Summary:

Curve was recently deployed on Celo. Following this deployment, the Celo community is proposing to add the Tripool (cUSD / USDC (bridged via Portal) / USDT (bridged via Portal)) to the gauge controller so users can assign gauge weights and receive CRV incentives.

Mento protocol is a platform for using on-chain governance mechanisms to propose and launch governance approved stable assets. Today the family of Mento assets consists of cUSD, cEUR and cREAL on the Celo blockchain.

Starting from June 20, 2022 all Mento stable assets (cUSD, cEUR, cREAL) are fully backed by USDC and DAI in the Reserve (CGP-62).

cEUR (bridged via Portal) is already listed on Curve on Ethereum. It is part of the Euro Pool together with agEUR and EUROC. As of this writing, the TVL of the pool is $3.1m.

cUSD (bridged via Portal) is already part of cUSD/FRAXBP pool on the Ethereum mainnet.

References/Useful links:

Website: mento.org

Reserve stats: https://reserve.mento.org

Issuance & Redemption Mechanism: The Celo Reserve FAQs. What it is & how it works | by Markus Franke | The Celo Blog

Documentation: https://docs.mento.org/

Stability Protocol whitepaper: https://celo.org/papers/stability

Source code: Celo · GitHub

Protocol Description:

cUSD is one of Mento Protocol’s on-chain collateralized stable assets on the Celo blockchain. The token address on Celo is: 0x765DE816845861e75A25fCA122bb6898B8B1282a.

Mento stable assets are backed by an on-chain Reserve. As mentioned in the summary, outstanding supply of Mento assets is fully backed by USDC and DAI. As of this writing, The Reserve is overcollateralized by 218% and consists of over $140M in holdings made up by 37M DAI, 31.4M USDC, 283 BTC, 5K ETH, 120M CELO, and 83K cMCO2, against an outstanding supply of $65M in stable assets.

As part of their research, the Mento team has simulated various market conditions (summary article), including bear market conditions. And while simulations can never capture all the complexities of the real world, analyses showed stability through a wide range of adversarial conditions and informed crucial design choices, such as diversifying the reserve by including low-volatility assets.

When the price of cUSD is below $1, an arbitrager can redeem 1 cUSD for $1 worth of $CELO from the reserve. When the price of cUSD is above $1, the arbitrager can issue 1 cUSD by depositing $1 worth of $CELO to the Reserve. The Reserve is then periodically rebalanced to maintain the target allocation as per Celo governance.

The Reserve

CELO is held in the Reserve smart contract. The Reserve ensures that non-CELO reserve assets are held safely through the use of approved, qualified and licensed custodians, currently Anchorage (https://web.anchorage.com/anchorage-celo/) and Hex Trust (https://hextrust.com/), which do not operate in countries that are blacklisted by the Financial Action Task Force (FATF) or subject to any sanctions prohibitions. Custodians are required to make publicly available the assets they hold on behalf of the Reserve to ensure that Celo stakeholders and the broader Celo community have full transparency with respect to reserve assets.

Celo Reserve

0x9380fA34Fd9e4Fd14c06305fd7B6199089eD4eb9

Celo with Custodian

0x246f4599eFD3fA67AC44335Ed5e749E518Ffd8bB

0x298FbD6dad2Fc2cB56d7E37d8aCad8Bf07324f67

BTC

38EPdP4SPshc5CiUCzKcLP9v7Vqo5u1HBL

3AKvfpb3Yqc3hLkziyudM2ByEqYDUFGy1D

ETH

0xe1955eA2D14e60414eBF5D649699356D8baE98eE

0x8331C987D9Af7b649055fa9ea7731d2edbD58E6B

DAI

0x16B34Ce9A6a6F7FC2DD25Ba59bf7308E7B38E186

USDC

0x26ac3A7b8a675b741560098fff54F94909bE5E73

cMCO2

0x298FbD6dad2Fc2cB56d7E37d8aCad8Bf07324f67

Anchorage holdings report (https://web.anchorage.com/anchorage-celo/)

Hex Trust and Celo (Hex Trust Partners with Celo, Bringing Institutional Access to the Mission-Driven Ecosystem | Hex Trust)

Motivation:

Following the deployment of Curve on Celo and the proposal to add a cUSD/FraxBP gauge on Ethereum, we hope to incentivize a cUSD Tripool on Celo to further integrate the Celo protocol with the wider Curve ecosystem. A gauge will allow the Celo ecosystem to begin incentivizing a cUSD Tripool. This will build on Celo’s partnership with Jump’s Wormhole to bridge USDC and USDT on the Celo blockchain to increase interoperability and utility. The USDC and USDT assets will be Portal-wrapped and their contract addresses are the following:

- USDC (Portal) 0x37f750B7cC259A2f741AF45294f6a16572CF5cAd

- USDT (Portal) 0x617f3112bf5397D0467D315cC709EF968D9ba546

Adding a gauge on Curve will help to increase liquidity of cUSD, USDC, and USDT, and increase the Celo ecosystem’s efforts to help build real world use cases and unlock the potential of regenerative finance. Given Celo’s partnership with Wormhole, the Celo community would like to make it easier for DeFi and payments users on Celo and other chains to actively participate in the Celo ecosystem, engage and use dApps on Celo, move across chains using stablecoins, and earn rewards on Curve for cUSD.

