Note: This is a re-submission of #126 which didn’t reach quorum during its vote. This post includes more info to help voters make an informed decision.

Proposal:

Summary

Proposed by Lewi from Empty Set protocol. This proposal aims to add DSU3Pool factory pool to the Gauge Controller. With this additional support of this pool, users will be able to supply gauge weight and mint DSU.

Abstract

DSU is a fully collateralized stablecoin with fast scalability, censorship resistance, and trust minimized attributes. DSU is minted 1:1 against stablecoin deposits in the protocol. The stablecoin collateral is then deposited by the protocol in widely used money markets - creating a “usage layer” between the collateral and the stablecoin making all Digital Standard Units truly fungible.

In the event that the token holder would like to redeem their DSU at any point, they could do so through the same mechanism - retrieving the underlying asset(s) from the reserve and burning the DSU token in the process

Motivation

DSU is a risk minimised alternative to the plethora of existing stablecoins. While most are centralised or rely on complex systems to maintain peg: DSU’s dependency minimised, fully backed design presents a lower risk avenue for users to risk-off in stable assets. With that in mind, DSU is currently being integrated across DeFi platforms and on various L2 solutions.

The addition of DSU to the Curve’s gauge program will provide a risk-minimised pool to the Curve platform and help grandfather our previously operational v2 pool.

Specification

You can find documentation around DSU and the V2 of Empty Set as a whole in the documentation . To check out the codebase go here.

This curve pool has been configured with an A value of 200 as the token is fully-redeemable for the underlying asset at any time. You can demo this at the dApp here . The redeemability helps with a tight peg as the token allows for easy arbitrage.

DSU + 3CRV Metapool: https://etherscan.io/address/0xf0C081020B9d06EB1b33e357767c00Ccc138bE7c

Risk Report

This section follows the suggested “Risk Report” template currently being discussed in the governance forum.

Privileged Addresses

- GovernorAlpha

- Address

- This address is a fork of Compound’s

GovernorAlphawhich governs the protocol. It has the power to upgrade contracts within the system. The voting process takes 3 days and then the Timelock is able to execute the proposal.

- Timelock

- Address

- This address takes proposals that have passed the governance process and holds them for 2 days before being able to deploy them.

- In total, there are 5 days between proposal of changes and the execution of those changes.

MultiSigs

- Address

- The only “protocol” multisig is a treasury which is used to fund grant and operations. It has no power over the protocol and receives tokens from protocol level governance votes.

- Signers

- Andrew Kang

- Dan Elitzer

- Lewis Freiberg

- Linda Xie

- Reuben Bramanathan

- Niraj Pant

Platform Details

V2 of the Emptyset protocol was deployed in August of 2021 and has been operational since then. DSU currently has pools on Uniswap V3 and on Curve with over $400k in liquidity. These pools have liquidity programs running on them, however the Curve V2 program will be grandfathered with this gauge proposal.

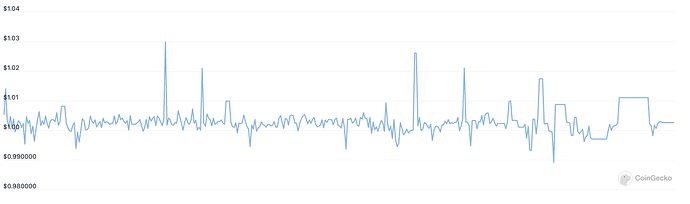

Peg Performance

Above is the last 60 days of price history for the DSU stablecoin, while not rock solid it’s able to maintain its peg relatively well with a low float. This will continue to improve as more DSU is issued and traded.

Pool History

- Curve V2 Pool - Liquidity has been migrated to v3 in anticipation of a gauge.

- Curve V3 Pool

- Uniswap V3

Audits

Empty Set V2 has been audited by OpenZeppelin. The audit covered the normal operation of the protocol and governance modules.

Note: after discussion with OZ the stabilizer module was removed as in certain edge-cases it could cause a risk to the system.

Context around Empty Set V2

This proposal relates to V2 of the Empty Set protocol which is a new mechanism which achieves the goals we set out to accomplish in V1 of the protocol but is able to with a much simpler & safer design.

Empty Protocol initially launched to create a risk-minimised, decentralised stablecoin. It did so by taking the earlier work of Basis Cash Basis.io, a seinorage style protocol, and expanding upon it. The aim was to have a stablecoin without external dependencies and thus lowered risk. The protocol launched and for a number of months the protocol functioned relatively well however after a time, the expansions began to outstrip the system used to claw it back. To address this a number of proposal went through governance to modify the system to stabilize it. Ultimately these efforts were unsuccessful.

Instead of abandoning the protocol and the community around it, the initial team and contributors decided to develop a new mechanism for the protocol to use that remained true to the initial ethos of the project: risk-minimised & decentralised. Taking the learnings from V1, a fully collateralised design was devised that could offer the required features and that became Empty Set V2.

Vote

For:

DSU3POOL should have a gauge that can earn CRV

Against:

DSU3Pool should not have a gauge

Poll:

Vote live: here