Proposal to add the DOLA pools to the Gauge Controller (3 total) [sUSDe, sUSDS, scrvUSD]

Summary:

Proposal to add the following 3 pools to the gaguge controller:

DOLA/sUSDe

References/Useful links:

Link to:

- Website: https://www.inverse.finance

- Documentation ABOUT INVERSE - Inverse Finance

- Transparency: Inverse Finance - Transparency Overview

- Github Page: Inverse Finance · GitHub

- Communities: Inverse.finance

- Defillama: Inverse Finance Page

Protocol Description:

Inverse Finance is an on-chain decentralized autonomous organization that develops and manages a suite of permissionless and decentralized financial products using blockchain smart contract technology. Originally founded by Nour Haridy in late 2020, the protocol is now governed by Inverse Finance DAO, a collective of crypto enthusiasts.

Inverse Finance’s main products are:

- FiRM, a fixed-rate lending market

- DOLA, a stablecoin pegged to the US Dollar

- sDOLA, yield-bearing version of the DOLA stablecoin

- DBR, a new DeFi primitive that enables holders to service a DOLA loan on FiRM.

DOLA is a debt-backed USD stablecoin which is added into and removed from circulation;

- On the supply side of money markets, such as DAO-owned protocol FiRM, by Inverse Finance’s “Fed” contracts and is then made available to be borrowed through over-collateralized loans.

- Via injection/contractions into pools such as the Curve DOLA/FraxPyusd, DOLA/USDC on Velodrome, DOLA/USDC on Balancer and DOLA/USDC on Aerodrome.

Motivation:

This proposal seeks to add 3 DOLA pools to the gauge controller. All of these liquidity pools are Stableswap-NG pools, paired with yield-bearing stablecoins. We believe that pairing with yield-bearing stablecoins is the future, and there is no better place to do this than Curve Finance given the tech for handling the yield (all of it goes to liquidity providers).

We’d encourage other stablecoin issuers to consider pairing their liquidity with sDOLA, in order give their liquidity providers decentralized organic yield coming from FiRM, Inverse Finance’s fixed rate lending protocol.

If approved, Inverse Finance DAO will incentivize liquidity through vote incentives to vICVX and veCRV holders to drive votes towards the pools, and thus ensuring a democratic and user-centric development of the pool. Inverse Finance has a long history of driving incentives towards the Curve ecosystem.

Specifications:

You can view analytics for DOLA on Defillama. To learn more about the protocol, please visit our official docs, governance and our transparency pages.

Please answer in a short and clear manner.

- Governance: Provide current information on the protocol’s governance structure. Provide links to any admin and/or multisig addresses, and describe the powers afforded to these addresses. If there are plans to change the governance system in the future, please explain.

Decisions for the DAO are made by using INV in the Governor Mills voting contract but as it takes a minimum of five days to vote through a proposal, Inverse Finance DAO has delegated decision-making power to several working groups with limited autonomy and budget. The scope of these working groups is determined in their proposals and they exist to meet fast moving market conditions, to transfer specific or minor decisions to relieve token voters from information overload, and to create a reliable and enjoyable work environment.

Working groups are held accountable to DAO governance, are required to produce progress reports and periodically apply for budget renewals. Delegates have insight into all discord conversations and working groups can be altered or disbanded by a DAO vote.

- Oracles: Does the protocol rely on external oracles? If so, provide details about the oracles and their implementation in the protocol.

The Fixed Rate Market or “FiRM,” is Inverse Finance’s Fixed Rate Market lending protocol. FiRM makes use of Chainlink price oracles or Curve’s ema, depending on the market, in combination with our native Pessimistic Price Oracle (PPO). This novel approach to price oracles for borrows and liquidations in FiRM uses the lower of two recorded prices: either a) the current collateral price on the oracle feed, or b) the 48-hour low price as observed by the PPO on the oracle feed, divided by the collateral factor. For example, if the current Chainlink price for wETH is $1,500, the 48-hour low was $1,000 and the collateral factor is 80%, the PPO returns $1,250. ($1,000 / .80 = $1,250).

Note: for some assets without a Chainlink price feed (such as cvxCRV, cvxFXS, INV), Curve’s EMA oracle (found in ng pools) is used instead.

- Audits: Provide links to audit reports and any relevant details about security practices.

Inverse Finance has undergone multiple audits, including the likes of yAudit, Nomoi, Peckshield and DeFiMoon. Inverse has also hosted a bug bounty contest on Code4rena to conduct a comprehensive audit of FiRM, and has an active bug bounty program live on ImmuneFi. All relevant audit information can be found here. The DAO also has dedicated members overseeing risk, what we call the Risk Working Group.

- Centralization vectors: Is there any component of the protocol that has centralization vectors? E.g. if only 1 dev manages the project, that is a centralized vector. If price oracles need to be updated by a bot, that is a centralized vector. If liquidations are done by the protocol, that is also a centralization vector.

The protocol itself is completely decentralized, and requires no human interaction to work as is. However, DAO working groups have been formed and are active in order to improve efficiencies is various operational areas within the DAO. Often, these working groups will have a Multisig wallet that the DAO governance awards certain roles and limited treasury asset allowances in order to carry out required work. All granted privileges and allowances can be reclaimed/disabled by INV token controlled governance. These are:

- Treasury Working Group (TWG): 3 of 5 Multisig with allowances giving access to Treasury funds to optimize treasury management.

- Risk Working Group (RWG): 1 of 3 Multisig with privileges to pause actions in our (now disabled) lending market.

- Policy Committee (PC): 5 of 9 Multisig that can change staking reward rate to INV stakers.

- Fed Chair: 4 of 7 Multisig with the operator role on DOLA Fed Contracts, which allows for DOLA to be expanded/contracted under the Fed smart contract logic (bounded by market conditions)

Please see our Multisig Wallet section of the transparency portal here.

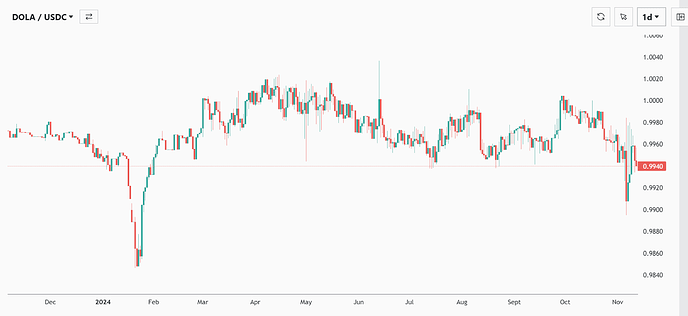

- Market History: Has the asset observed severe volatility? In the case of stablecoins, has it depegged? In the case of an unpegged asset, have there been extreme price change events in the past? Provide specific information about the Curve pool: how long has it been active, TVL, historical volume?

The DOLA stablecoin is soft pegged to $1, and like fully decentralized, over-collateralized stablecoins, can experience some volatility around this peg. Larger deviations (below $0.99) often recover fast due to the repegging mechanism built into the protocol (increasing borrowing cost on FiRM, AMM Fed contractions).