Summary:

ARTH is the first valuecoin that is designed to be stable and fight US dollar inflation. Most stablecoins today are pegged to the US dollar which carries on all the risk of the US dollar. ARTH is the first value-stable currency that is designed to appreciate slightly above US dollar inflation but also remain relatively stable.

We propose to add the ARTH.usd+3CRV pool to the Gauge controller to enable users to assign gauge weight and mint CRV.

References/Useful links:

- Website: https://mahadao.com/

- Documentation: Gitbooks

- Github Page: MahaDAO · GitHub

- Communities:

- Twitter: https://twitter.com/themahadao

- Telegram: Telegram: Contact @mahadao

- Discord: MahaDAO

- Audit: Trail of Bits, Hacken, Certik

MahaDAO Abstract:

MahaDAO is a DAO focused on creating the world’s first valuecoin, ARTH. A valuecoin is a coin that maintains its value (or purchasing power) over time.

ARTH.usd is a positive rebase token backed by ARTH that maintains it’s price at 1$. This makes it flexible to be used in stablecoin pools like Curve.

We propose to add pool ARTH.usd-3pool and include it in the Gauge.

Motivation:

The current curve pool is the home for the most of the stablecoin’s liquidity and this is where most users are buying/selling to use the protocol for leverage.

Specification:

Governance: The protocol currently uses a governance mechanism very similar to Curve’s veCRV model. Users come in with their MAHA tokens and lock them up to get MAHAX. MAHAX holders then vote on various proposals with the protocol.

Oracles: The protocol uses a mix of Chainlink and Umbrella finance feeds to get the prices of the collaterals.

Audits: ARTH is audited and its technical implementation is largely based on Liquity’s. Reports of the audits on Liquity can be found here. Furthermore we have conducted additional audits from Certik, Hacken and continue to conduct regular audits of the code. We also have a bug bounty program set up.

Centralization vectors: Most of the ownership of the protocol has been revoked, except for the ability to add new collateral types and update the peg which is kept behind a 3/5 Gnosis Multisig but that will soon get migrated to a vote proxy as part of our decentralization roadmap.

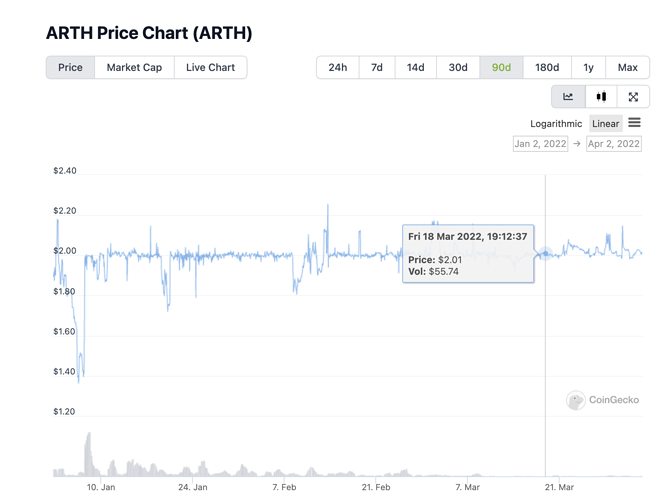

Market History: The ARTH.usd token has not experienced significant volatility or de-pegging due to its redeemability with the underlying collateral.

For:

ARTH.usd should have a gauge that can earn CRV

ARTH performs well and maintain its peg within the affordable range of volatility. This was accomplished even due to the trading on Uniswap-forks. ARTH.usd-3Pool LP in Curve will make the ARTH peg even more stable.

ARTH/MahaDAO has a deeply engaged community in the protocol who have been with us throughout the inception. Majority of MAHA community members have staked their tokens for more than 4 years.

ARTH will start to play a even more important role in Defi allowing users from various other protocol to leverage the stablecoin to get exposure to more staking pools and yield farms.

ARTH is a fully decentralized stablecoin. The team keeps transparency and decentralization as one of the top most priorities.

Against:

ARTH.usd should not have a gauge that can earn CRV

Poll:

Post a link to your proposal if it’s already been created