Summary:

Proposal to add PWRD+3Crv factory pool 44 (“PWRD Metapool”) to the Gauge Controller to enable users to assign gauge weight and mint CRV.

Abstract:

Gro protocol is a yield aggregator that offers leveraged and protected products (Vault and PWRD).

PWRD is a yield bearing stablecoin that is protected (as a senior tranche) by Vault (junior tranche product offering leveraged yield).

PWRD is over-collateralised with a minimum of 200% of stablecoin collateral (diversified mix of USDT, USDC, DAI) for each 1 PWRD minted. You can track the collateral level in real time in the PWRD dashboard (currently 149% protected by Vault + 100% collateral provided to mint).

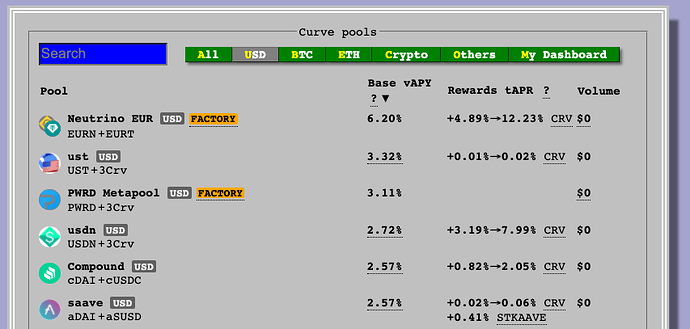

The PWRD Metapool currently has $16.3m in it, and has been incentivised to date by the base yield on PWRD and by Gro DAO tokens ($GRO).

Motivation:

PWRD is designed to be the most stable stablecoin, as its peg is based on a diversified basket of USDT, USDC and DAI (the three most stable stablecoins) where the assets are isolated from each other (unlike the 3pool).

It is also protected with at least 200% collateral cover (currently 249%) using risk-traching (ie the junior tranche product Vault provides collateral for PWRD), all backed by major stablecoins.

On top of all this it offers base yield of between 3% and 6% (currently 5.85%), through a rebasing mechanism by which yield continually accrues straight to your wallet. This built-in yield means the PWRD Metapool naturally has one of the highest base APYs on Curve, offering a safe and reliable yield option for Curve users to deposit their stablecoins.

This is the only stablecoin on Curve which has base yield, in-built protection from collateral, while its peg is based on major stablecoins only.

Adding a gauge would boost the demand and TVL for PWRD, which would enable more and more utilisation of PWRD as a high velocity stablecoin which is protected and offers yield to its holders. This in turn allows more holders to diversify their stablecoin portfolio into a safe and over-collateralised asset, without giving up on yield opportunity.

veCRV holders will benefit from the opportunity to boost total Curve usage by adding in a powerful competitor to the existing stablecoins available, and in doing so increase the utility of Curve for all users and trading fees that accompany this.

Specification:

You can view analytics for PWRD on the PWRD dashboard. To learn more about the protocol, please visit the official docs or the Gro DAO discord.

Minting PWRD is available from the Gro dApp and the Argent wallet. In each case you deposit stablecoins (USDT, UDSC or DAI) and receive PWRD.

Gro protocol has been live since July 2021. We have completed several audits and reviews of our smart contracts with Peckshield, Fixed Point solutions (Kurt Barry) and Code Arena. In addition there is a $1m bug bounty live with Immunefi. More information on this is available in the docs.

We use Curve to price assets during deposits and withdrawals for the most responsive and accurate asset pricing. Because Curve can be manipulated with flash loans, we are also sanity checking stablecoin price ratios with an external third-party price oracle (Chainlink).

For:

PWRD Metapool should have a gauge than can earn CRV

Against:

PWRD Metapool should not have a gauge that can earn CRV

Poll:

The goal of this post is to measure the community’s sentiment on this idea. The proposal will be posted soon after.