Summary:

Proposed by the Badger DAO. This is a proposal to add ibBTC+crvRenWSBTC factory pool to the Gauge Controller. This will allow users to assign gauge weight and mint CRV.

The factory pool is live and Badger DAO will be adding $250k in liquidity shortly.

- ibbtc/sbtcCRV-f | 0xFbdCA68601f835b27790D98bbb8eC7f05FDEaA9B

Adding an ibBTC pool will further increase the liquidity of Bitcoin on Ethereum and make it easier to swap between assets.

Hello everyone, my name is Spadaboom, a contributor at Badger DAO and proponent of ibBTC. The intention for this post is to (1) introduce ibBTC to the Curve community, and (2) provide subsequent information to inform voters for adding the ibBTC+crvRenWSBTC factory pool to the Gauge Controller.

ibBTC is an asset launched in collaboration with DeFiDollar, it stands for Interest Bearing Bitcoin. It was created to serve as the default interest-bearing Bitcoin asset across DeFi.

ibBTC is an ERC-20 token. As such it can be transferred normally, lent out, collateralized and bridged to other chains with the goal of enabling people with the most basic DeFi knowledge to start earning interest in just a few clicks.

Current market cap of ibBTC is $31M with $50M+ in liquidity across mainnet, Polygon and Solana. https://www.coingecko.com/en/coins/interest-bearing-bitcoin#markets

ibBTC is backed 1:1 by a basket of our Badger vault tokens which themselves are interest maximizing products accepting deposits of different synthetic BTC’s with a focus on CRV LP’s. Each runs a different underlying smart contract based strategy that leverages the Convex protocol. Users can mint ibBTC in the Badger App and it’s currently composed of these 3 BTC CRV LP vault positions;

- bcrvRenBTC

- bcrvSBTC

- bcrvTBTC

ibBTC on Badger app | Badger DAO | Deposit & Earn on your Bitcoin

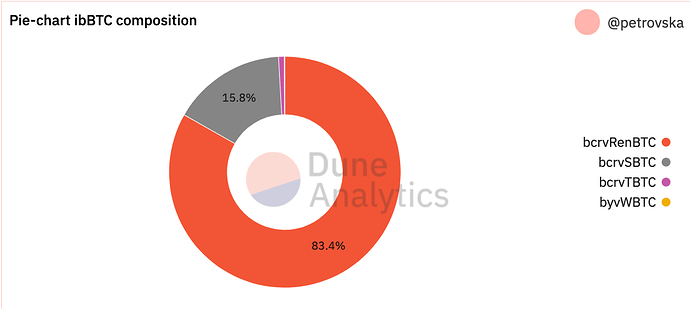

As of writing this proposal the current composition of ibBTC is;

Current ibBTC composition | Dune Analytics

How the underlying strategies of ibBTC work

Curve/Convex Optimizer Vault Strategies

Badger DAO is dedicated to having a “partner first” approach to our vaults and how they create yield for our users. The intention of our strategies are to give optimized yield while supporting the protocols that the yield comes from.

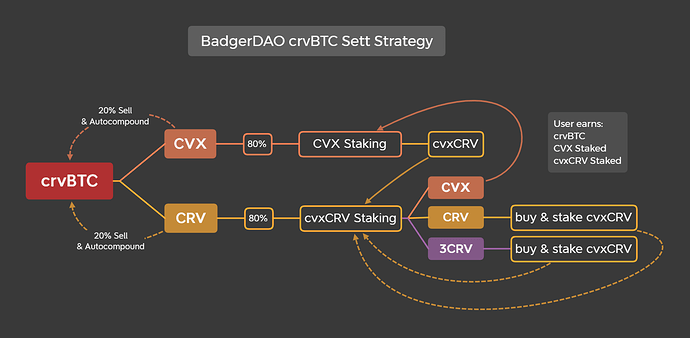

With that in mind, the underlying vault tokens (CRV ren, sbtc and tbtc lp’s) that make up ibBTC have Curve/Convex optimizer strategies. Where 80% of all earned yield in the form of CRV or CVX is either held as veCRV (through Convex cvxCRV) or staked via CVX pool.

Here is a breakdown on how the bCrvRenWBTC, bCrvRenWSBTC and bCrvtBTC strategies work. After locking CRV via cvxCRV we are taking the rewards earned (CVX, CRV, 3CRV) and buying cvxCRV on the market to further support its peg and lock up even more CRV. All CVX is currently staked on Convex and in the near future we will be converting this part of the strategy to locking CVX instead.

Further detail regarding Badger/Convex collaboration | medium article | video

With about $380M in TVL deposited in Curve/Convex through these specific vaults, our vaults are projected to lock a significant amount of Curve annually while bringing additional utility and rewards to CRV LP’s through trading fees (vault harvests) and additional Badger rewards.

New Badger ibBTC Curve/Convex Optimizer Vault

As of writing this proposal roughly 30% of BTC CRV LP tokens are deposited in the Badger app utilizing our Curve/Convex optimizer strategies.

Badger vault market share of BTC CRV LPs

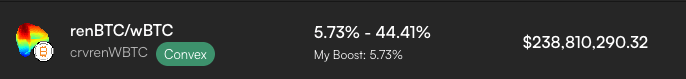

To further optimize the CRV rewards allocated to this pool if it were to be added to the gauge controller, Badger will build an ibBTC CRV LP vault in our app. Where users can deposit the LP tokens from this ibBTC+crvRenWSBTC factory pool and earn bcvxCRV, bcvx and BADGER (with boost applied if you hold native assets already).

