Proposer

Beanstalk Farms

Summary

Beanstalk is a decentralized credit based stablecoin protocol that maintains price stability relative to an arbitrary value peg without collateral requirements. The price history of the Beanstalk USD-pegged stablecoin, Bean, and other data demonstrate that Beanstalk can regularly cross the Bean price above and below $1 through protocol-native incentives.

Beanstalk Farms, a decentralized development organization working on Beanstalk, continues to implement features that incentivize providing liquidity to and trading against the BEAN:3CRV pool. Beanstalk recently integrated the BEAN:3CRV pool into the Silo (the Beanstalk DAO, which functions as a protocol-native deposit account) which means Beanstalk now incentivizes users to provide liquidity to the pool in exchange for a portion of future Bean seigniorage. The integration of the BEAN:3CRV pool into the Curve gauge, in addition to the Beanstalk Silo, will offer a unique investment opportunity within DeFi, attract more liquidity and volume to Curve, and support the continued growth of Beanstalk as the leading decentralized credit based stablecoin issuer.

Abstract

We propose including the existing BEAN:3CRV pool in the gauge.

Background

Beanstalk issues Bean, a censorship resistant, liquid and stable currency by using a decentralized credit facility (the Field) and a decentralized governance mechanism (the Silo). When the price of one Bean is below its value peg, Beanstalk adjusts the terms of lending Beans to the protocol (Sowing), increasing both the total amount of Beans that can be lent to the protocol (Soil) and the interest rate (Weather) on those loans. This incentivizes creditors to buy and lend Beans to Beanstalk in exchange for claims to future Bean mints (Pods), which decreases supply and should increase price. When the price of one Bean is above its value peg, Beanstalk mints more Beans and distributes them to (1) creditors to pay off its debts and (2) Silo members to reward them for providing liquidity and participating in governance, which increases supply and should decrease price. Thus, Beanstalk can regularly oscillate the Bean price over its value peg.

Stability

In the first 6+ months since deployment on Ethereum mainnet, Beanstalk has demonstrated its ability to cross the Bean price over $1, consistently decrease volatility and increase liquidity over time. The relatively long life of Beanstalk has allowed for the continuous implementation of model improvements to further stabilize the price of Bean and the sustainability of Beanstalk.

Price

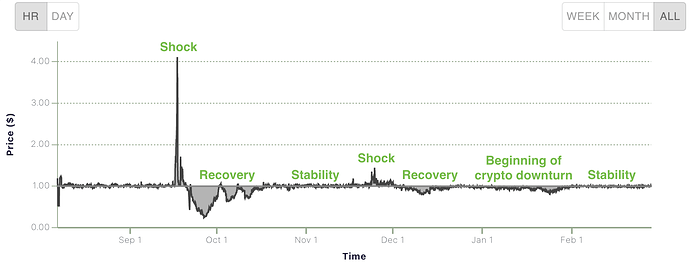

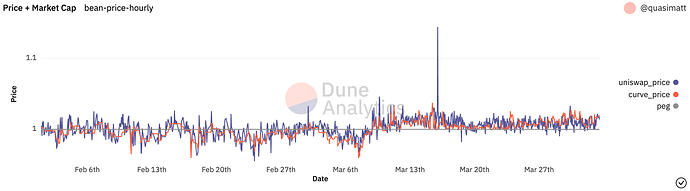

Beanstalk has repeatedly crossed the price of one Bean over its peg and generally decreased Bean price volatility over time via protocol-native incentives. Figure 1 depicts the price of one Bean since the protocol’s inception. There are two clear cycles where the Bean price increases above peg and subsequently decreases below peg for extended periods of time. The magnitude of the price change in the second cycle (beginning in late November) is lower than that of the first cycle (beginning in mid-September). Despite the two large demand shocks that catalyzed periods of deviation from the peg, Beanstalk has returned the Bean price to its value peg via autonomous changes to protocol incentives.

Figure 1: Bean price over time

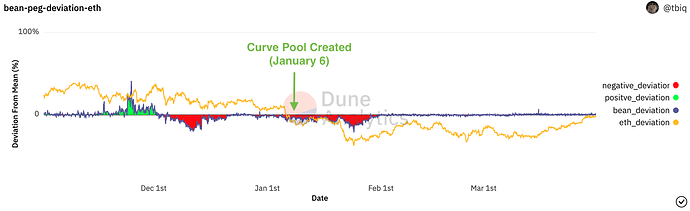

Figure 1 includes a period from late December until the end of January when the Bean price fell in conjunction with the beginning of the larger crypto market downturn. Since then, the ETH price has decreased by more than 40%. The high amount of Bean liquidity against ETH (see Figure 4) dictates that the Bean price is correlated with the ETH price over short periods of time. While the Bean price initially also decreased during the downturn, in early February Beanstalk started to demonstrate its ability to tightly cross the Bean price over its value peg even during an extended market downturn.

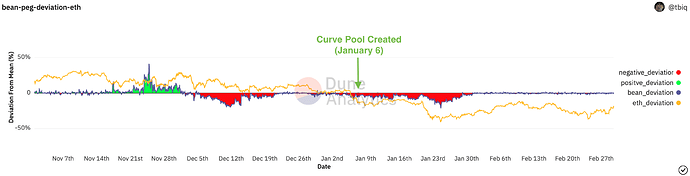

Figure 2 highlights the decreasing correlation between the ETH and Bean prices. Despite the high amount of liquidity against ETH during the downturn, the Bean price was significantly less volatile than the ETH price during this period, and Beanstalk ultimately returned the Bean price to its value peg before ETH made a recovery.

Figure 2: Bean price deviation from its peg and ETH price deviation from its mean over the displayed time period

Correlation with the ETH price will continue to decrease as the ETH liquidity against Bean decreases as a percentage of total liquidity. Following the introduction of the stableswap BEAN:3CRV Curve factory pool with an A of only 10, the Bean price has remained closer to its value peg and has been less correlated to ETH price movements. The growth of the BEAN:3CRV pool is an important step to continue to decrease the ETH and Bean price correlation.

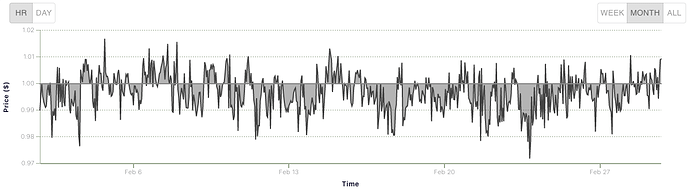

Figure 3 illustrates the price of Bean over the past month. The Bean price has remained stable and oscillated over its value peg since the beginning of February.

Figure 3: Bean price over the past month

Liquidity

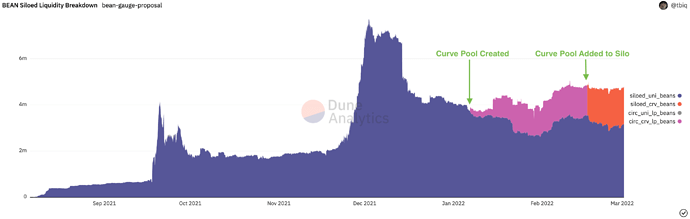

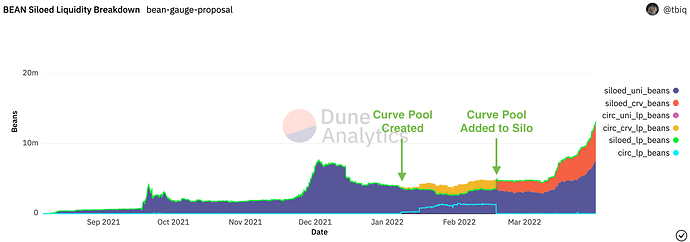

Bean liquidity is currently split between a Uniswap V2 BEAN:ETH constant product pool and a more capital efficient BEAN:3CRV stableswap pool. Figure 4 shows there are about 3.1 million Beans in the Uniswap pool and about 1.6 million Beans in the Curve pool.

