Summary:

This is the proposal to add STBT/3CRV pool to the Gauge Controller.

The US Federal Reserve has increased interest rates to address inflation and fulfill its dual mandate of achieving full employment and price stability. By raising rates, the Fed aims to reduce investment and spending by offering a more attractive yield for holding cash rather than investing or spending it. The interest rate paid on deposits by the Fed is considered risk-free, leading investors to sell equities and crypto assets and deposit their cash in treasury-backed savings products such as money market funds or US Treasury securities.

However, the market for USD stablecoins has reacted differently, with the “risk-free” rate decreasing in response to the Fed’s actions. To earn this yield, investors must take significant counterparty or protocol risk. It is anticipated that the Fed will maintain a high interest rate regime for an extended period, requiring stablecoin holders to navigate this challenging market while earning the risk-free rate.

We are pleased to introduce the Matrixdock STBT, the Short-term Treasury Bill token. This token is backed by U.S. Treasury securities that have a maturity period of six (6) months or less, and reverse repurchase agreements, which are collateralized by U.S. Treasury securities. STBT is developed according to the ERC 1400 standard and is equipped with the latest security features, as certified by BlockSec and Zellic.io.

About STBT:

• Website: https://stbt.matrixdock.com/ (jurisdiction restrictions apply)

• White Paper: STBT-contracts/STBT White Paper.pdf at main · Matrixdock-STBT/STBT-contracts · GitHub

• Github Page: GitHub - Matrixdock-STBT/STBT-contracts: The smart contracts of STBT

• Coingecko: https://www.coingecko.com/en/coins/short-term-t-bill-token#markets

• Dune Analytics: STBT Dune Dashboard

Motivation:

At present, Matrixdock, the issuer of STBT, serves as the sole outlet for the issuance of STBT. However, the T+4 timeline for issuance and redemption renders it unsuitable for STBT holders with pressing liquidity management requirements. The STBT/3CRV pool serves as a real-time liquidity venue to all STBT holders. The gauge will incentivize more liquidity into the STBT pool also into the Curve ecosystem; the STBT & 3CRV token holders will earn CRV rewards on top of the native T-bill yields.

Specifications:

1. Governance: Provide current information on the protocol’s governance structure. Provide links to any admin and/or multisig addresses, and describe the powers afforded to these addresses. If there are plans to change the governance system in the future, please explain.

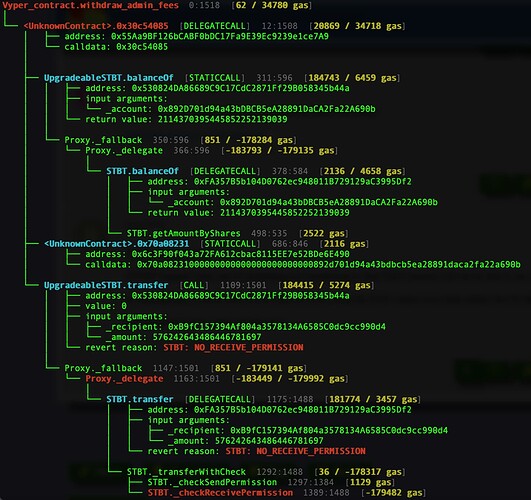

To control the STBT contract, a “time lock” contract is implemented. The administrators of the “time lock” contract include three segregated private keys, enabling multi-signature and permission management, with two private keys controlled by Cactus Custody. Contract modifications and upgrades also require operation through the “time lock” contract (which also requires multi-signature).

Time lock contract: 0x22276A1BD16bc3052b362C2e0f65aacE04ed6F99

2. Oracles: Does the protocol rely on external oracles? If so, provide details about the oracles and their implementation in the protocol.

The STBT price feed does not rely on external oracles currently.

3. Audits: Provide links to audit reports and any relevant details about security practices.

BlockSec - DocSend

Zellic - DocSend

4. Centralization vectors: Is there any component of the protocol that has centralization vectors? E.g. if only 1 dev manages the project, that is a centralized vector. If price oracles need to be updated by a bot, that is a centralized vector. If liquidations are done by the protocol, that is also a centralization vector.

STBT adopts ERC1400 standard, and the smart contract allows the issuer to interact with the rebase function for interest distribution.

STBT is designed for accredited investors, and it can only be transferred to account-holders who have been pre-approved via a KYC/AML white-listing mechanism.

5. Market History: Has the asset observed severe volatility? In the case of stablecoins, has it depegged? In the case of an unpegged asset, have there been extreme price change events in the past? Provide specific information about the Curve pool: how long has it been active, TVL, historical volume?

1 STBT is valued at 1 US dollar upon issuance, and has not experienced severe volatility since its launch.

The STBT/3CRV pool was launched on March 6, 2023. As of March 22, 2023, the TVL is $5,517,541.67, out of which $2,213,412 is STBT.