TL;DR : Allocate 240,000 CRV from Curve DAO’s vested treasury to incentivize the tricrypto2 over a month in order to deepen the pool and grow its volume.

Context :

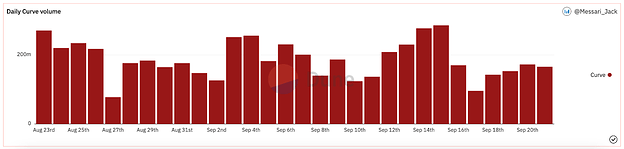

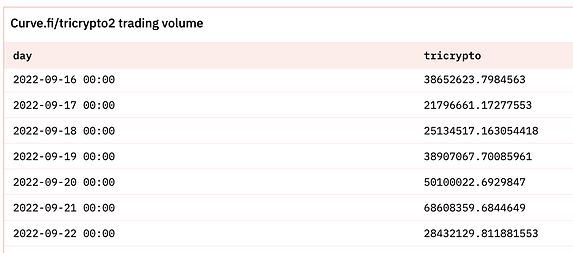

Curve has been averaging 170M$ of daily volume lately, with tricrypto2 representing over 20% of its volume on average. Because admin fees are proportional to volume, the tricrypto2 pool is a major provider of trading fees revenue for the Curve DAO (~225,000$ / week)

While Tricrypto2 is responsible for 20% of the protocol fees, it only receives 11.4% of emissions (60M veCRV), and this is after external incentives. From this gauge weight, 66% come from a core team wallet, and the rest (33%) are incentivised by a 60,000 weekly CRV bribe on bribes.crv by the same address.

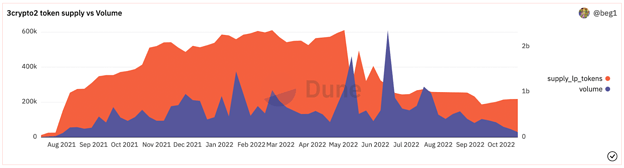

Furthermore, we can observe that the volatility in volume seems very correlated, with a little delay, to the volatility in total supply of LP token, thus, to the TVL. The correlation coefficient is also likely to be very high on the upside.

Rationale :

Raising the depth of the tri-crypto should also raise its volume, enabling it to capture more of the trades between USDT, ETH & BTC, hence bringing more fees to the Curve DAO.

By incentivizing votes directed towards the pool, Curve DAO should raise its admin fees durably.

Quest is the ideal tool to get more veCRV holders aligned with tricrypto2:

- Our Governor Quest module enables the DAO to entirely operate this on-chain (from governance to execution), with just a multi-sig to set up custom parameters if needed.

- Quest users are mostly organic veCRV holders, it’s in their best interest to align with the protocol growth, hence directing the CRV emission toward the most profitable pool seems logical.

- Our Dark Quest module would allow the DAO to blacklist any address on-chain. This is especially relevant knowing that the biggest voter of the pool has been deliberately avoiding claiming any bribe whatsoever.

- Quest is the only unified marketplace for all veCRV wrappers (vlCVX, sdCRV, veCRV and more soon), which means that the external incentives are currently only aimed at veCRV holders who double the number of potential votes being targeted.

We recommend testing out the solution for gauge incentives of the same size as what has been allocated on bribes.crv for a month’s period (60,000 CRV * 4) before discussing a longer partnership.

Means :

-

246,000 CRV from the DAO’s vested CRV allocation (Paladin takes a 2.5% fee on Quest for Ecosystem Partners)

-

(https://etherscan.io/address/0xe3997288987e6297ad550a69b31439504f513267)

-

At least three signers to set parameters for optimal Quests on a weekly basis (we can provide one member of our team to help set these initially)

For:

Spend 246,000 CRV to grow the 3-crypto TVL

Against:

Do not spend 246,000 CRV and let the 3-crypto as is