This proposal seeks to add the RCH-crvUSD pool on Ethereum to Curve’s Gauge Controller, enabling users to assign gauge weight and mint CRV rewards.

References/Useful Links:

Website: sofa.org

Documentation:docs.sofa.org

Github:GitHub - sofa-org/sofa-protocol

Twitter:x.com

Discord:SOFA.org

Telegram:Telegram: Contact @SOFAorg

RCH-crvUSD token/pool:

0x017433c8be1ce841d2d1b9bffd577a6b74cf302c

Protocol Description:

SOFA.org is a decentralized, non-profit organization (DAO) built by experienced banking and technology veterans to define a common standard for settling all financial assets on-chain. It aims to facilitate the tokenization and on-chain settlement of Real World Assets (RWA) and financial products, creating a decentralized clearinghouse.

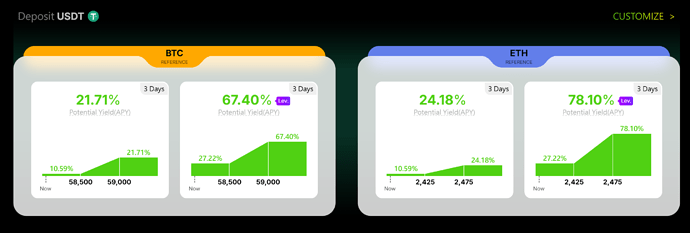

Our project launched product-ready on day 1 (currently live on ETH and Arb), where we built one of the 1st crypto structure product protocols that’s fully on-chain, giving users an innovative and uncorrelated way to earn yield with customizable payoffs.

Key features of SOFA.org:

-

Users can access customizable structured products vaults via a traditional ‘RFQ’ system.

-

There are Earn and Surge structured product protocols catering to different risk appetites users.

-

Currently, SOFA.org supports deposit tokens including USDT, USDC, stETH and RCH.

-

Instant on-chain settlement eliminates credit risks and back-office operations.

-

Utilizes ERC-1155 standard for secure collateral re-pledging across CeFi and DeFi protocols.

-

$RCH utility token was 100% fair-launched on Uniswap with no pre-sales or insider privileges.

-

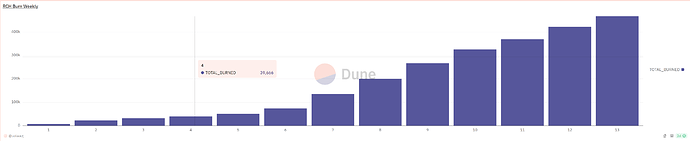

All protocol earnings are used to buyback and burn $RCH on Uniswap.

-

$SOFA is the governance token that allows holders to participate in the decision-making process for the SOFA.org ecosystem.

Motivation:

Curve’s platform is ideal for facilitating stable asset swaps, particularly for uncorrelated assets like $RCH and crvUSD. By adding the RCH-crvUSD pool to Curve’s gauge, SOFA.org aims to:

-

Enhance liquidity for $RCH by pairing it with the stable and efficient crvUSD.

-

Provide Curve users with a unique, yield-generating pool while minimizing price volatility risk.

-

Further diversify the Curve ecosystem by offering users access to SOFA’s innovative yield enhancement platform.

$RCH is the core utility token within the SOFA ecosystem. It was 100% fairly launched with no pre-sales or insider privileges, ensuring a community-driven approach. And it is designed to reward users for transacting within the ecosystem and participating in its growth.

$RCH has a total supply of 37 million tokens, with 25 million (~67%) pre-minted and locked in a Uniswap liquidity pool. The remaining 12mm (33%) are earmarked to be airdropped to protocol users and supporters. Furthermore, all protocol revenues will be used to buyback $RCH in Uniswap on a regular basis, ensuring a long-term deflationary supply design and long-term value accrual to token holders.

More details about $RCH: Tokenomics · SOFA.org Documentation

$RCH historical price can be found on:

Coingecko: https://www.coingecko.com/en/coins/rch-token

CMC: SOFA Org price today, RCH to USD live price, marketcap and chart | CoinMarketCap

crvUSD is Curve Finance’s stablecoin, allowing users to mint stable assets using various crypto collateral. It operates with a passive position management system. And it is designed to provide a more capital-efficient stablecoin mechanism and smoother liquidations, while maintaining a decentralized design which the Curve DAO governs.

For more information on crvUSD, visit:

https://docs.curve.fi/crvUSD/overview/

Liquidation Resistance and Elimination of Counterparty Risks:

SOFA’s execution workflow requires both users and market makers to lock up their maximum exposures at trade inception into our ERC-1155 vaults. As such, there are zero liquidation risks at any point in our product life cycle, ensuring collateral value stability and workflow fluidity on a continuous basis.

Governance:

SOFA.org’s governance system is built around $SOFA, the governance token, allowing holders to participate in key decisions about protocol development. This ensures decentralization and community involvement in managing the ecosystem, including decisions about product onboarding, collateral support, and airdrop distribution rates.

$RCH is the core utility token driving value accrual within the platform, with 100% of protocol earnings used for buybacks and burns on Uniswap to create a deflationary supply.

(The SOFA points system will be introduced in Q4, enabling $RCH holders to actively participate in SOFA DAO governance through $SOFA tokens)

Oracles:

SOFA.org integrates on-chain oracle networks to ensure transparent, real-time settlement of financial products. These oracles report market prices for external assets, allowing for accurate execution of our structured products.

Audits:

SOFA.org has undergone comprehensive audits by leading security firms:

-

SigmaPrime public-audits/reports/sofa/review.pdf at master · sigp/public-audits · GitHub

-

Code4rena Code4rena | Keeping high severity bugs out of production

Centralization Vectors:

As a decentralized, non-profit, open-source technology organization, all decisions within the SOFA.org ecosystem are determined by votes from $SOFA token holders. As a pure governance token, $SOFA does not participate in any profit sharing within the ecosystem.

SOFA.org’s $RCH token was launched with no insider ownership or pre-sale allocations, ensuring no large centralized holders can manipulate or exit-dump the token. This decentralized approach safeguards the ecosystem and aligns with our commitment to community-driven governance.

Market History:

Since launching in June 2024, $RCH has been paired with ETH in a Uniswap V3 liquidity pool, with the pool tokens immediately burned to prevent liquidity withdrawal. And all protocol earnings are used to buyback and burn $RCH on Uniswap.This deflationary mechanism sets a stable floor for $RCH’s value.

Adding the RCH-crvUSD pool to Curve’s gauge controller will further stabilize and grow liquidity, benefiting both the SOFA and Curve communities by providing a unique stable-asset pair.