Summary:

Proposal to add the DCHF+3CRV pool to the Gauge Controller to enable users to assign gauge weight and mint CRV.

References/Useful links:

- Website: defifranc.com

- Apps: app.defifranc.com

- Docs: docs.defifranc.com/

- Github: DeFi Franc (DCHF) · GitHub

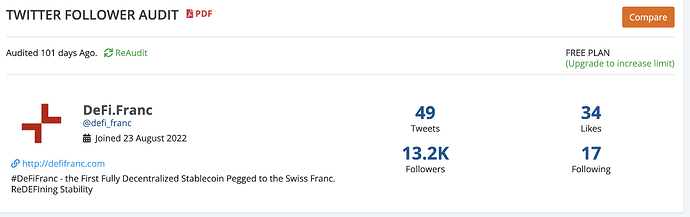

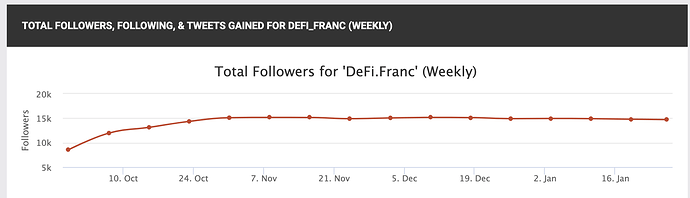

- Twitter: https://twitter.com/DeFi_Franc

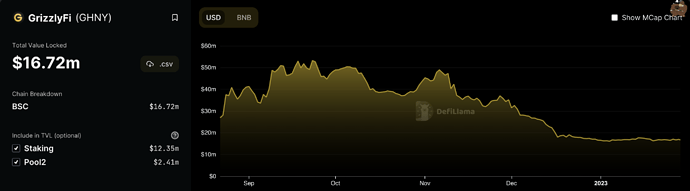

- Defillama: DeFi Franc: TVL and Stats - DefiLlama

- Security: Audits - The Defi Franc

- DCHF: https://etherscan.io/token/0x045da4bFe02B320f4403674B3b7d121737727A36

- DCHF/3CRV pool: https://curve.fi/factory-crypto/116

Protocol Description:

The DeFi Franc (DCHF) is an overcollateralized stablecoin pegged to the Swiss Franc. The Swiss Franc (CHF) is historically a very stable fiat currency and usually thrives in times of economic downturn. This makes the DCHF an attractive alternative to USD denominated stablecoins for everyone seeking to preserve wealth and earn “real yield”. The DeFi Franc smart contract system is a friendly fork of Liquity, with certain governance processes for expanding the set of collateral tokens, and is deployed on the Ethereum Mainnet. DCHF can be borrowed by depositing Ether or Wrapped Bitcoin as collateral and enforces a minimal collateral ratio of 110% on each borrow position. At the time of writing this proposal, the system’s global collateral ratio exceeds 220% according to the DCHF dashboard. Similar to Liquity the DeFi Franc utilizes DCHF deposited into a stability pool in order to perform instantaneous liquidations on undercollateralized positions. Moreover, just as LUSD the DCHF is 100% redeemable against the high-quality liquid assets accepted as collateral (currently ETH and WBTC). More information around these mechanisms can be found in the DCHF docs. In its turbulent first months the DeFi Franc weathered the market crash of November 7/8/9 without any problems and with the collateral ratio remaining at a safe level of above 160%.

Motivation:

The DeFi Franc provides CHF denominated borrow and yield opportunities thereby catering to “real yield” seekers, a growing market amidst the high USD (and EUR) inflation. Furthermore, the goal of the DeFi Franc is to grow the European DeFi market by offering non-USD denominated borrow and yield facilities. The European DeFi market remains underserved to date while at the same time Europe hosts a large number of DeFi communities and a strong user base.