It will leverage a similar Curve/Convex optimizer strategy to our other vaults which should lead to a significant increase in the amount of locked CVX and CRV (as cvxCRV) that the DAO facilitates. This is a further dedication to supporting Curve/Convex and ensuring there are no “double dipping” concerns from the community.

We will advocate for the vault to receive similar Badger rewards and APY to the max boost level of the existing crvrenBTC vault at present TVL. Ideally this will help drive significant liquidity to this pool fairly quickly.

Assuming that a large majority of the ibBTC LP tokens that would be receiving CRV gauge rewards will be deposited into the Badger app (based on historical deposits), 80% of these rewards would be locked as veCRV (via Convex cvxCRV).

Impact our vaults will have on Locked Curve and Convex

See a breakdown of how CRV rewards are leveraged through our vaults below.

Assuming Baseline APY of 3.33% in CRV rewards (historically it’s been lower than it is today)

Assuming TVL of $380M on CRV LP that are deposited in underlying vault tokens that make up the ibBTC basket

- $$ value of CRV sold over 1 year = $2.5M ($209k/month)

- $$ value of CRV locked over 1 year via Underlying vault tokens = $10M ($835k/month)

- $$ value of CRV locked over 1 year via ibBTC CRV LP vault on Badger (assuming an additional $600M pool TVL) = $20M ($1.7M/month)

With Badgers increased influence in Curve Gauge rewards via it’s 1.276M CVX token holdings, we anticipate the underlying APY on the new ibBTC CRV pool to be higher than the 3.33% benchmark and in turn lock an even larger amount of CRV & CVX.

If ibBTC were to be approved for a Curve pool with full rewards and assuming the TVL number above ($300M in underlying vault tokens and $600M in new ibBTC pool) then:

$30M of CRV per year would be locked for 4 years with just $2.5M in CRV being sold annually; 14:1 benefiting CRV holders as locking takes assets off the market that might otherwise be sold and coordinate incentives for long term participants of which Badger is one. This doesn’t account for additional fees earned by veCRV holders since all these swaps would happen on Curve.

Coupled with that, our vaults would be staking/locking the equivalent amount ($30M) in CVX. Actively helping keep the peg of cvxCRV through buy pressure, improving the utility of the cvxCRV asset, and ultimately furthering the relationships and synergies between our three protocols.

Voting for full rewards to the pool would signal to BadgerDAO that the Curve community supports our mission of being ecosystem friendly, and would further enable our protocols to continue building incredible things together.

Cross-chain

With Curve’s cross-chain expansion to Polygon, FTM, xdai and other chains/L2’s as they launch, ibBTC is an ideal asset for subsequent BTC pools on those chains. As Curve looks to continue expanding, it’s important to have transferable assets with a track record on their ETH mainnet market.

Currently ibBTC lives on ETH, Polygon and Solana with the intention to expand to Arbitrum, Optimism, Fantom, xDAI, Avalanche and many others.

With over $30M+ of liquidity across Solana and Polygon, it shows the potential for ibBTC pools on Curve’s cross-chain markets in the future.

Polygon on-chain validation:0x4EaC4c4e9050464067D673102F8E24b2FccEB350

Solana on-chain validation:66CgfJQoZkpkrEgC1z4vFJcSFc4V6T5HqbjSSNuqcNJz

Badger Bridge

Badger Bridge is a first of its kind bridge that allows users to go directly from native BTC to earning yield on mainnet tokenized Bitcoin immediately, all while transacting within the same app through the Mint and Earn functionality.

With the bridge’s Mint and Earn feature users experience a 1-step process to transform native BTC into Badger Curve setts (bCrvRenWBTC, bCrvRenWSBTC and bCrvtBTC).

The bridge is also utilized to convert native BTC to wBTC. To achieve this BTC is converted to renBTC and renBTC swapped to wBTC via Curve BTC pools.

To date net in-flows of native BTC crossing the bridge to mainnet exceeds $135M (3,000 BTC). Roughly $95M (2,100+ wBTC) have been swapped in curve pools by users crossing the bridge with native BTC.

The Badger Bridge has been operational for a few months and remains a key element in fulfilling our mission to bring Bitcoin to DeFi, its utility will continue to grow with the inclusion of one click ibBTC and ibBTC LP minting.

Bridge app | Badger DAO | Deposit & Earn on your Bitcoin

Bridge statistics | Dune Analytics

Official: https://badger.finance/

Governance forum: https://forum.badger.finance/

Github: Badger Finance · GitHub

Help and FAQ: https://badger.wiki/

Motivation:

Compared with other AMM-based DEXs, Curve’s stablecoin/like kind pair swapping curve has lower transaction slippage. Adding ibBTC to a metapool will increase liquidity and utility for the asset. Our hope is that this pool will create a positive flywheel and help bring more fees and incentives to the Curve protocol.

Curve’s importance in the defi ecosystem is not to be taken lightly and BadgerDAO wants to continue to foster a positive relationship that can benefit both users of each protocol as well as the broader ecosystem through more capital efficient swapping and increased liquidity.

Specification:

Badger DAO is open source and has been audited | Zokyo | Haechi Audit

ibBTC audit report | Quantstamp

Source code | Badger Finance · GitHub

Current ibBTC supply:503

ETH on-chain validation: 0xc4e15973e6ff2a35cc804c2cf9d2a1b817a8b40f

For:

ibBTC/crvRenWSBTC pool should have a gauge that can earn CRV

Against:

ibBTC/crvRenWSBTC pool should not have a gauge that can earn CRV

Poll:

Vote Here: https://dao.curve.fi/vote/ownership/97