Figure 4: Bean liquidity over time

Silo depositors, including liquidity providers, only receive Bean seigniorage when the liquidity and time-weighted average price of 1 Bean is above its value peg for any given hour. As a result, liquidity is positively correlated with the Bean price. The same cycles identified in the Bean price chart are evident in the total liquidity chart. A similarly positive overall trend is also clear: total liquidity increases after each demand shock as compared to the pre-shock liquidity, despite the fact that liquidity providers do not receive new Beans when the Bean price is below its value peg.

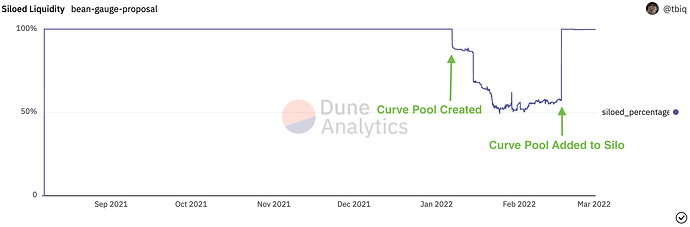

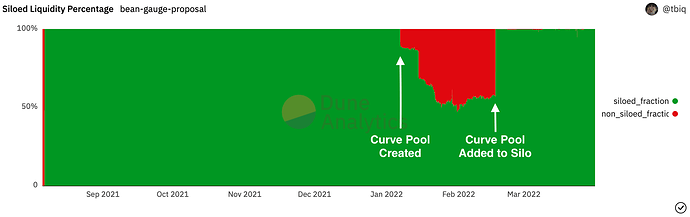

Figure 5 shows the percentage of Bean liquidity that is in the Silo over time. That almost all of the liquidity is in the Silo is evidence that the Stalk System, a Beanstalk-native reward system designed to encourage long-term investment in the Silo, has a meaningful impact on user behavior.

Figure 5: Percentage of total Bean liquidity in the Silo over time

Demand for Debt

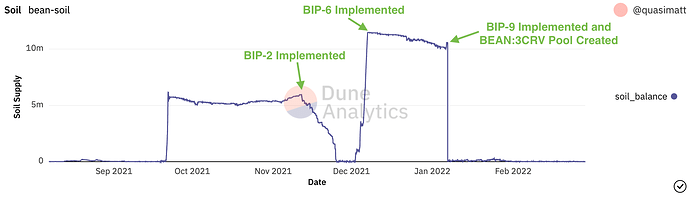

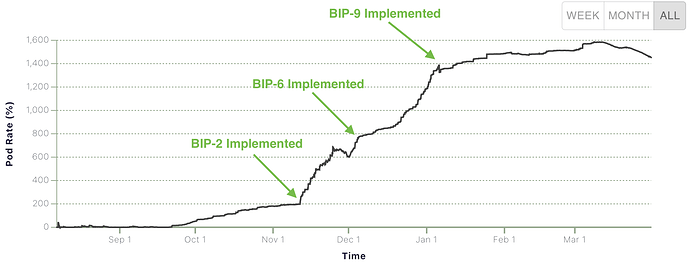

Beanstalk is a credit based stablecoin protocol: it relies on its ability to attract credit to maintain Bean price stability. Therefore, Beanstalk’s ability to attract creditors is critical to return the Bean price to its value peg when there is excess marginal supply such that the liquidity and time weighted average Bean price is below $1. Beanstalk’s willingness to borrow Beans is represented by the available Soil. Generally, high Soil levels mean Beanstalk is not attracting enough creditors, while a zero Soil level indicates that there is excess demand for Beanstalk’s debt. Figure 6 shows the Soil supply since Beanstalk’s inception. The graph shows that the implementation of efficiency-related Beanstalk Improvement Proposals (BIPs) — BIP-2 and BIP-6 — increased demand for Soil, and that since early January, when the BEAN:3CRV pool was created and BIP-9 was implemented, the available Soil has been close to zero. It is clear that currently, if Beanstalk needs to take on debt in order to return the Bean price to its peg, creditors are willing to buy and lend Beans to Beanstalk.