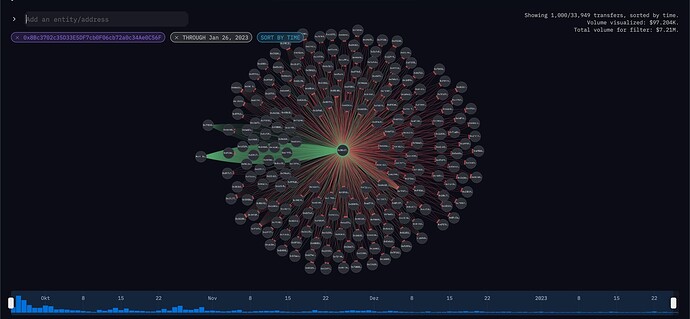

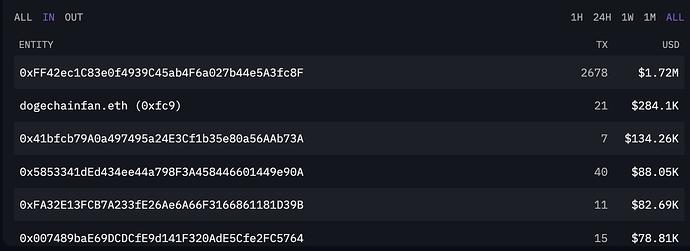

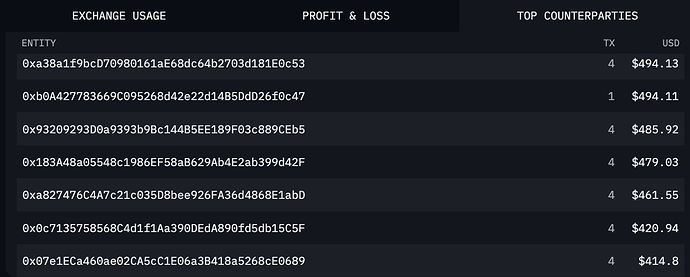

In order for the DeFi Franc to deliver on that promise, availability of deep secondary liquidity for the project’s stablecoin is of paramount importance. The team behind the DeFi Franc believes that Curve is the go-to market for stablecoin liquidity and, thus, has taken a number of steps to align long-term with the Curve ecosystem. First, the DCHF/3CRV pool has been set up at protocol launch and its liquidity has grown to about USD 5M at the time of writing this proposal and a peak of about 8M. Currently, LPs in this pool are incentivized with the project’s native fee distribution token Moneta (MON). Second, the project’s treasury is currently in the process of accumulating veCRV voting power in order to participate in Curve governance and allow for a more sustainable pathway to grow DCHF liquidity. And lastly, a number of integrations of the DeFi Franc with other Curve pools or new Curve pairings are underway.

Specifications:

- Governance:

The DeFi Franc protocol allows for limited governance interventions. Most notably, governance may make the following updates to the protocol:

- Add new collateral assets with their own stability pool and price oracle

- Change a collateral asset’s risk parameters such as minimal collateral ratio

- Replace a collateral asset’s price oracle

Governance powers explicitly exclude the following:

- Outright minting of protocol tokens

- Transferring user funds

The limited governance powers currently reside with the DeFi Franc Guardian DAO which is organized as a multisig similar to Curve’s Emergency DAO. The Guardian DAO employs a 3-out-of-5 threshold and signers are composed of doxxed founders and contributors to the DeFi Franc and other DeFi projects. The multisig can be found on Ethereum Mainnet under this address 0x83737EAe72ba7597b36494D723fbF58cAfee8A69.

- Oracles:

The protocol uses Chainlink feeds to fetch prices for the collateral assets and the CHF-USD price. Thus, currently the ETH, BTC, and CHF Chainlink feeds are used. The current implementation of the price oracles and respective sanity checks (lifeness, price validity) are very similar to Liquity’s implementation with the difference, that it uses two Chainlink feeds one for the collateral value in USD and a second converting USD prices to CHF (the DeFi Franc’s peg asset). The implementation can be found here.

- Audits:

The DeFi Franc protocol is a friendly fork of the Liquity system. Liquity was audited by Trail of Bits and Coinspect with audit reports available here. In addition, the DeFi Franc protocol has been audited separately by Certik and the audit report can be found here.

- Centralization vectors:

The DeFi Franc protocol runs autonomously on the Ethereum Mainnet. No individual has control of DCHF minting powers or user funds. The protocol is a friendly fork of Liquity and in general is susceptible to the same centralization vectors than Liquity. These are very limited however and center around keeper functions for the initiation of risky trove liquidations, which rely on external actors to seize risk-free profits. In order to further strengthen the robustness of the protocol, the DeFi Franc is integrating with the Keep3r Network as a trustless keeper fallback layer.

In addition, other than the Liquity system, the DeFi Franc protocol grants ownership rights to the DeFi Franc Guardian DAO which, however, requires a 3-out-of-5 signer threshold for any change to be enacted (see section Governance for more details). A further centralization vector worthwhile mentioning is that the DeFi Franc protocol currently relies on Chainlink price oracles. While the protocol has no fallback oracle system implemented at the time of writing this proposal, the DeFi Franc Guardian DAO is able to activate such a system in the future or switch to another price oracle in the unlikely case of Chainlink feeds failing.

- Market History:

The DeFi Franc has weathered the FTX crisis and market downturn without a notable effect on peg stability during the said period in November. Due to its redemption mechanism the DeFi Franc is extremely robust against downward depeg events. On the other hand, similar to LUSD, due to its mechanics the DeFi Franc is more susceptible to upward depegs due to users buying DCHF off the market in order to repay their debt. It is therefore paramount for the DeFi Franc to gain access to a Curve gauge in order to further grow on-chain liquidity.