Summary:

Proposal to add FTML/FTM Factory Pool to Gauge Controller to enable users to assign gauge weight and mint CRV. FTML is a collateral-backed synthetic asset.

References/Useful links:

Website: https://topshelf.finance/

Documentation: https://docs.topshelf.finance/

Medium: TopShelf - Medium

Token Address: TopShelf (FTML) token tracker | FTMscan

Twitter: https://twitter.com/TopShelfFinance

Community: TopShelf

Github: https://github.com/topshelf-finance

Protocol Description:

TopShelf is a decentralized borrowing protocol based on the Liquity protocol, that allows users to draw interest-free loans against collateral. Loans are paid out in synthetic tokens (e.g. USDL, BNBL, FTML) and need to maintain a minimum collateral ratio of 110%. The loans are secured by the collateral, a Stability Pool and by fellow borrowers collectively acting as guarantors of last resort. TopShelf Finance is non-custodial, immutable, and governance-free.

TopShelf’s redemption feature serves as FTML’s price floor as users can always redeem USDL for the underlying collateral, and the collateralization ratio of 110% on g3CRVserves as a price ceiling. These two mechanisms ensure FTML’s peg to FTM.

The team is filled with DeFi veterans who want to remain anonymous. There are no VCs or other backers involved in this project.

Motivation:

Stable pair swaps on Curve are the cornerstone for like-pair assets like FTML. This proposal presents the first synthetic FTM pool on Curve. Adding incentives to FTML liquidity on Curve would help increase access to the FTML pool as well as provide additional visibility. Curve incentivization would help deepen the liquidity of FTML and help reach critical mass to become a widely adopted synthetic asset.

Specifications:

-

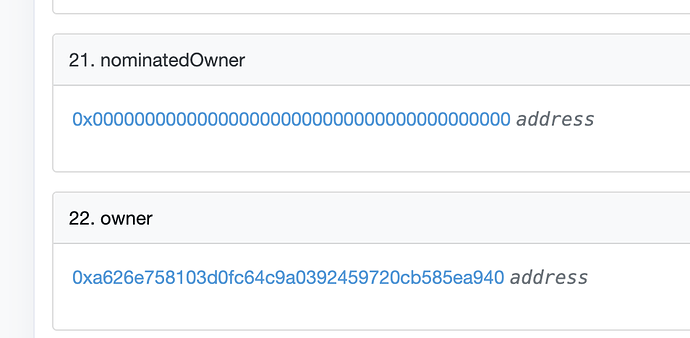

Governance: As TopShelf is non-custodial, immutable, and governance-free all the tokens sent to the protocol will be held and managed algorithmically without the interference of any person or legal entity. That means your funds will only be subject to the rules set forth in the smart contract code.

-

Oracles: TopShelf uses Chainlink and Band price feeds to get the prices of the collaterals.

-

Audits: TopShelf is audited and its technical implementation is largely based on Liquity’s. Reports of the audits on Liquity can be found here.

-

Centralization vectors: None.

-

Market History: The FTML token has not experienced significant volatility or de-pegging against FTM due to its redeemability.