Figure 6: Soil supply over time

Debt Level

Lending Beans to Beanstalk is a long-term investment that demonstrates creditors’ confidence in Beanstalk’s ability to pay off its debt. Beanstalk has issued over $663 million of debt, and paid back $23 million of that debt thus far.

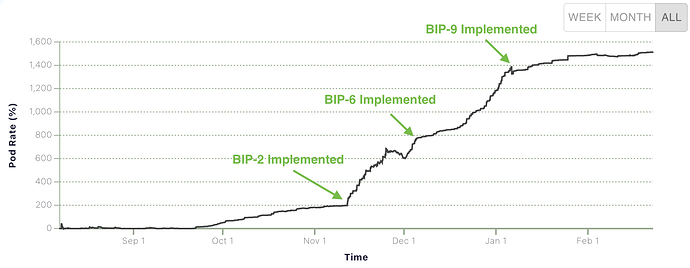

Like any credit-based system, its overall debt level is a strong indicator of its health. Since the initial demand shock in mid-September until late January, the Beanstalk debt level (Pod Rate), increased somewhat continuously. However, since the implementation of various efficiency improvements in BIP-9, the Pod Rate has stabilized and even decreased slightly in early February (see Figure 7). Because Beanstalk’s peg maintenance model is designed around a stable price and sustainable debt level, decreasing its debt level is a major step towards a larger proof of concept.

Figure 7: Pod Rate over time

Audits

Secure code is essential to the success of Beanstalk. Beanstalk Farms has hired both Trail of Bits and Omniscia to conduct both initial audits of Beanstalk and ongoing audits of future BIPs. Minor changes reflecting the initial report from Omnisica are in progress, and the initial public audit report should be ready sometime in April. The initial Trail of Bits audit is expected to be completed in June.

Beanstalk and Curve

Beanstalk Farms deployed a BEAN:3CRV liquidity pool in January, which has significantly increased the price stability of Bean.

To date, liquidity providers have added about $3 million of assets into the pool. The recent implementation of BIP-12 allows BEAN:3CRV LP Tokens to be Deposited into the Silo to earn a portion of Bean seigniorage and a vote in Beanstalk governance. This makes the BEAN:3CRV pool more attractive to investors and generates more fee revenue for the pool while decreasing Bean price volatility. Over 99% of BEAN:3CRV LP Tokens has since been Deposited in the Silo, indicating that those providing liquidity on Curve are doing so to receive Beanstalk-native rewards.

If the BEAN:3CRV pool is accepted into the gauge, a variety of additional unique yield opportunities are opened up which can benefit both Beanstalk and Curve. Beanstalk Farms is working on a BIP to facilitate distribution of rewards from yield-bearing assets Deposited in the Silo in a modular fashion. This will facilitate the earning of both Beanstalk rewards and Curve rewards boosted via Convex simultaneously.

BEAN:3CRV tokens Deposited directly into the Silo cannot earn boosted CRV rewards because the Beanstalk smart contract is not whitelisted to hold veCRV. Depositing BEAN:3CRV tokens on Convex, which is whitelisted to hold veCRV, allows the tokens to earn boosted CRV rewards. Convex issues yield-bearing cvxBEAN:3CRV tokens to BEAN:3CRV depositors. The upcoming BIP will permit the Silo to accept yield-bearing assets like cvxBEAN:3CRV and facilitate the proper distribution of non-Beanstalk-native yield from those assets to Silo Depositors. This will allow Depositors to earn boosted CRV rewards and Beanstalk Silo rewards for their BEAN:3CRV tokens. Beanstalk Farms plans to propose this update within a month of the BEAN:3CRV pool being approved to be included in the gauge. Furthermore, Beanstalk Farms intends to propose another BIP in the coming weeks that will allow users to go from arbitrary assets with liquidity on Uniswap or Curve to cvxBEAN:CRV Deposited in the Silo in a single transaction.

