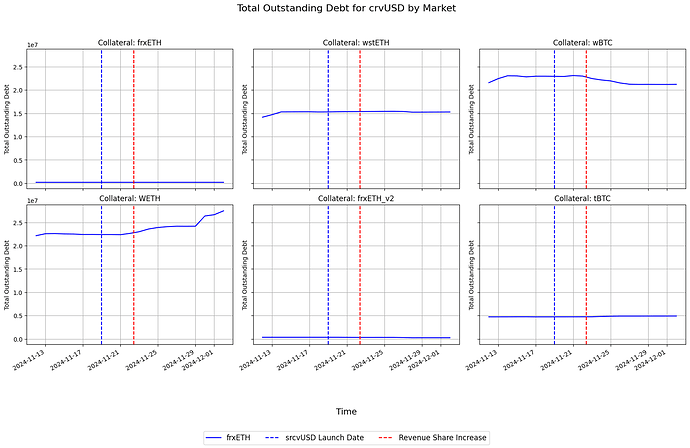

crvUSD Markets

Since the fee share increase, there has been growth in the WETH market and a slight reduction in outstanding debt in the WBTC market. The reaction to scrvUSD has so far been somewhat muted, although the overall trend has been positive.

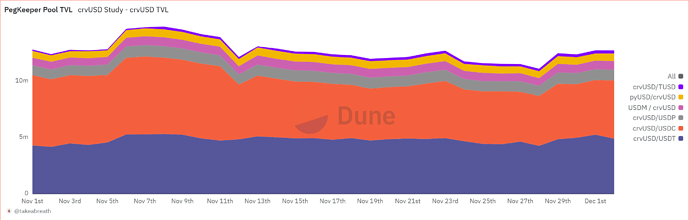

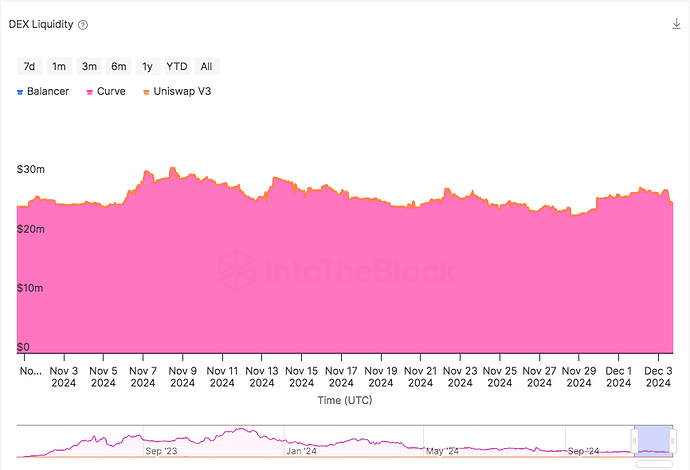

PegKeeper Pool Liquidity

It is essential that crvUSD pegkeeper pools are sufficiently liquid for infusions of crvUSD when necessary and to process liquidations. With attractive rates to scrvUSD, there is a risk that LPs may withdraw from venues such as pegkeepers which are systemically important to crvUSD. We observe that there has been a slight reduction in pegkeeper pool liquidity since scrvUSD was introduced.

According to intotheblock’s dashboard, crvUSD liquidity has been relatively flat since the introduction of scrvUSD.

Takeaway

The trajectory of crvUSD deposits to scrvUSD is looking healthy. There may be an advantage to increase the fee share further, although the influence of the 20% share on crvUSD supply expansion has so far been mild and possibly obscured by dramatic external market circumstances. If a fee share increase goes to vote, it will be necessary to continue monitoring the pegkeeper pools’ liquidity and ensure incentives are sufficient to preserve liquidity there.