Summary

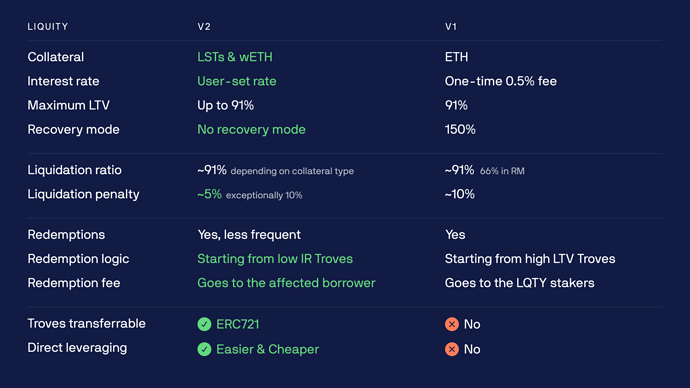

The Liquity team launched v2 “Bold” on Jan 23 (yesterday), delivering much anticipated improvements over the original v1 (LUSD). These include user-defined interest rates, an extended collateral range, a native yield source, and streamlined L2 support.

BOLD liquidity already lives on Curve, with a BOLD/USDC pool that grew to $8M TVL in a day and a ~$1M BOLD/LUSD pool, thanks to the allocation of 75K LUSD of weekly incentives to the pools.

This proposal suggests enabling CRV rewards for both gauges, harnessing the CRV flywheel to sustain BOLD liquidity further.

References

- Website – https://liquity.org/

- Documentation – https://docs.liquity.org/

- Codebase: GitHub - BOLD

- App (list of 3rd party front ends): Liquity | Frontends List

- Twitter – Liquity

- Discord: Liquity

- YouTube: Liquity

- Security Audits – Liquity Security Audits

Protocol Description

Liquity v2 is an immutable decentralized protocol that allows users to borrow against ETH, rETH, and wstETH on their terms as they decide the interest rate they pay (or can delegate its management). Loans are paid out in BOLD - a USD-pegged stablecoin and must maintain a minimum collateral ratio of only ~110% (on ETH).

In addition to the collateral, the loans are secured by Stability Pools containing BOLD and ultimately by fellow borrowers collectively acting as guarantors of last resort. LQTY is the secondary token issued by Liquity. Staking it enables/ holders to accrue voting power that can be used to direct BOLD to the various Liquidity Initiatives.

Liquity as a protocol is non-custodial, immutable, and governance-free. No person or group controls the protocol — it is “set in stone” in smart contract code and can never be changed.

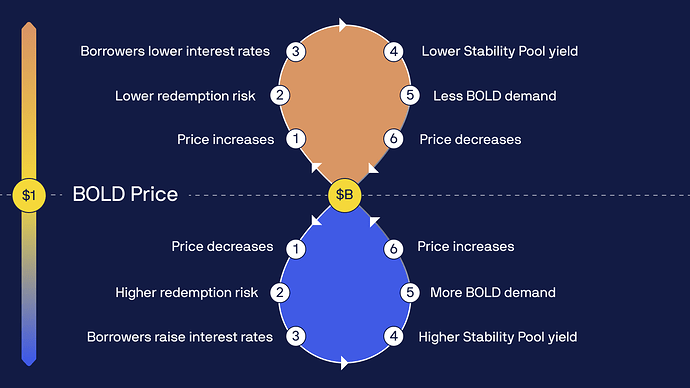

The introduction of interest rates, as well as the adjustment to the redemption logic helps BOLD better maintain its peg than LUSD:

Motivation

Liquity is not new to Curve, and several active pools, such as LUSD/3crv or LUSD/crvUSD, exist. The Liquity Treasury owns 900k veCRV, which could be used to further support the new pool’s growth.

On top of the CRV emissions allocated to these pools, they benefit from an initial and sizable LUSD incentives budget for the first week. Once the first voting rounds conclude, BOLD can be directed to the respective gauges.

Specifications

Governance

BOLD has a minimized governance, as its only function is to allocate the BOLD collected as interest to Liquidity Initiatives. No protocol parameters can be changed.

Oracles

Bold uses Chainlink as a price source for supported collaterals. Additional mitigating measures are also implemented.

Audits

Reputable actors have conducted numerous audits:

- ChainSecurity - Core Protocol Audit Report, December 2024

- Dedaub - Core Protocol Audit Report I, August 2024

- Dedaub - Core Protocol Audit Report II, November 2024

- Certora - Formal Verification, December 2024

- Coinspect - Bold Core Smart Contract Audit, December 2024

- Coinspect - Bold Governance Audit, January 2025

- ChainSecurity -Governance Smart Contract Audit, January 2025

- Dedaub - Governance Audit 1, August 2024

- Dedaub - Governance Audit 2, November 2024

- Dedaub - Governance Audit 3, January 2025

Centralization Vectors

Bold code is immutable and cannot be modified. There are no pause or protocol freeze functions. BOLD (stablecoin) does not have a blacklist/whitelist nor freeze functionality. Liquity v2 has built-in shutdown thresholds to graciously handle events such as a severe drop or failure of collateral.

For more information on risks, please refer to the Risk Disclosure.

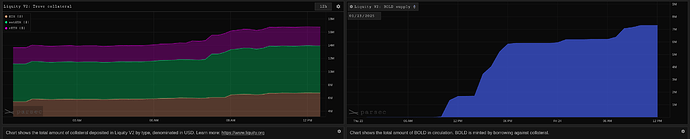

Market History

While BOLD is a day old, Liquity has been running smoothly for 3.5 years. Despite being launched yesterday, Bold attracted $17M of collateral, minting 7.2M BOLD. The primary liquidity source is the Curve BOLD/USDC pool, with currently ~$8M TVL.

There is also a $1.7M TVL Uniswap BOLD/USDC pool.

Proposer’s Disclosure

I am TokenBrice from DeFiCollective, a nonprofit association created to support the most resilient DeFi protocols. Although I no longer work with the Liquity team since October 2023, I am happy to give a hand to help strengthen BOLD’s ecosystem.