Summary: This proposal, submitted on behalf of BadgerDAO and Lido, seeks to add the eBTC/wstETH pool’s gauge to the Gauge Controller on the Ethereum network.

- Pool Address: 0x94a5B3A7AAF67415B7F5973ed1Adf542897a45F1

- Gauge Address: 0xBEb468BEb5C72d8b4d4f076F473Db398562769ed

References/Useful Links:

- Websites: eBTC Finance, BadgerDAO

- Documentation: eBTC Documentation

- Analytics: eBTC Analytics

- CoinGecko: eBTC on CoinGecko

- GitHub: eBTC GitHub

- Discord: BadgerDAO Discord

- Twitter: eBTC Protocol Twitter, BadgerDAO Twitter

Protocol Description: eBTC is a collateralized crypto asset, soft pegged to the price of Bitcoin and built on the Ethereum network. It is backed exclusively by Lido’s stETH and powered by immutable smart contracts with minimized counterparty risk. Designed to be the most decentralized synthetic Bitcoin in DeFi, eBTC allows anyone in the world to borrow BTC at no cost.

Motivation: The request to enable this gauge is motivated by several factors. Firstly, establishing Curve as a primary liquidity venue for eBTC will strengthen the protocol and enhance its composability and use cases. Secondly, Lido aims to expand the liquidity profile of stETH and views eBTC as a strategic pairing due to the synergies between the assets.

Additionally, the CDP nature of eBTC, backed solely by stETH with a 110% MCR requirement and no fees or interest rates, makes it the most capital-efficient way to long stETH against BTC in DeFi. Having a pool with this pair will enable a smooth path for most leverage operations, and we believe Curve is the perfect venue to handle this with the highest efficiency possible. The liquidity in this pool is expected to drive most of the leverage volume, resulting in high fees for the protocol.

Finally, Lido plans to incentivize LPs to adopt the pool. The communities of Lido, BadgerDAO, Curve, and Convex have historically collaborated closely, and this pool will further strengthen these ties, unlocking a variety of integrations and synergies.

Specifications:

- Governance: eBTC’s Minimized Governance framework is detailed in this forum post. The protocol’s contracts are immutable, with minimal parameters that can be modified via two Timelocks with 2 or 7-day delays. Only parameters that do not violate users’ trust assumptions can be changed.

- Oracles: The eBTC Protocol primarily relies on Chainlink for price data and is adding a secondary (fallback) oracle via governance. Details on the Chainlink Oracle setup can be found here.

- Audits:

- RiskDAO’s Risk Report

- Cantina Security Review - 20/08/2023

- Spearbit Security Review - 20/08/2023

- Trust Security Smart Contract Audit - 20/09/2023

- Code Arena: Badger eBTC Audit + Certora Formal Verification Competition

- Immunifi Pre-launch Bug Bounty

-

Centralization Vectors: The protocol has no major centralization vectors. Minimal governance is conducted transparently and distributedly, with robust timeclocks and monitoring. Contracts are immutable, and collateral types cannot be changed.

-

Market History:

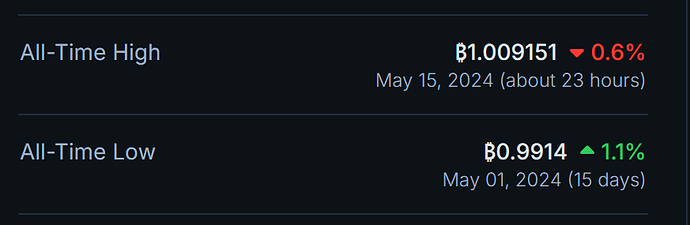

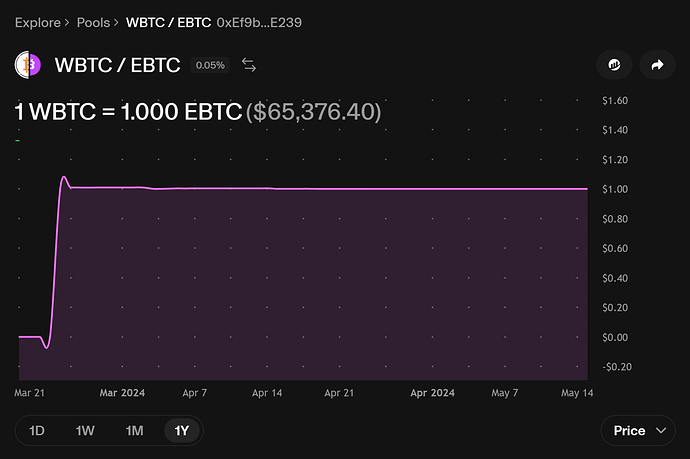

- eBTC has maintained a strong peg to BTC since its launch (~2 months ago) ranging from 0.99 to 1.009.

- All its liquidity (~$4.1M) is currently in a Uniswap V3 pool paired with wBTC, where it has consistently maintained a strong peg: