Proposal to add the FRAX/dUSD and dUSD/sUSDe pools on Fraxtal to the Gauge Controller

Summary:

Proposal to add the 2 following pools on Fraxtal to the Gauge Controller:

FRAX/dUSD

dUSD/sUSDe

References/Useful links:

- Website: dtrinity.org

- Documentation: docs.dtrinity.org

- Github Page: github.com/dtrinity

- Discord: discord.gg/dtrinity

- Twitter: x.com/dtrinity_defi

- DefiLlama: defillama.com/protocol/dtrinity

Protocol Description:

dTRINITY is the world’s first subsidized lending protocol on Fraxtal L2. It offers secured stablecoin loans with sustainable interest rebates to reduce borrowing costs and enhance yields for DeFi users. In addition to rebates for borrowers, lenders and LPs may also earn liquidity rewards from the protocol as dT Points. All Points will be converted to dTRINITY’s governance token upon the TGE in 2025.

dTRINITY consists of 3 key DeFi primitives:

dUSD: A decentralized US Dollar-pegged stablecoin, fully-backed by an on-chain reserve of other stablecoins and yieldcoins like sDAI and sFRAX. dUSD is dTRINITY’s unified liquidity layer between its money markets and external liquidity pools (e.g., Curve). Most importantly, a majority of the reserve’s exogenous earnings are used to fund ongoing interest rebates for dUSD borrowers on dLEND.

dLEND: A specialized Aave v3 fork that allows borrowers to take out secured dUSD loans against multiple collateral assets. dUSD borrowing rates on dLEND are subsidized by rebates to provide borrowers with cheaper access to liquidity/leverage, stimulating demand and utilization which also drives higher yields for lenders.

Curve: The primary DEX venue of the dTRINITY ecosystem where dUSD liquidity pools are deployed. Curve enables low-slippage swaps between dUSD and other assets as well as opportunities for dUSD LPs. It is also one of the key liquidity venues that support collateral liquidators from dLEND.

Motivation:

dTRINITY’s early growth strategy focuses on attracting and subsidizing loopers of major yieldcoins, such as sUSDe. Borrowers (loopers) can supply sUSDe as collateral on dLEND to borrow dUSD at up to 80% LTV and earn ongoing interest rebates. Thanks to cheaper access to leverage, they can swap dUSD for more sUSDe on Curve, repeat the loop, and amplify their earning potential.

The process above relies on the dUSD/sUSDe pool and the FRAX/dUSD pool as the intermediary route to the FRAX/sUSDe pool. As such, they need to have adequate liquidity to accommodate user demand from dTRINITY. Obtaining CRV incentives is, therefore, a strategic catalyst to attract more LPs and strengthen liquidity for dUSD.

As dUSD grows over time, the Curve ecosystem will also acquire more TVL and volume via LPs, lenders, and loopers from dTRINITY, creating a mutually symbiotic relationship.

Specifications:

Please answer in a short and clear manner.

Governance: The TRIN token will be launched within 2025, empowering the community with governance rights over dTRINITY. Currently, the protocol utilizes a 2/3 multi-signature wallet to deploy and manage its smart contracts (soon to be updated to 3/5). As the protocol moves into the community-governed phase, the core contributors will shift governance over to public discussions and voting.

Oracles: The dUSD reserve’s NAV and mint ratio per collateral asset are determined based on each reserve asset’s USD price feed via the API3 oracle. More oracles, such as RedStone and Curve pools, will be incorporated in the future to add redundancy and enhance the reliability of price feeds. Additionally, dUSD is hard-coded to $1 on dLEND to encourage arbitrage from borrowers (i.e., buying dUSD below $1 to repay debt at $1). This does not pose any liquidation risk because dUSD is also disabled as a borrowing collateral to prevent subsidy arbitrage through recursive lending.

Audits: dTRINITY has completed three separate smart contract audits with leading security firms, including Halborn, Cyberscope, and Verichains prior to mainnet launch in 2024. A fourth audit will be initiated by the end of Q1 2025.

Centralization vectors: Prior to to the TGE of TRIN and the implementation of community governance, dTRINITY’s protocol mechanics are managed by a team of core contributors, including reserve management, risk management, and open market operations.

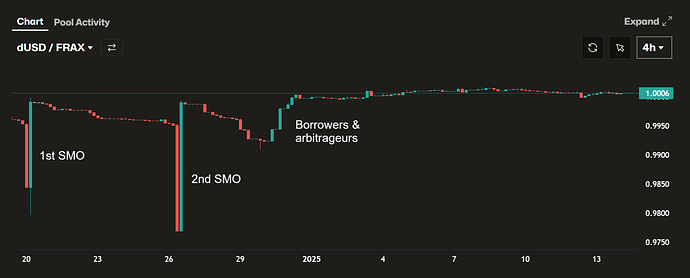

Market History: Similar to the US Dollar (post-Nixon Shock 1971), the dUSD stablecoin is non-redeemable by design. Instead, it relies partially on arbitrage from borrowers, traders, and LPs to maintain a soft peg to $1. Additionally, dUSD features open market operations called “SMO” (Stability Market Operations) where the protocol utilizes its full-reserve backings to buy back/redeem dUSD from Curve when it’s trading at a discount, restoring price stability while capturing arbitrage profits for the protocol in the process. Since dUSD’s launch on Dec 18, two SMOs have been successfully conducted: the first one on Dec 20 and the second on Dec 26. No other buybacks were done by the protocol after the second SMO, only by market participants, most noticeably on Dec 30 and 31. Note that dUSD has been trading with less than ±0.2% deviation vs. $1 ever since.