Summary:

Proposal to add bveCVX + CVX factory pool to the Gauge Controller to enable users to assign gauge weight and mint CRV.

Abstract:

Badger is a DAO dedicated bringing BTC to DeFi. Our core product are Sett Vaults which enable users to optimize yield on their tokenized Bitcoin across Ethereum, BSC, Polygon and Arbitrum. Badger takes a partner first approach to how it aggregates yield across protocols like Curve, Convex, Sushi and others. It aims to maximize yield for its users while supporting the protocols providing those emissions through staking, LPing and locking their native assets vs selling rewards earned.

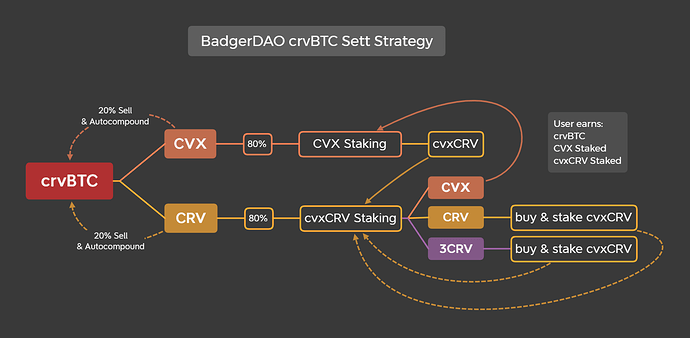

Badger has been a big supporter of Curve and subsequently Convex since inception in depositing our BTC CRV LP tokens on Convex (currently $425M deposited) but more importantly helping support staking of CVX and locking of CRV as cvxCRV with very little selling of rewarded assets. See below how our existing CRV LP vault strategies work.

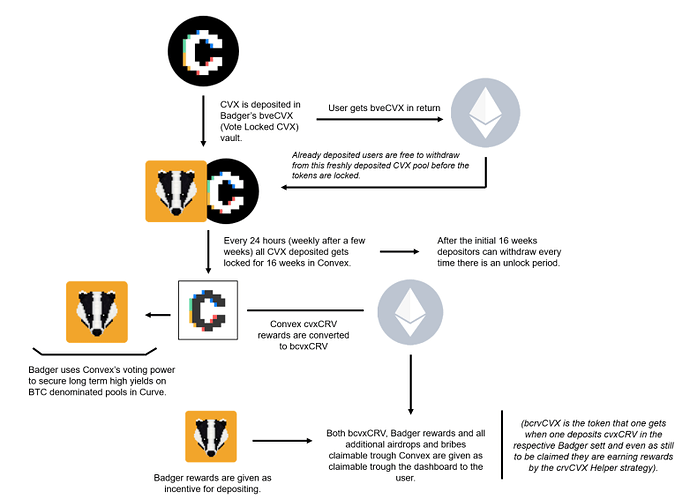

After completing our security review both via audit and through capped deposits in a guarded launch state, we launched the first Vote Locked Convex vault (bveCVX) a few weeks ago. This vault takes deposits in CVX, locks it for the 16 week period as vlCVX and distributes a wrapper token back to users (bveCVX). Users then receive the same rewards as they would locking on Convex but with increased Badger rewards + any cvxCRV earned through our CRV BTC vaults as described above. Unlike locking on Convex directly users have partial withdraw-ability on the bveCVX vault.

Users with bveCVX can withdraw CVX from this vault to the maximum of the CVX currently idle waiting to be locked. Currently we lock every day but moving forward we intend to have a longer period in between locking intervals. There are no fees on this vault except a 0.1% withdraw fee for security measures.

Read more around how our vault works here

See diagram below for how our bveCVX vault works

Motivation:

Currently less than 3% of CRV emissions go towards BTC pools although making up 20% of the TVL on Curve. Badger intends to use its Locked Convex to vote to allocate CRV emissions to BTC pools. Better underlying yield on CRV BTC LP’s = more CRV being locked as cvxCRV through our vaults. (estimated $12m/annually at current TVL levels).

Although vlCVX has proven to be an attractive locking mechanic for CVX users, there is no way for users to exit before the 16 week unlock window. Our core motivation for a bveCVX/CVX Curve pool is to give an option for lockers to immediately withdraw as needed beyond the available withdraw amount described above (which will be limited by incoming deposits). A gauge that earns CRV rewards would help increase liquidity significantly and ensure a better peg for bveCVX.

Limiting abuse of CRV emissions to increase Badger Locked Convex holdings:

Badger has no intention to abuse CRV gauge rewards to amass an exceptional large CVX position. Instead our main goal is to increase the amount of CRV emissions to BTC pools since it directly effects our ability to offer yield to our users.

To address this Badger will be conducting a governance vote amongst its community shortly that places a limitation on the amount of CVX voting weight it puts towards the bveCVX/CVX pool during bi-weekly gauge votes. This is part of our commitment to both the Curve and Convex community to be good stewards and partners without abusing emissions.

What will be done with the CRV emissions earned for this pool if this proposal passes:

Badger will launch a new vault for CRV LP’s of bveCVX/CVX to deposit on app.badger.com that will take 100% of the CRV emissions earned and stake them for cvxCRV then distribute to LP’s. In turn locking all this CRV indefinitely and further supporting the Convex protocol’s veCRV vote weight.

For:

bveCVX/CVX should have a gauge that can earn CRV

Against:

bveCVX/CVX should not have a gauge that can earn CRV

Poll: