Summary:

Increase PayPool liquidity concentration (A parameter) from 1000 to 5000 over two weeks and increase off-peg fee multiplier from 5x to 10x.

Abstract:

A pool configuration, commonly referred to as Strategic Reserves was first implemented in a recently deployed USDT/USDC pool. It is a StableSwap pool configuration characterized by an ultra-high liquidity concentration, ultra low base fee, and a high off-peg multiplier. This pool configuration may be suitable for stablecoins that have efficient redemption mechanisms and have a track record of maintaining a very tight peg.

This proposal will adjust the pyUSD/USDC pool toward the direction of the strategic reserves config, which has A=20000, fee=0.003% and off-peg multiplier=10x. By contrast, the pyUSD/USDC pool is configured as A=1000, fee=0.01%, off-peg multiplier=5x.

Motivation:

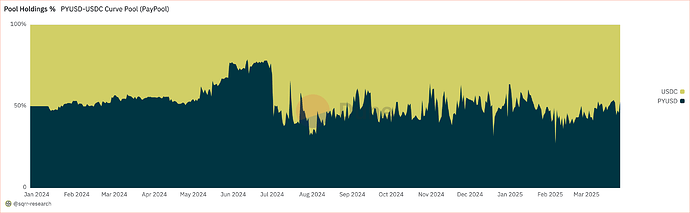

PayPool is composed of readily redeemable stablecoins that have demonstrated a track record of maintaining a tight peg with a stable pool balance over the past 6-8 months. Higher pool concentration will allow the pool to process larger swaps with minimal slippage and attract additional arbitrage volume to the pool.

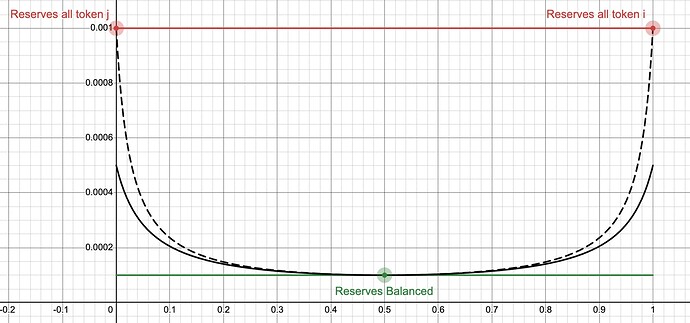

Increasing the fee multiplier from 5x to 10x will influence the dynamic fee based on the pool balance. Shown below is the current dynamic fee in solid black and the proposed dynamic fee in dashed black. Increasing the dynamic fee allows LPs to capture greater arb fees at times when the pool goes out of balance, improving overall returns.

Specification:

WEEK = 86400 * 7

RAMP_TIME = chain.time() + (3 * WEEK)

PAYPOOL = "0x383E6b4437b59fff47B619CBA855CA29342A8559"

ACTIONS = [

# Ramp paypool A to 5000 over 2 weeks (includes week for DAO vote)

(PAYPOOL, "ramp_A", 5000, RAMP_TIME),

# Paypool off-peg fee multiplier to 10x

(PAYPOOL, "set_new_fee", 1000000, 100000000000)

]