Summary:

Proposal to add Tri-CRV Pool to the Gauge Controller to enable users to assign gauge weight and mint CRV. cCRV is converted from cvxCRV.

Gauge contract modifications:

Only limited addresses can deposit LPs into the Tri-CRV curve gauge (currently, only the TriCRV LP Reward Pool Contract)

References/Useful links:

Website: https://ccrv.finance

Documentation:cCRV.finance - HackMD

Token Address: https://etherscan.io/address/0xd6ecdfd41ddb7167f3ed9b37f33fb24d57543e26#code

Twitter: https://twitter.com/cCRVfinance

Community: c(CRV)

Github: GitHub - CongruentFi/ccrv-v1-contract: Contracts used in cCRV

Audit: Omniscia Congruent Audit

Abstract:

What is cCRV?

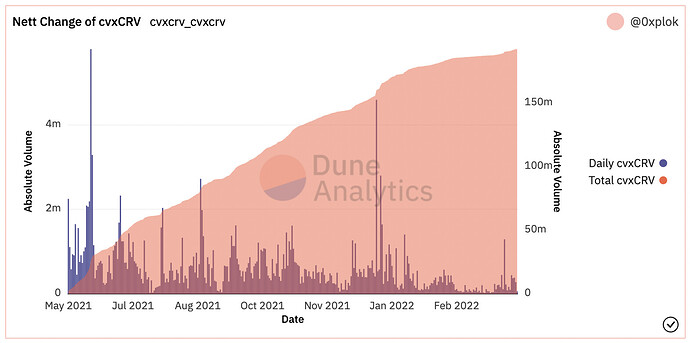

cCRV is essentially converted cvxCRV, and each cCRV is backed by 1 cvxCRV

What solution does cCRV provide?

Tri-CRV Pool & cCRV staking system

- cCRV takes in cvxCRV and converts it to cCRV. The cvxCRV is then locked in order to generate consistent yield. The cCRV emissions are then combined with the Convex yield to offer a combined yield that is higher than the regular Convex yield.

- cCRV creates a Tri-CRV pool on Curve (CRV+cvxCRV+cCRV) and gauge emissions are used to attract liquidity and thereby assist in tightening the CRV-cvxCRV-ccRV peg.

- Tri-CRV pool LP farming earns CRV emissions, which are then converted to cvxCRV and staked on Convex, which helps Convex to attract more CRV and, thus, hold more veCRV

Despite Convex holding a large number of veCRV, it still holds less than 50% of all veCRV and so still has room to hold even more. Each locked vlCVX currently represents 4.8 locked veCRV (as of Mar.30), which means that CVX is trading at a premium. The more value that CRV holds, the more ve-type services it can create and offer. Over 80% of possible CVX tokens have already been emitted, which means that Convex will likely require additional strategies going forward in order to ensure consistent yields.

Motivation:

Our aim is to create a new flywheel.

Create good liquidity for the Tri-CRV pool and to secure CRV emissions so that we can continue to convert more CRV to cvxCRV, thereby increasing the veCRV/vlCRV ratio and driving the Convex flywheel. So, what had previously required users to actively move their CRV to Convex and convert to cvxCRV, cCRV now automates this process by taking CRV emissions and automatically converting them to cvxCRV and then staking.

Specifications:

1. Multi-sig:

The 4/7 multisig wallet on Ethereum:

0x4a6bf7737b54195BFB72030d8F2bf7Cf2b466dC3

The following 7 individuals will have Multi-sig rights:

Holy

Carrot

bMeta

1xNW

Freddy

DegenBing

Bitpan

2. Audits:

cCRV has already undergone a complete audit by Omniscia

Omniscia Congruent Audit

3. Centralization Vectors:

The multi-sig address has the right to modify the protocol’s parameters, such as adjusting the yield speed, the minter whitelist, etc. The multi-sig holds the rights to withdrawal by the Convex Depositor contract. But, modifications to the deposit contract will only be used if the Convex contract undergoes upgrades.