Summary:

This proposal aims to add a gauge for the alXAI/XAI liquidity pool to the GaugeController. By incentivizing this pool, we intend to:

- Establish Curve as the primary on-chain liquidity hub for the liquid staking token alXAI.

- Minimize slippage for traders and improve market efficiency.

- Accelerate the adoption of alXAI as a pivotal liquid staking derivative for the Layer 3 Gaming Blockchain, “XAI Games,” powered by Offchain Labs.

This initiative supports both ecosystem growth and seamless trading experiences for participants.

- Curve Pool: Curve.fi

- Root Gauge: https://etherscan.io/address/0x0b8750500484629c213437d70001e862685ce2d0

References/Useful links:

• Website: https://novadash.io/

• Documentation: https://novadash.gitbook.io/novadash-docs

• Discord: https://discord.gg/novadash

• Twitter Novadash: https://x.com/Novadashio

Protocol Description:

At Novadash, we are transforming the staking and gaming experience within the XAI ecosystem, a cutting-edge Layer 3 gaming blockchain built on Arbitrum and co-developed by Offchain Labs. Designed to support decentralized gaming applications and infrastructure, the XAI ecosystem offers unparalleled opportunities for gamers, developers, and investors alike.

Our Mission

Our goal is to empower participants in the XAI ecosystem by addressing the limitations of traditional staking systems while enhancing liquidity, flexibility, and accessibility for all users.

What We Offer

One of our flagship innovations is stXAI, a liquid staking derivative of the XAI token, revolutionizing how users stake and earn in the ecosystem.

The Problem

While XAI staking offers highly attractive rewards of up to 120% APR (10% monthly), it comes with significant drawbacks:

- Tokens are locked for up to 180 days.

- Early redemptions can incur penalties of up to 75%.

- These restrictions limit flexibility and access to funds, even for users aiming to maximize yield.

The Solution: stXAI

stXAI solves these challenges by offering a liquid staking alternative that combines high rewards with unmatched flexibility:

- No Lockup Periods: Stake your XAI without committing to lengthy lockups.

- Full Liquidity: Trade, transfer, or redeem your stXAI at any time.

- Passive Rewards: Continue earning rewards from the XAI ecosystem without being tied down.

Convert stXAI to alXAI

To further enhance liquidity and trading flexibility, users can convert stXAI to alXAI, a token pegged to esXAI. This enables:

- On-Demand Trading: alXAI can be freely traded in liquidity pools.

- Maximized Utility: Unlock your staking rewards for immediate use or reinvestment.

Why Novadash?

Novadash is the largest staking pool operator in the XAI ecosystem, hosting over 8,650 Full Sentry Nodes. As a key player, we:

- Control Mining Reward Distribution: Ensuring that rewards are efficiently allocated across the network.

- Guarantee Great APR for stXAI Holders: Leveraging our extensive network and operational expertise, we provide consistently high returns for our users.

By combining advanced staking solutions with our pivotal role in the XAI ecosystem, Novadash is uniquely positioned to drive growth, flexibility, and profitability for all participants.

Motivation:

-

Increase Liquidity

Incentives attract more liquidity providers, ensuring smoother trading and better execution. -

Reduce Slippage

More liquidity means less slippage, allowing traders to execute large orders at expected prices. -

Boost stXAI Adoption

Incentives drive wider use of stXAI, making it a key asset for staking and trading. -

Ensure Stability

A well-incentivized pool provides stability, benefiting both staking and trading within the ecosystem. -

Attract New XAI Stakers

Deeper liquidity draws more users to stake XAI, expanding the staking pool and enhancing the ecosystem. -

Sustain the Staking Pool

A growing pool of stakers ensures continued high APRs and keeps the system robust.

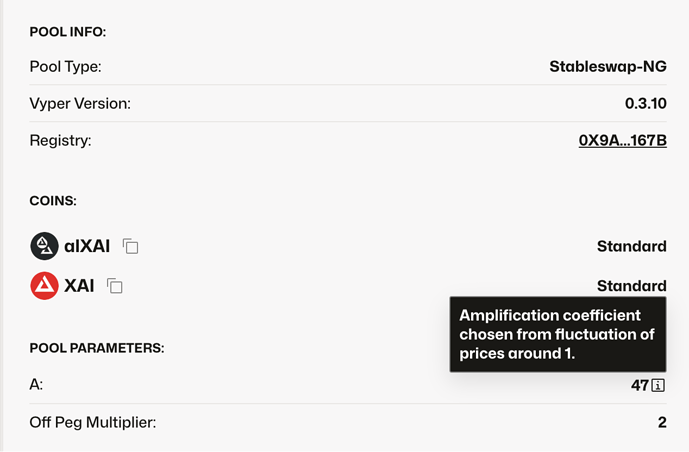

Specifications:

-

Governance: The liquid locker is managed with a 3/5 multisig safe wallet on Arbitrum. Wallet Address: 0xffD25D48e5EEDF4D3A043571B185C096629184a0

-

Oracles: The protocol does not rely on external oracles.

-

Centralization vectors: None.

-

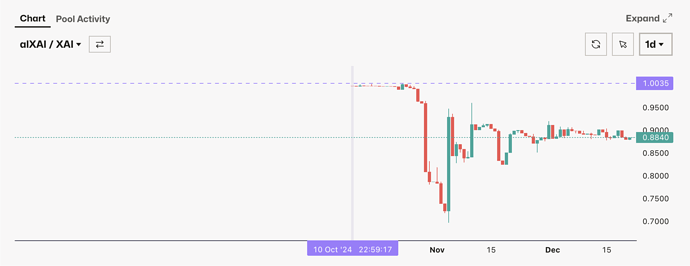

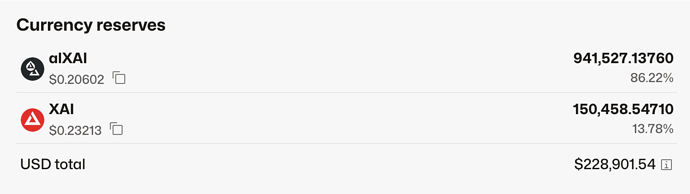

Market History:

- The pool has been active since 10th October 2024.

- alXAI is backed 1:1 by XAI if you use the 180-day redemption queue. On average, the pool experiences a depeg of about 12%. This depeg is considered the premium people pay to convert a locked asset into a liquid one.