Summary:

MAI is a stablecoin backed by locked collateral tokens. It was created by the QiDao Protocol. MAI borrowing is decentralized and non-custodial, meaning that only users have control over their funds. MAI can only be made with collateral backing it, either through approved collateral in vaults or through the USDC Swap.

To make MAI through vaults, users can deposit collateral in their vaults and borrow up to ⅔ of the USD value of their locked collateral. The following are our accepted collateral types: MATIC, WETH, AAVE, LINK, CRV, amWMATIC, amWETH, and amAAVE. Each week, the community votes on the collateral that will be added next week. We require that collateral tokens have a Chainlink price feed.

Users can always mint MAI for USDC through the Swap page. When you swap USDC for MAI, new MAI is minted by the treasury and the deposited USDC is held in the treasury as collateral. Given the 1% fee charged on this transaction, MAI’s peg has a $0.99 floor and $1.01 ceiling on its price. The graph below shows MAI’s 30d price performance and illustrates its price floor and ceiling:

For more information about MAI, check out the stablecoin economics section of our docs: How Does it Work: Stablecoin Economics - Mai Finance

MAI analytics page: https://app.mai.finance/analytics

Abstract:

We propose to list MAI (miMatic) on Polygon.

Motivation:

Given the liquidity of MAI on Polygon and its stability, adding MAI to Curve can significantly contribute to revenue of the Curve LPs and veCRV holders.

Specification:

Dashboard: https://app.mai.finance/

Docs: https://docs.mai.finance/

MAI Analytics dashboard: MAI Analytics

Contract address: 0xa3fa99a148fa48d14ed51d610c367c61876997f1

Github: GitHub - The QiDao Protocol/Lao Zi

CoinGecko: https://www.coingecko.com/en/coins/mimatic

For:

-

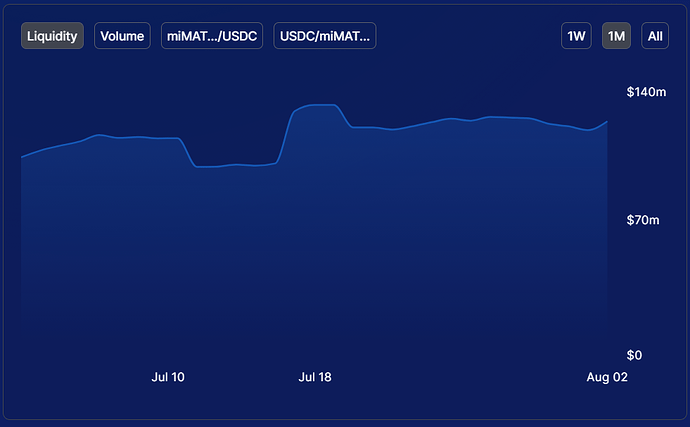

MAI has one of the largest LPs on Polygon: $120 million on MAI-USDC LP on QuickSwap: https://info.quickswap.exchange/pair/0x160532d2536175d65c03b97b0630a9802c274dad

-

MAI is on Balancer’s only incentivized stablecoin pool (2.5k BAL, 15k QI, and 37.5k MATIC per week). The pool currently holds $35 million in liquidity: https://polygon.balancer.fi/#/pool/0x06df3b2bbb68adc8b0e302443692037ed9f91b42000000000000000000000012

-

MAI has maintained its peg through recent market downturns. It’s max spread is 1% from peg, due to its USDC Swap feature used to mint MAI at a fixed rate.

-

7d high: $1.0100

-

7d low: $0.9951

-

Polygon has agreed to use MAI as its only stablecoin for hackathons and bounties

-

MAI has strong early backers: https://twitter.com/sandeepnailwal, https://twitter.com/rsg, https://twitter.com/ArjunKalsy

MAI integrations: https://www.notion.so/Welcome-to-MAI-Universe-0fdb275bca624bcaba5884e5f71c4a94

Against:

It’s important to be risk-averse in the stablecoin trading business, and MAI is a young stablecoin. However, MAI has been battle-tested by several market downturns throughout the past few months and has maintained its peg successfully. MAI is overcollateralized and can only be minted against collateral that has Chainlink price feeds, the gold standard for price feeds. Additionally, the USDC Swap feature, which allows users to mint and redeem MAI at a fixed rate, ensures that the price of MAI stays within a 1% spread of the dollar.

Poll:

Post a link to your proposal if it’s already been created

Materials:

MAI-USDC 30d liquidity chart on QuickSwap: