Summary:

Proposal to add sETH2-stETH factory pool on Ethereum to the Gauge Controller to enable users to assign gauge weight and mint CRV.

References/Useful links:

Website

Dune Dashboard

Documentation

Medium

Github Page

Communities: Discord / Twitter

Protocol Description:

StakeWise is a non-custodial liquid ETH2 staking platform with ~70k ETH staked by ~4k users. StakeWise removes key barriers to entry, such as requiring 32 ETH or the expertise needed for maintaining staking infrastructure, allowing anyone to benefit from the rewards of the beacon chain.

A unique feature of StakeWise is the dual token system - deposits into the staking pool are tokenised into sETH2, an ERC-20 token that acts as interest-bearing wrapped ETH. Staking rewards are paid into a separate token, rETH2, mapped to ETH earned in the Beacon Chain. LP providers passively accrue their staking rewards (rETH2) in the same wallet where they hold their LP token, allowing access to staking rewards without having to withdraw liquidity. More information on how this token system compares to others can be found here. Users are free to un-stake at any time through the pre-existing UniSwap pool found here.

Token Analysis:

sETH2 (0xFe2e637202056d30016725477c5da089Ab0A043A) behaves like interest-bearing wrapped ETH. It does not re-base or re-price, it simply remains static and pegged 1-to-1 with ETH.

stETH (0xae7ab96520DE3A18E5e111B5EaAb095312D7fE84) is Lido’s equivalent staked ETH token. It is a re-balancing token, passively accruing staking rewards daily as the token balances for each user increase. stETH also remains pegged 1-to-1 to ETH, providing an optimal pairing with sETH2.

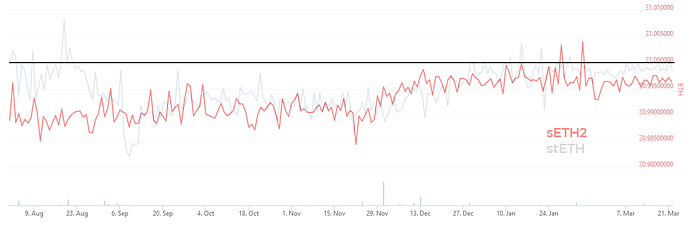

Superimposing stETH / ETH with sETH2 / ETH shows the stability of both assets compared to ETH and each other.

StakeWise will soon be adjusting the UniSwap pool by reducing the fee tier from 0.3% to 0.01%, which is expected to close the remaining gap between stETH and ETH.

Motivation:

Curve is optimised for such a stable asset pair and already supports significant liquidity between stETH and ETH. Given capital efficiency in liquidity pools is a key limitation to the current DEX model, this pool will allow LPers to benefit from staking yields on both assets. Combining this with the addition of the liquidity gauge will solve the issues of capital inefficiency. Staked ETH tokens are becoming more ubiquitous across the ETH ecosystem as more ETH is staked and more DeFi protocols integrate staked ETH derivatives. Providing efficient liquidity between different staked ETH tokens will become ever more important, with this new Curve pool providing liquidity between the most liquid staked ETH assets providing a cornerstone for such liquidity.

Specifications:

1. Governance:

The StakeWise DAO is community owned with all voting rights falling to holders of SWISE, the StakeWise governance token. The protocol’s smart contracts can only be changed following a successful DAO vote. The DAO treasury is a Gnosis Safe with a DAO committee of 7 persons. The goal of the DAO committee is to monitor transactions voted upon via Snapshot and reject malicious transactions that would harm the protocol. In order to reject a transaction, a threshold of 4 out of 7 committee members must sign the rejection. Details of the committee members can be found here.

2. Oracles:

StakeWise relies on an Oracle network to accurately report daily staking rewards to the rETH2 smart contract in order to mint and distribute the correct amount of rETH2. Currently, there are 5 oracles live with details provided here. Note that the number of oracles on the network will be increasing from 5 to 10 over the coming months.

4 out of the 5 oracles are required to submit the same rewards data for the total supply of rETH2 is updated.

Further information is found here.

3. Audits:

StakeWise - Runtime Verification, Certik and Omniscia (reports are here)

Lido - Quantstamp, MixBytes and Sigma Prime (reports are here)

4. Centralization vectors:

StakeWise currently has 3 node operators active on the network: StakeWise Labs, CryptoManufaktur and VeriHash. External node operators can apply to run institutional-grade infrastructure courtesy of the StakeWise open-source deployment package. Node operator applications undergo vetting by a DAO appointed committee before entering a testnet. Prospective operators are then required to pass scenario stress testing before a final DAO vote is submitted for the new node operator to go live on mainnet. StakeWise launched this decentralisation upgrade in Jan 2022 and has several other leading node operators at various points of onboarding to the testnet, such as BlockDaemon. StakeWise will continue to add quality node operators to its network in order to preserve the highest levels of security and yield for its users, with the aim to transition to a fully decentralized solution over time.

5. Market History:

Neither stETH nor sETH2 has experienced a major, negative market event, as shown previously by the graph comparing both assets’ stability to ETH. The curve pool will be seeded with 2.5k sETH2 and 2.5k stETH from the Tribe DAO (proposal here), balanced 50/50. The exchange rate of sETH2/stETH is established at 1, where we expect it to remain for the foreseeable future.

Proposal - add gauge to sETH2/stETH pool?

Link to on-chain vote: Here