Summary:

This proposal seeks to add RCH/crvUSD lending pool to Gauge Controller. By enabling CRV emissions for the pool, we aim to incentivize liquidity providers (LPs) and boost lending/borrowing activity, particularly borrowing crvUSD against $RCH collateral via Curve lend. This initiative will strengthen Curve’s ecosystem and encourage deeper utility and adoption of both crvUSD and $RCH.

Upon gauge approval, SOFA.org will leverage Stake DAO’s Votemarket to further boost the pool’s CRV vote allocation. SOFA.org will provide additional incentives on Stake DAO to attract CRV vote buyers, maximizing the yield for LPs.

-

Pool Address: 0xc9ccb6e3cc9d1766965278bd1e7cc4e58549d1f8

-

Gauge Address: https://etherscan.io/tx/0x25fa510caff50438da7f8abb4e25f0e105c799e52b9a4e977e7772d301989dbc

-

Objective: Incentivize lending/borrowing activities on Curve Finance, driving greater adoption of crvUSD while adding utility for $RCH.

-

Proposal Vote : CRV Hub

References/Useful links:

Website: https://dapp.sofa.org/products?project=Earn

Blog: https://blog.sofa.org/

Documentation:docs.sofa.org

Github:GitHub - sofa-org/sofa-protocol

Twitter: x.com

Discord:SOFA.org

Telegram: Telegram: Contact @SOFAorg

RCH-crvUSD Lending Pool: 0xc9ccb6e3cc9d1766965278bd1e7cc4e58549d1f8

Protocol Description:

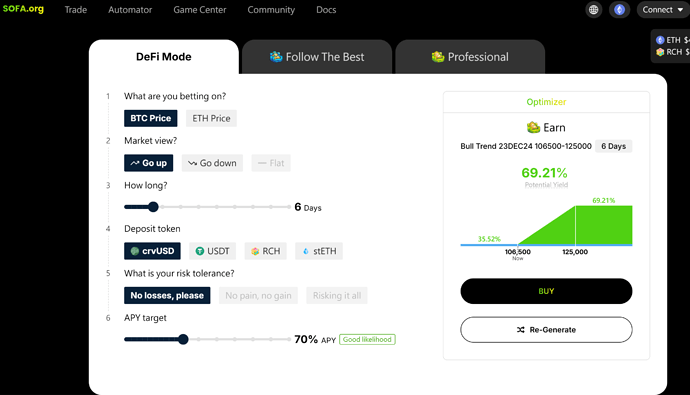

About SOFA.org- SOFA is a fully decentralized yield protocol that allows users to generate sustainable and on-demand yields under any market scenarios through volatility harvesting, supporting multiple token deposits (including crvUSD) with full principal return even in adverse scenarios.

- Live Products: SOFA.org has launched Earn, Surge and Automator vaults catering to varying risk profiles.

Earn is designed for users seeking stability and capital preservation. It involves depositing initial funds into established yield protocols to generate basic interest. If market conditions align with specific criteria, additional profits may be provided.

- Supported Assets: USDT, USDC, crvUSD, stETH, and RCH.

-

Key Features:

-

Harvesting sustainable yield through volatility

-

Instant on-chain settlement eliminating credit risks.

-

ERC-1155 standard for secure collateral re-pledging across CeFi/DeFi.

-

$RCH utility token was 100% fair-launched on Uniswap with no pre-sales or insider privileges.

-

$RCH token used for utility and incentives, with deflationary buyback mechanisms.

-

All protocol earnings are used to buyback and burn $RCH on Uniswap.

-

$SOFA is the governance token that allows holders to participate in the decision-making process for the ecosystem.

-

Backed by prestigious DAO members including Curve Finance

-

$RCH Token

- $RCH is the core utility token within the SOFA ecosystem. It was 100% fairly launched with no pre-sales or insider privileges, ensuring a community-driven approach. And it is designed to reward users for transacting within the ecosystem and participating in its growth.

$RCH has a total supply of 37 million tokens, with 25 million (~67%) pre-minted and locked in a Uniswap liquidity pool. The remaining 12mm (33%) are earmarked to be airdropped to protocol users and supporters. Furthermore, all protocol revenues will be used to buyback $RCH in Uniswap on a regular basis, ensuring a long-term deflationary supply design and long-term value accrual to token holders.

More details about $RCH: Tokenomics · SOFA.org Documentation

$RCH historical price can be found on: Coingecko: https://www.coingecko.com/en/coins/rch-token CMC: SOFA Org price today, RCH to USD live price, marketcap and chart | CoinMarketCap

crvUSD crvUSD is Curve Finance’s stablecoin, offering capital efficiency, decentralized governance, and robust liquidation mechanisms.

SOFA-Curve Collaboration

SOFA.org is dedicated to intensifying its collaboration with Curve Finance through the following initiatives:

-

crvUSD Deposit Token Vault: SOFA has launched vaults for crvUSD deposit tokens, allowing users to earn stable yields on crvUSD and extra boosted yield from SOFA’s structured products.

-

crvUSD-RCH AMM Pool: SOFA has established an Automated Market Maker (AMM) pool for crvUSD-RCH, providing liquidity and facilitating efficient swaps.

-

crvUSD-RCH Lending Pool: Recently launched, this pool enables users to borrow crvUSD against $RCH collateral, driving additional utility for both assets.

crvUSD is designed to provide stable yields through its groundbreaking Lending-Liquidating AMM (LLAMMA), which mitigates liquidation risks while optimizing liquidity management. By integrating crvUSD into SOFA’s structured products, we can also combine crvUSD’s attractive lending rates with SOFA’s secure and flexible yield strategies.

Benefits to Curve Finance Ecosystem

-

Boosts crvUSD Adoption: The proposal encourages borrowing crvUSD against $RCH collateral, strengthening Curve’s stablecoin utility and liquidity.

-

Increased TVL: CRV rewards attract LPs to supply liquidity in the RCH/crvUSD pool, growing Curve’s Total Value Locked.

-

New DeFi User Base: SOFA.org’s structured product users and community bring new users to the Curve ecosystem.

-

Enhanced Liquidity: By combining CRV emissions and Stake DAO’s Votemarket, the pool will remain highly incentivized for sustained LP participation.

Stake DAO Vote Market Collaboration

Following gauge approval, SOFA.org will provide incentives through Stake DAO’s Votemarket:

-

Incentives: SOFA.org will allocate rewards to Votemarket participants to increase CRV votes for the RCH/crvUSD pool.

-

Outcome: Greater CRV vote allocation for the pool translates into higher CRV emissions, further boosting LP yields and attracting liquidity.

This synergistic approach benefits Curve Finance, Stake DAO, and SOFA.org by aligning incentives across all platforms.

Motivation:

The motivation for this proposal stems from the following:

-

Liquidity Incentivization: Adding a gauge for the RCH/crvUSD pool will attract liquidity providers, improving borrowing conditions and stability for crvUSD.

-

$RCH Utility Growth: This initiative creates a new on-chain use case for $RCH, encouraging users to borrow crvUSD using $RCH as collateral.

-

Collaborative Ecosystem Expansion: By leveraging Stake DAO’s Votemarket, we can amplify CRV incentives efficiently, ensuring optimal LP rewards and long-term sustainability.

This proposal aligns with Curve Finance’s mission to enhance stablecoin liquidity and utility through decentralized markets and incentives.

Specifications:

Technical Considerations

-

Gauge Configuration: Standard integration into Curve’s Gauge Controller.

-

Lending Market: RCH/crvUSD pool is already operational on Curve Lend and ready for gauge inclusion.

-

Oracles: SOFA.org uses Chainlink oracles for secure and transparent on-chain price feeds.

-

Audits: SOFA Protocol has been comprehensively audited by:

Liquidation Resistance and Elimination of Counterparty Risks:

SOFA’s execution workflow requires both users and market makers to lock up their maximum exposures at trade inception into our ERC-1155 vaults. As such, there are zero liquidation risks at any point in our product life cycle, ensuring collateral value stability and workflow fluidity on a continuous basis.

Governance:

SOFA.org’s governance system is built around $SOFA, the governance token, allowing holders to participate in key decisions about protocol development. This ensures decentralization and community involvement in managing the ecosystem, including decisions about product onboarding, collateral support, and airdrop distribution rates.

$RCH is the core utility token driving value accrual within the platform, with 100% of protocol earnings used for buybacks and burns on Uniswap to create a deflationary supply.

Centralization Vectors:

As a decentralized, non-profit, open-source technology organization, all decisions within the SOFA.org ecosystem are determined by votes from $SOFA token holders. As a pure governance token, $SOFA does not participate in any profit sharing within the ecosystem.

SOFA.org ’s $RCH token was launched with no insider ownership or pre-sale allocations, ensuring no large centralized holders can manipulate or exit-dump the token. This decentralized approach safeguards the ecosystem and aligns with our commitment to community-driven governance.

Market History:

Since launching in June 2024, $RCH has been paired with ETH in a Uniswap V3 liquidity pool, with the pool tokens immediately burned to prevent liquidity withdrawal. And all protocol earnings are used to buyback and burn $RCH on Uniswap.This deflationary mechanism sets a stable floor for $RCH’s value.

Conclusion

By approving a gauge for the RCH/crvUSD lending pool:

-

Increase crvUSD adoption and liquidity.

-

Attract new liquidity providers and DeFi users to Curve Finance through CRV incentives.

-

LP will benefit from SOFA.org’s commitment to incentivize Votemarket participation via Stake DAO.

This proposal creates a win-win for Curve, Stake DAO, and SOFA.org while further solidifying crvUSD’s role in decentralized finance.

We encourage the Curve DAO community to support this proposal for the long-term growth of the Curve ecosystem.