Summary: Azeem Ahmed is a BAD ACTOR and has slow rugged the USDM - Mochi Community. He should be banned from Curve and Convex, and other crypto protocols. USDM holders should be audited, all Azeem Ahmed transactions should be investigated, the USDM/3CRV pool needs to be consciously closed with ill-gotten gains of 1200 ETH, 1M CVX and PRISMA AIRDROP distributed pro-rata to legitimate USDM holders and Mochi Investors.

This DRAFT PROPOSAL is an effort to SELF-REGULATE and REMOVE BAD ACTORS from GOOD PROTOCOLS and to close up DAMAGED & DEPEGGED LIQUIDITY POOLS to the best of our abilities. I’m hoping to receive intelligent, creative, and resourceful comments such that I can draft a better proposal, or edit this one.

Abstract: Propose taking action against Azeem Ahmed to reverse his ill-gotten gains, to punish his “slow rug” and distribute pro-rata to legitimate USDM Holders, and Mochi Investors as best as possible. Screenshot evidence provided.

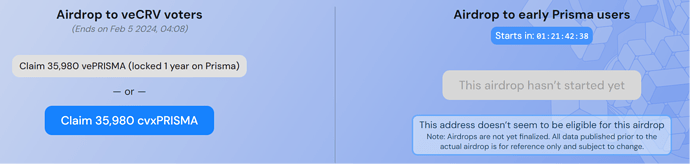

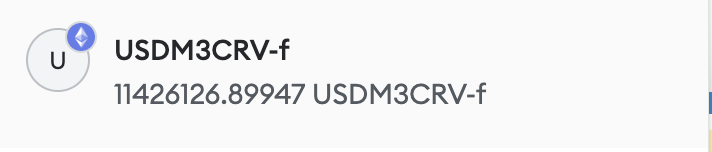

The proposed change is to do something to close or possibly repeg the USDM-3CRV pool after an extensive audit and investigation into Azeem Ahmed. Additionally, the 1M CVX tokens he locked on Convex ought to be distributed pro-rata to the USDM holders, which is a solution he had already offered but rescinded. (Likely requires Convex Proposal as well.)

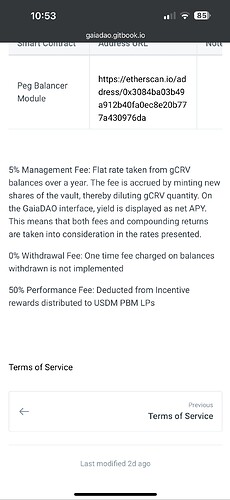

Motivation: My motivation comes from the frustration of dealing with this charlatan crook who had promised to do everything to restore the USDM peg, and the CRV emissions. He gave himself a 5% management fee, and 20% performance fee, and recently increased the performance fee to 50%! He was caught, and he reduced it back to 20%. See screenshots:

Increase to 50%

Reduce back to 20%

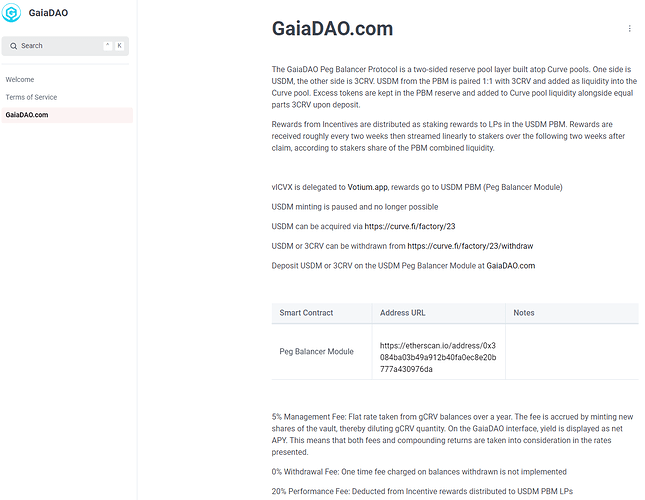

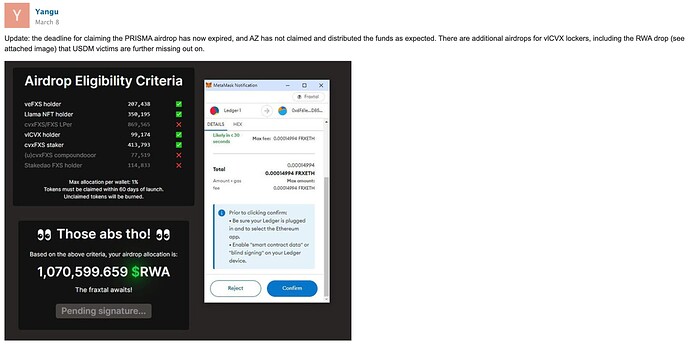

Why does he deserve any management or performance fee? For collecting and distributing rewards from locked CVX tokens? He doesn’t even distribute AIRDROPS. Here is the PRISMA AIRDROP which he hasn’t offered to distribute.

Furthermore, USDM holders are expected to claim the 75% of their rewards as gCRV available on GaiaDAO.com, but this is the second time the claim function is broken, and the wallet is not called to confirm the transaction. There is no support and various Discord servers are censored and ignored. Mass deletion of comments have happened in an attempt to erase his criminal behavior.

My motivation is to help the victims of USDM & Mochi, to redistribute his ill-gotten gains, to punish his criminal behavior, to clean up the Curve & Convex ecosystems, to kill or restore the USDM/3CRV Pool, and to discover how we can do this in a decentralized manner.

I think this proposal is worthwhile because the Emergency DAO to kill the USDM gauge happened in a centralized manner, it was not voted on, many small LP holders did not know about this and were absolutely wrecked after the depeg of USDM. This was a rare centralized action of Curve. This is an opportunity to review the life cycle of the slow rug of Azeem Ahmed, and to deliver justice. Certainly Bad Actors should be punished, and efforts ought to be made to make the victims whole.

For:

If you believe BAD ACTORS should be punished, and efforts ought to be made to make the USDM & Mochi Victims whole. You also want dead, depegged pools to be cleaned off of the protocol.

Against:

If you don’t care about BAD ACTORS and think we should have known better. You don’t care about protocol housekeeping.

My personal letter: First and foremost, I apologize for my previous support of Azeem Ahmed. Please forgive me. I sense you felt frustrated that I was complaining and rationalizing for who you clearly saw as a crook taking advantage of the Curve protocol. You can count on me to do better due diligence, be suspicious of brazen actions, and be way more careful of who I trust.

Azeem Ahmed has turned out to be a charismatic crook who continues to extract 25% in fees (5% Management / 20% Performance) from the 1M Locked CVX rewards that ought to go to USDM bagholders. He recently raised it to 50% Performance Fee, got caught, and lowered it to 20%. (See screenshots) Recently the GaiaDAO.com website stopped functioning so that USDM bagholders can not collect the 75% of their gCRV rewards from the locked CVX.

Azeem Ahmed HAD offered a pro-rata disbursement of CVX to USDM bagholders, as well as a full refund to early investors in Mochi. Everyone agreed this was a good idea. He has since rescinded on this offer, favoring instead to slowly siphon 25% in fees per month. There is also the PRISMA airdrop which he hasn’t announced as being disbursed, and likely will be stolen. (See screenshot.)

I’d like to ask the community to generate decentralized solutions. Yes, we are looking at legal action and enforcement. Curve was able to use an Emergency DAO to help the whales exit the USDM / 3CRV Pool in a centralized manner, which destroyed smaller liquidity providers who were not aware of the action, nor called for a vote.

Will Curve be able to help the smaller bag holders who are getting milked and abused by Azeem Ahmed in another centralized manner, or is a decentralized way possible?