Specifications:

- Governance: Provide current information on the protocol’s governance structure. Provide links to any admin and/or multisig addresses, and describe the powers afforded to these addresses. If there are plans to change the governance system in the future, please explain.

Mento uses a formal on-chain governance mechanism to manage and upgrade the protocol such as for upgrading smart contracts, adding new stable assets, or modifying the Reserve’s target asset allocation. All changes must be voted on by CELO holders. A quorum threshold model is used to determine the number of votes needed for a proposal to pass.

More details can be found here:

- Oracles: Does the protocol rely on external oracles? If so, provide details about the oracles and their implementation in the protocol.

The Mento Protocol relies on oracles that report CELO/USD rates on the following exchanges:

- Binance

- Coinbase

- Bittrex

- OKCoin

More details regarding the oracles and issuance & redemption mechanism can be found here:

- Audits: Provide links to audit reports and any relevant details about security practices.

The Mento Protocol has been audited by OpenZeppelin, Certora, Teserakt, and Trailofbits.

The process of reserve trading has been internally and externally (NCC group) audited.

A stability analysis was performed by Gauntlet and Economic Analysis by Prysm Group.

- Centralization vectors: Is there any component of the protocol that has centralization vectors? E.g. if only 1 dev manages the project, that is a centralized vector. If price oracles need to be updated by a bot, that is a centralized vector. If liquidations are done by the protocol, that is also a centralization vector.

As a threshold matter, the Mento Protocol is a stable asset platform that runs on the Celo Layer-1 decentralized, permissionless blockchain.

-

Portions of the Reserve are held in centralized custody via Anchorage and Hex Trust. There is a multisig that can access these funds. The identity of these individuals and the number of trustees and thresholds for the multisig are not disclosed for security reasons. However, as mentioned above, custodians are required to make publicly available information on the assets they hold on behalf of the Reserve to ensure that Celo stakeholders and the broader Celo community have full transparency with respect to reserve assets. The reserve assets can be viewed on-chain at all times at the addresses listed above.

-

Almost all Oracles that the Mento issuance & redemption mechanism relies on are currently run through on-chain smart contracts only accessible to certain accounts maintained by cLabs, with the ability for additional access to be added through the protocol’s governance process.

As part of Oracles decentralization effort, one Oracle is run by Celo community members (link to the proposal). The plan is to have at least half of the Oracles to be run by the community members by end of the year. In the nearest future Mento will have an automated on-chain circuit breaker to limit trading via mento when prices shift more than a calculated threshold (link to the proposal). The Mento issuance & redemption mechanism has safeguards in place to ensure that the reserve is protected in the case of oracle failure. (Celo Stability Algorithm (Mento) | Celo Documentation) -

Presently, there is an absence in the general market of a reliable and market-tested cross-chain value transfer solution. As such, the ‘cross-chain’ rebalancing still requires assets (e.g. Celo) be transferred via multisig to a CEX, traded against other assets (e.g. BTC) and then transferred back to a reserve address. Although the reserve address may be on a different blockchain, the whole process is fully transparent because the movement of funds in and out occurs on-chain and allows for the calculation of the implicit exchange rate. The administrative action to accomplish this change is required due to the currently available market infrastructures and is not specific to Celo. Before a trading session is started, a review is completed to check whether the distance to target weights and current liquidity levels require running a session - if not, no trading occurs. If yes, assets are traded as described above. The whole process of reserve trading has been internally and externally (NCC group) audited.

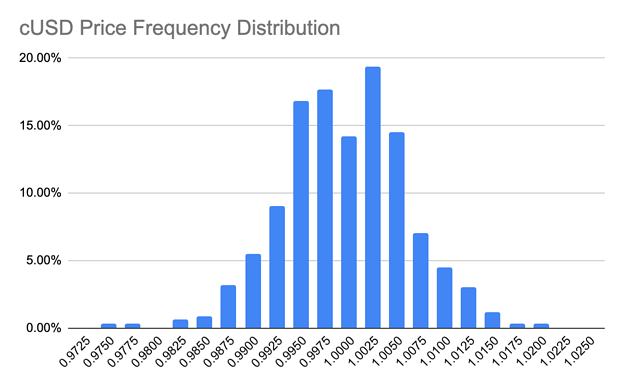

- Market History: According to Coingecko, since November 2020 and up until 31 October 2022, on a closing basis, cUSD was within +/-1% of the peg 91.43% of the time and within +/-2% 99.44% of the time. The collapse of UST caused an impact on the broader digital currency market. cUSD withstood this pressure and is within 1.2% of the peg. The deviations from the peg are observed in relatively illiquid venues where small transaction sizes have a disproportionate impact on the price.