Summary:

Proposal to add DOLA/CUSD to the Curve Gauge Controller.

Pool deployed here.

Gauge deployed here.

References/Useful links:

Link to:

About Inverse Finance

- Website: https://www.inverse.finance/

- Documentation:ABOUT INVERSE - Inverse Finance

- Transparency: Inverse Finance - Transparency Overview

- Github Page: InverseFinance

- Communities: Discord

- Defillama: DOLA: TVL and stats

About Coin98

- Website: https://coin98.com/dollar

- Documentation: Coin98 Dollar - Coin98 Finance

- Token address: Etherscan

- Github Page: Coin98 Labs · GitHub

- Communities: CUSD Twitter | Discord | Telegram Chat Group

- Coingecko: https://www.coingecko.com/en/coins/coin98-dollar

Protocol Description:

About Inverse Finance

Inverse Finance is a community of crypto enthusiasts organized as a DAO and started on December 26th 2020. Inverse DAO governs and develops a suite of permissionless and decentralized financial tools using blockchain smart contract technology. The code base is open source and maintained by the community.

Inverse DAO’s core product is DOLA, a debt-backed USD stablecoin. DOLA is added into and removed from circulation;

- On the supply side of money markets, such as DAO-owned protocol FiRM, by Inverse Finance’s “Fed” contracts and is then made available to be borrowed through over-collateralized loans.

- Via injection/contractions into pools such as the Curve DOLA/FraxBP through our partnership with Yearn (currently $31.6M TVL), DOLA/USDC on Velodrome ($1.5M TVL), DOLA/bb-a-USD on Balancer ($8.6M TVL).

- Via purchase with DAI stablecoin using The Stabilizer.

DOLA is not “algorithmic” and the INV governance token is not used to mint or redeem DOLA.

About Coin98

Coin98 is a DeFi product builder focusing on creating and developing an ecosystem of DeFi protocols, Web3 applications, and NFTs on multiple blockchains. Our mission is to fulfill untapped demand and enhance in-demand utilities in the DeFi space, helping people to access DeFi services effortlessly. The Coin98 universe is now consolidating Coin98 Super App, Coin98 Exchange, Coin98 SpaceGate (cross-chain bridge), Coin98 Dollar (CUSD) and many more incubating initiatives.

Coin98 Dollar (CUSD) is a fully-backed stablecoin that aims to become a cross-chain unit of account that fulfills the demand for cross-chain liquidity in DeFi.

In order to convert to 1 CUSD, a total of $1 worth of the collateralized assets must be sent into the CUSD Reserve smart contract. Specifically, in the initial phase, the collateral ratio to convert to 1 CUSD will be $1 worth of fiat-backed stablecoins - BUSD (on BNB Chain) and USDC (on Solana and Ethereum).

Motivation:

This proposal aims to add the DOLA/CUSD pool to the Curve Gauge controller.

CUSD is a stablecoin recently launched by Coin98. Coin98 has a wide range of products, including Coin98 Super App (aka Coin98 Multichain Wallet) that has 6 million users worldwide, especially popular in the Asia region, and is the best multichain wallet that supports more than 70 blockchains, including EVM and non-EVM chains.

Adding a gauge to this LP will onboard Coin98 and its users to the Curve ecosystem via CUSD stablecoin, and consequently get them to experience all other pairs available on Curve. This also provides a platform for Coin98 to build and release further products and integration for CUSD on the Ethereum blockchain.

Both Inverse Finance DAO and Coin98 will jointly incentivize liquidity to the pool, allowing CUSD to access the already deep liquidity of DOLA.

Specifications:

Please answer in a short and clear manner.

You can view analytics for DOLA on Defillama. To learn more about the protocol, please visit our official docs, governance and our transparency pages.

- Governance: Provide current information on the protocol’s governance structure. Provide links to any admin and/or multisig addresses, and describe the powers afforded to these addresses. If there are plans to change the governance system in the future, please explain

About Inverse Finance

Inverse Finance Fed contracts mint DOLA directly to the supply side of lending markets or to pools such as the DOLA/FraxBP Curve pool as demand increases, or they retract and burn DOLA from the supply when demand decreases. The Fed contracts are governed by the Inverse Finance DAO, which is controlled by INV holders through governance. A detailed description of our governance can be found here. Equally, check out our transparency portal here which gives a visual representation of Inverse Finance Governance.

About Coin98

The CUSD protocol governance structure is currently managed by:

0x1db6ad727ae60d7b4dbee81f79c4bcbcff8759f8 - CUSD

0x6fd5991da792f09ed0ed0e9327f4c5164c66e1f3 - CUSD Mint BurnCoin98 team has been maintaining the CUSD protocol with these addresses to ensure a smooth transition toward decentralization while having proper product development progress in the initial phase.

We have plans to decentralize the CUSD governance system via C98 token in the future.

- Oracles: Does the protocol rely on external oracles? If so, provide details about the oracles and their implementation in the protocol.

About Inverse Finance

Inverse Finance’s new fixed-rate money market, FiRM, uses Chainlink price oracle for its wETH market. Inverse Finance’s old lending market relied on both Chainlink and non ChainLink oracles, however, borrows have been disabled since June 2022 with no current plans to re-enable.

About Coin98

No.

- Audits: Provide links to audit reports and any relevant details about security practices.

About Inverse Finance

As part of our renewed smart-contract review process, Inverse Finance hosted a bug bounty contest on the Code4rena platform to conduct a comprehensive audit of our fixed rate lending protocol, FiRM. Inverse has also recently expanded its bug bounty program by launching a vault on the Hats.finance platform. FiRM contracts were also reviewed by boutique auditing firm DefiMoon, who have been our official security partners during Q4. In addition to providing security consulting and auditing services for FiRM, DefiMoon has also played a role in our recent deployments of FraxBP Fed, Aura Fed, and Velo Fed. In the immediate aftermath of our price manipulation incident, Inverse had hired leading security firm PeckShield in Q3 to perform an audit of our renewed INV oracle, as well as our bad debt repayment product. Their report can be found here.

The DAO also now has dedicated members overseeing risk, what we call the Risk Working Group. An announcement of the team’s formation can be found here.

About Coin98

Security has always been our top priority since the beginning of product development There for Coin98 Dollar (CUSD) had been audited by multiple organizations such as SlowMist, PeckShield & Inspex previously before launch. All audit records can be found here.

- Centralization vectors: Is there any component of the protocol that has centralization vectors? E.g. if only 1 dev manages the project, that is a centralized vector. If price oracles need to be updated by a bot, that is a centralized vector. If liquidations are done by the protocol, that is also a centralization vector.

About Inverse Finance

Within the DAO working groups have been formed to deliver work in specific areas. Often, these working groups will have a Multisig wallet that the DAO governance awards certain roles and limited DOLA or INV allowances in order to carry out required work. All granted privileges and allowances can be reclaimed/disabled by INV token controlled governance. These are:

- Treasury Working Group (TWG): 3 of 4 Multisig with allowances giving access to Treasury funds to optimize treasury management.

- Risk Working Group (RWG): 1 of 3 Multisig with privileges to pause actions in our (now disabled) lending market.

- Policy Committee (PC): 5 of 9 Multisig that can change staking reward rate to INV stakers.

- Fed Chair: 2 of 6 Multisig that can call the expansion and contraction functions (to mint/burn DOLA) on the Fed Contracts.

Please see our Multisig Wallet section of the transparency portal here.

About Coin98

The CUSD protocol is currently managed by the Coin98 team. We have a plan to decentralize the protocol management in the future, starting with a multi-sign approach for the contract keys managed by multiple contributor groups.

- Market History: Has the asset observed severe volatility? In the case of stablecoins, has it depegged? In the case of an unpegged asset, have there been extreme price change events in the past? Provide specific information about the Curve pool: how long has it been active, TVL, historical volume?

About Inverse Finance

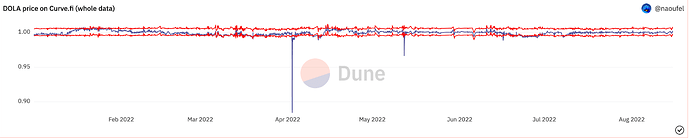

Inverse Finance DAO launched DOLA In February of 2021. Through the “Feds”, Inverse maintains the flexibility to adjust borrowing rates across one or even all partner lending markets in order to optimize supply and demand for DOLA and to maintain its USD peg. DOLA’s Fed mechanics have proven to be highly resilient at defending the peg, even during times of extreme stress. The DOLA-3Pool experienced 3Pool bank runs twice (on the days of oracle exploits) on April 2nd and June 16th; both times DOLA depegged for very short periods of time. Please see our graph below of DOLA’s peg YTD.

Currently, the deepest liquidity pool for DOLA stablecoin is DOLA/FRAXBP on Curve, with a TVL of $31.6m at the time of writing.

About Coin98

Coin98 launched CUSD in September 2022. CUSD is a fully-backed stablecoin that you can redeem at 1:1 ratio for the collateralized assets in the smart contract, which currently supports USDC & BUSD.

CUSD has maintained a stable price with liquidity pools on multiple blockchain (Kyberswap Elastic for Ethereum, Baryon Network on BSC & Saros Finance on Solana) with no significant price change events. There was a price deviation display error on Coingecko but yet it got fixed immediately.

The DOLA/CUSD Curve pool has just been recently established as a joint effort of Coin98 and Inverse Finance to onboard our users to the Curve ecosystem.