The inclusion of the BEAN:3CRV pool in the gauge will further increase the attraction of the BEAN:3CRV pool to both Beanstalk and non-Beanstalk investors, which is likely to lead to an increase in both liquidity and volume in the pool, as well as a decrease in Bean price volatility.

FAQ

The following are additions to the initial proposal in response to specific questions asked on the proposal’s thread.

Centralization vectors: Is there any component of the protocol that has centralization vectors?

Decentralization is both a core principle ingrained in every aspect of the design of Beanstalk, and necessary to Beanstalk’s long term success.

Beanstalk is currently being developed primarily by Beanstalk Farms, a decentralized development organization of contributors that range from all across the tech stack to non-technical roles. Beanstalk Farms currently has ~1 dozen full time and ~2 dozen part time contributors. Beanstalk Farms includes a handful of back end developers that each work on BIPs.

Beanstalk requires code execution on the Ethereum blockchain on a regular (hourly) basis. In practice, someone needs to manually call the

sunrise()function in order to facilitate the execution of this code. To ensure the execution of thesunrise()function in a timely fashion without any points of centralization, Beanstalk offers a reward (in the form of newly minted Beans) for the successful calling of thesunrise()function. The award for successfully calling thesunrise()function increases exponentially every second past the top of the hour that elapses before the function is called. Thus, Beanstalk can ensure regular code execution on the Ethereum blockchain without any points of centralization.Governance: Provide current information on the protocol’s governance structure. Provide links to any admin and/or multisig addresses, and describe the powers afforded to these addresses. If there are plans to change the governance system in the future, please explain.

Beanstalk is governed by the Beanstalk DAO, which is comprised exclusively of Stalk holders. Stalk is the governance token of Beanstalk. Anyone can earn Stalk and participate in governance by Depositing assets in the Silo. The Beanstalk DAO can make arbitrary changes to Beanstalk through BIPs. A BIP can only be passed if more than 50% of the total outstanding Stalk votes in favor.

The owner of Beanstalk is currently: 0xefd0E9ff0C4E1Bee55Db53FDD1FAD6F6950CeD0b. This address is a multi-sig wallet custodied by various members of Publius, the initial deployers of Beanstalk. In addition to the DAO, the owner address can also make arbitrary changes to Beanstalk. In the future, upon successful completion of multiple audits of Beanstalk, the expectation is for the DAO to vote to transfer ownership of Beanstalk to the null address, effectively destroying any ownership privileges.

Oracles: Does the protocol rely on external oracles? If so, provide details about the oracles and their implementation in the protocol.

Beanstalk does not rely on any external oracles. At the top of every hour, upon completion of the

sunrise()function call, Beanstalk mints Beans and/or Soil based to the time and liquidity weighted excess or shortage of Beans in the BEAN:ETH Uniswap V2 pool. To determine the price of 1 Bean in USD, Beanstalk compares the time weighted average BEAN:ETH Uniswap V2 pool ratio with the time weighted average USDC:ETH Uniswap V2 pool ratio. Beanstalk is able to access the necessary information by exclusively reading on-chain data. Thus, Beanstalk can determine the price of 1 Bean without exposure to any centralized actors or oracles. In order to disrupt Beanstalk, the centralized providers of USDC would need to blacklist the USDC:ETH Uniswap V2 pool, which would cripple their value proposition.In the near future, Beanstalk Farms intends to propose a BIP to generalize Bean and Soil minting across a variety of pools in addition to the BEAN:ETH Uniswap V2 pool. The BEAN:3CRV pool is likely to be the first additional pool proposed to be incorporated into the minting schedule.

Voting

For

The BEAN:3CRV pool should be included in the gauge.

Against

The BEAN:3CRV pool should not be included in the gauge.