Summary:

FIDU is an ERC20 token representing a Liquidity Provider’s [LPs] position in the Senior Pool on Goldfinch. This is similar to the cUSDC token you get for depositing USDC into Compound. Liquidity Providers [LPs], who provide capital to the Senior Pool that is automatically allocated across Borrower Pools, take on less risk by providing second-loss capital via senior tranches.

This proposal is to add a gauge to the FIDU/FRAXBP pool currently on Curve.

References/Useful links:

• Curve Pool: Curve.fi

• Website: https://goldfinch.finance/

• Documentation: Introduction - Goldfinch Docs | Goldfinch

• Github Page: Goldfinch Foundation · GitHub

• Communities: Goldfinch

• Twitter: https://twitter.com/goldfinch_fi

Protocol Description:

Goldfinch is revolutionizing the $1T+ global private debt market by first allowing credit funds and FinTechs to access cost-efficient crypto loans. Goldfinch provides crypto lenders with access to debt deals collateralized with real-world assets that have been historically inaccessible outside exclusive networks.

The Protocol is expanding financial access for thousands of individuals around the world via its Borrowers, spanning over 20 countries. Some of Goldfinch’s Borrowers include PayJoy in Mexico, QuickCheck in Nigeria, Divibank and Addem Capital in LatAm, Greenway through Almavest in India, and Cauris in Africa, Asia, and Latin America. You can view more Borrower Pools here.

FIDU is a “digital receipt ” that represents an LP’s supply to the Senior Pool. The Senior Pool supplies senior capital that must be fully paid back before Backers (first-loss capital) receive their principal/interest repayments. FIDU increases in USDC exchange value as interest payments are made to the Senior Pool and only decreases in the case of defaults where the assets recouped are below the value of the loan.

Goldfinch to date has maintained a 0% default rate across a currently ~$100m in loans deployed and over $1M in protocol revenue.

Warbler Lab’s Founders are two ex-Coinbase employees with a team of ex-Goldman Sachs, Morgan Stanley, McKinsey, World Bank, Binance.US, Airbnb, Meta, BlockFi, and more. Goldfinch has raised a $25M Series A, backed by a16z, Kindred Ventures, Coinbase Ventures, Variant Fund, IDEO, Bill Ackman via TABLE, Kingsway Capital, Stratos, and more.

Motivation:

A robust secondary market is a core part of any functioning debt market. Such a market enables price discovery for the market value of the debt instruments and allows participants like DAOs to get exposure.

Prior to working with Frax, the FIDU/USDC pool historically had a TVL of $5.2M with $GFI incentives coming from the Goldfinch DAO.

Specifications:

-

Governance: Any changes to the protocol are done through the governance processes established by the Goldfinch DAO. This includes token voting for protocol changes using the GFI token and ratified through the Goldfinch Council which is a 6 of 10 multisig. More information here: Governance - Goldfinch Docs | Goldfinch.

-

Oracles: Goldfinch does not rely on any external oracles.

-

Audits: Since its inception, Goldfinch has published the report from every external audit in an open-source repo.

-

Centralization vectors: Goldfinch does not have any such centralization vectors. A credible, 3rd party risk assessment here is produced by DeFi Safety which includes centralization risk. They have a report produced by the organization that assigns Goldfinch an industry leading DeFi Safety Score of 93% which you can read about here. This is equivalent to other bluechip DeFi protocols like Compound, Yearn, and Aave. Notably, it is far above other protocols like Maker.

-

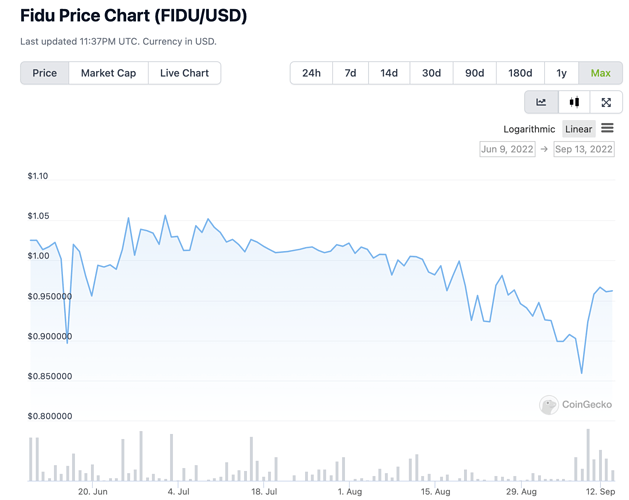

Market History: As FIDU’s NAV is composed of fixed income instruments, it has not had significant price volatility. It is not meant to be a stablecoin. The original FIDU/USDC pool has been around since April 2022. The new FIDU/FRAXBP pool was deployed on Oct 26, 2022.