Summary:

Proposal to add the arUSD/USDT/USDC pool to the Gauge controller to enable users to assign a gauge weight and mint CRV on Avalanche.

This proposal is aimed at adding arUSD/USDT/USDC to the gauge controller. This way, the overcollateralized stablecoin of Arable Protocol, arUSD, can play a more significant role on Curve and add value to its community through increased visibility of Curve’s new Avalanche product and increased trading volume.

References/Useful links:

-

Linktree: @arable_protocol | Linktree

-

Website: mvp.arable.finance

-

Documentation: https://about.arable.finance/

-

Github Page/Litepaper: https://github.com/ArableProtocol/arableintro/blob/main/Arable_Litepaper.pdf-

-

Communities- Twitter: https://twitter.com/ArableProtocol - Telegram: Telegram: Contact @ArableProtocol - Discord: Arable Protocol

Protocol Description:

Arable Proccol offers synthetic multi-chain trading and synthetic farming, a first in DeFi! Our objective is to make multi-chain farming accessible, affordable, and simple for everyone. Both seasoned and novice farmers can easily stake in yield farms from various chains thanks to a user interface that is straightforward but effective.

We are actively marketing Arable Protocol and engaging with our community through multiple avenues:

- We run numerous competitions, including our current “Arable Olympics” series of high-rewards events.

- We host our own AMAs on our social channels and are guests at AMAs of our partners, such as Multichain.

- We publish a variety of articles and educational content.

- We collaborate with many partners across the DeFi space and micro-influencers.

Arable Protocol is based around a synthetic ecosystem and its liquidity is created through the minting of the stable asset arUSD which is Arable’s native stablecoin which is pegged to the USD. Users can exchange between different LP tokens and synthetic cryptocurrencies using arUSD, and they can farm on synthetic yield farms that follow the APR of their native chain counterparts.

Minters play an essential role in the Arable protocol. They act as the suppliers of synthetic liquidity to facilitate the trading and farming of synthetic assets (synths) at Arable. They create this liquidity by minting arUSD and mint arUSD by first depositing supported collateral assets in the Arable app. The USD value of the provided collateral is called Collateral Value. This value can change if the market value of the collateral changes.

More information on arUSD is available at the following links:

Motivation:

The motivation to add a gauge on Curve is to increase the demand and establish an additional use for arUSD, which will be used by farmers and traders as a base currency to swap between different synthetic assets. This would positively impact Arable Protocol as its liquidity source. The current arUSD Curve pool is a result of a development proposal that the Arable community voted for. These are the key motivations to participate as a gauge, as we believe this would benefit the Curve community and the entire Arable community.

The minting of arUSD is over-collateralized. Over-collateralization helps protect the protocol against sudden price movements of the collateral assets.

Collateralization ratios:

-

USDT: 200%

-

FRAX: 200%

-

YUSD: 200%

-

AVAX: 300%

-

ACRE: 400%

Specifications:

-

Governance:

a. The protocol’s contracts are under the control of a 4-way multisig using a Gnosis Safe: Gnosis Safe

b. Although this wasn’t voted on an on-chain voting system such as Snapshot.org, we created an informal voting system which was done on our Discord server. -

Oracles:

a. A select set of Arable Protocol validators run the following script to broadcast pricing data: arablevalidator/oracle at main · ArableProtocol/arablevalidator · GitHub

b. We are in talks with Chainlink to utilize their price feed.

c. Our polling rate currently is every 12 minutes on average, we are working on getting this down to at least 4 by inviting more oracle nodes. -

Audits:

Multiple audits by Solidity Finance: arable-contracts-official/audits at main · ArableProtocol/arable-contracts-official · GitHub -

Centralization vectors:

a. Liquidations can be done by any user.

b. A select number of permissioned validators provide oracle services for the protocol.

c. For newly deployed contracts, the ownership is set to the deployer’s address until contract parameters are finalized. The ownership will then be moved to multisig. -

Market History:

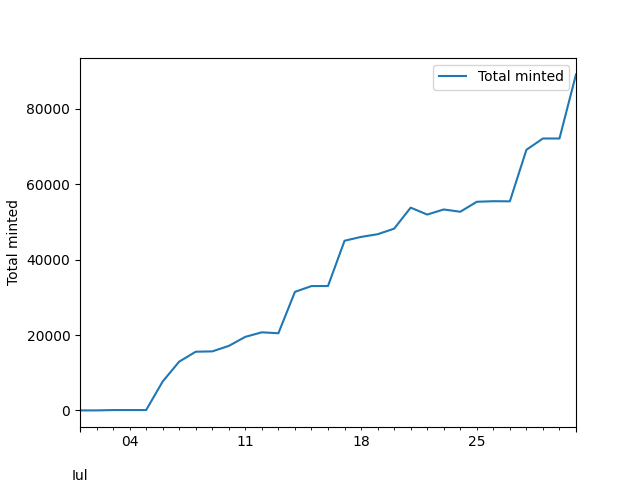

arUSD has increased in the amount of collateral that has been deposited since its launch in July 2022. arUSD has never depegged or come anywhere close to that kind of situation.

arUSD liquidity in July:

Curve pool: Curve.fi

TVL on Curve: $19.000

Historic volume: The pool has only been in operation for a short time, so there is no relevant historical volume available yet.

Exchange rate:

Exchange rate arUSD/USDC (including fees): 0.9963

Exchange rate arUSD/USDt (including fees): 0.9961